Table of Contents

If you’re new here, check out the About Page first.

If you’re interested in any of the companies below, Hidden Gems Investing can save you many hours of work and thousands of dollars by being your one-stop shop for research.

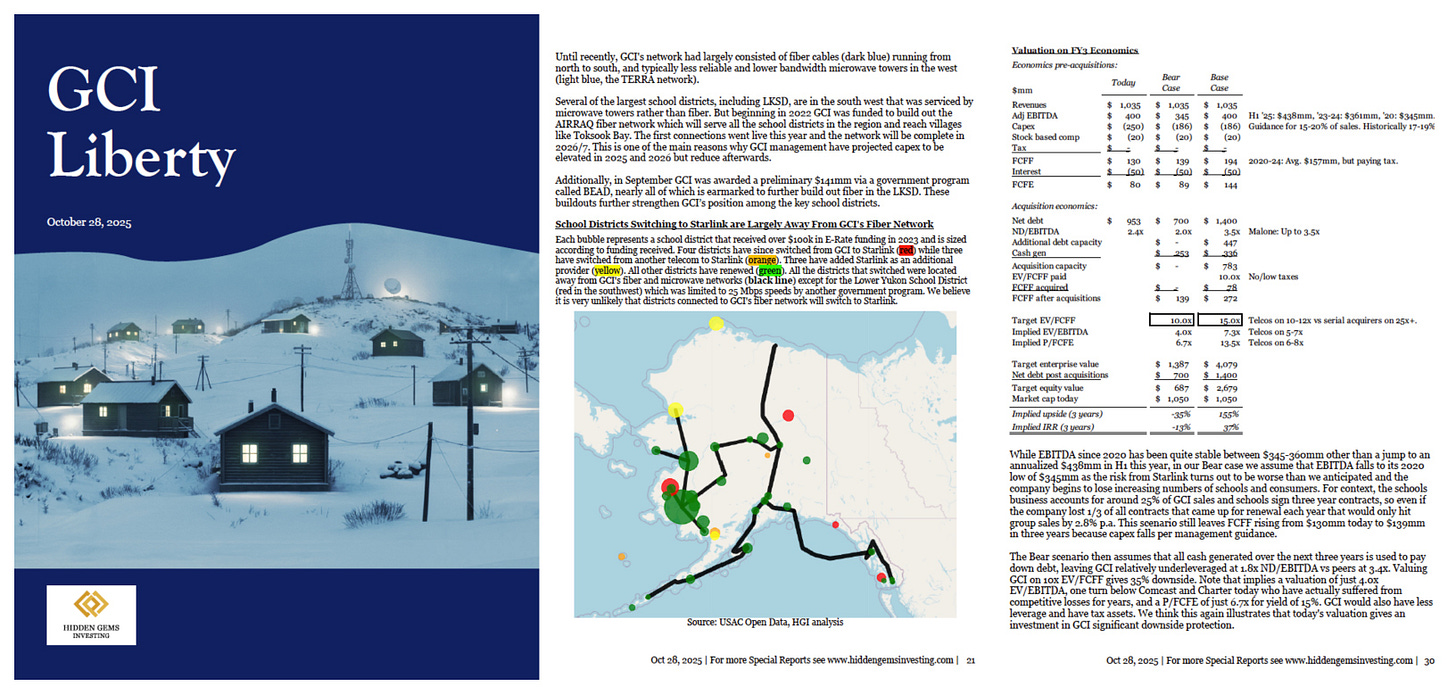

GCI Liberty (GLIBK)

GCI Liberty spun out from Liberty Broadband in July 2025. The company is Alaska’s dominant telecom operator with 90% market share in its key business yet trades for 10x underlying FCF. Investors have overlooked the spinoff because Liberty Broadband was 13x larger and is being acquired.

But John Malone did not ignore the spinoff. He is Chairman of GCI, owns 7.2% of the company, and has been buying stock. He structured the spin to turn GCI into an advantaged acquirer and “the beginning of a new Liberty Media”. GCI is an ideal acquisition vehicle because it benefits from two substantial tax shields and has ~$1bn of acquisition capacity over three years, equal to its current market cap.

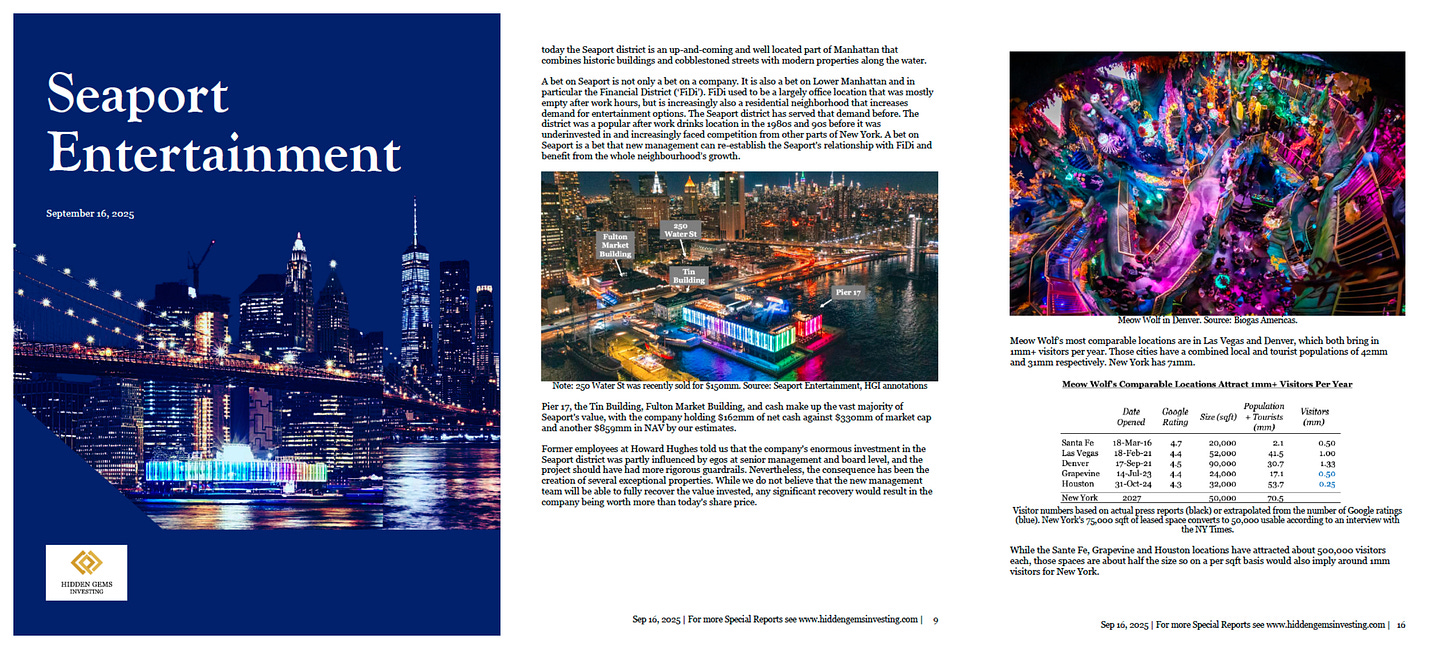

Seaport Entertainment (SEG)

Seaport Entertainment spun out of Howard Hughes (HHH) in July 2024 and owns a complex portfolio of loss-making properties, primarily in Manhattan just 10 mins walk from Wall St. The company is ignored or put in the ‘too hard’ bucket by investors but has a market cap of $300mm vs $162mm of net cash and properties Howard Hughes spent $1.2bn on. Execution by new management post-spin has been strong and cash burn is rapidly reducing.

Pershing Square owned 40% of the company and backstopped the post-spin rights offering at $25/shr. The company has made enourmous progress since but trades at $22 today with $13/shr of cash.

Special Reports: *Latest version (Sep ‘25)*, original (Nov ‘24)

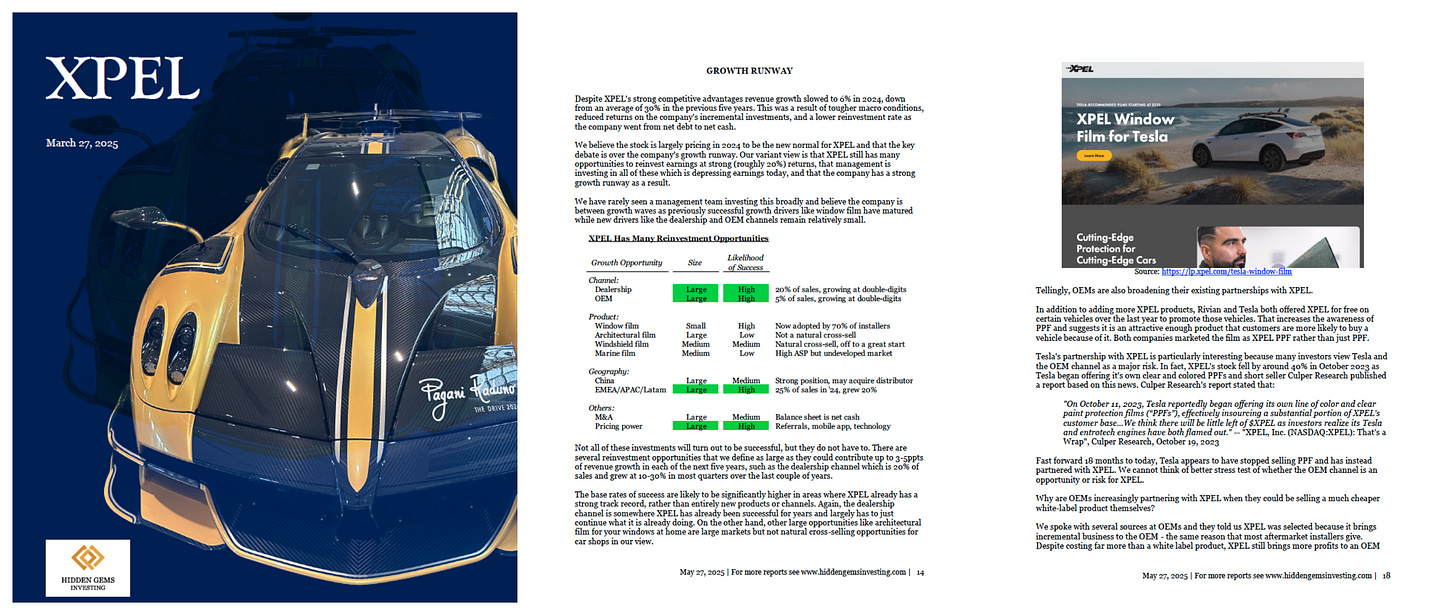

XPEL

XPEL is a great business going through a blip. The company is the leading supplier of automotive protection films. Over the last five years the stock has gone from $15 to $100 and back to $32 after XPEL went from delivering 30%+ returns on capital and 25% growth to suddenly 6% growth and reduced margins in 2024. Investors are extrapolating 2024 to be the new normal when in fact XPEL still has a long runway of around 13% organic growth and that margins will rebound.

The company is led by CEO Ryan Pape, who has high integrity, a strong customer focus, and has done an excellent job allocating capital. Pape owns shares worth $35mm and is 43, giving him a long runway too and incentive to keep compounding capital.

Notes from the trade show: Sep ‘25, Feb ‘25 (*free*)

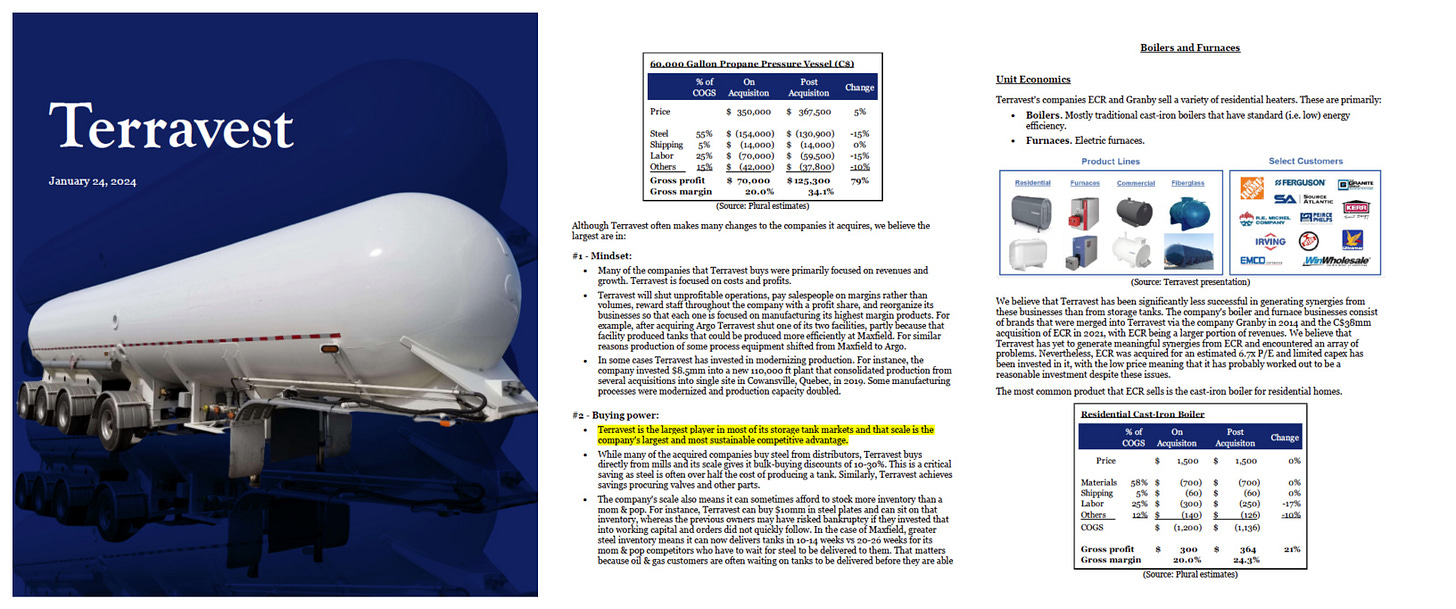

TerraVest Industries (TVK.TO)

Terravest Industries has delivered shareholder returns of ~30% p.a. for the last decade and we believe can come close to that going forwards. The company’s most senior members of management all earn relatively low base salaries and have the vast majority of their net worth in the stock. All are highly experienced and most are fairly young, giving them a strong incentive and long runway to continue compounding capital.

The company follows a roll-up strategy of acquiring, restructuring, and operating businesses that are generally mom & pops across storage tanks and pressure vessels (est. 55% of revenues), boilers and furnaces (25%), and oil & gas equipment (20%). Terravest creates value by acquiring businesses for an average of 11x P/E then restructuring to cut that to 7x, with restructuring the more important and where management spends most of its time.

2026 outlook, Update & trade show (May ‘25)

Monthly updates: Sep ‘25, Apr ‘25, Mar ‘25, Jan ‘25, Dec ‘24

Judges Scientific (JDG.L)

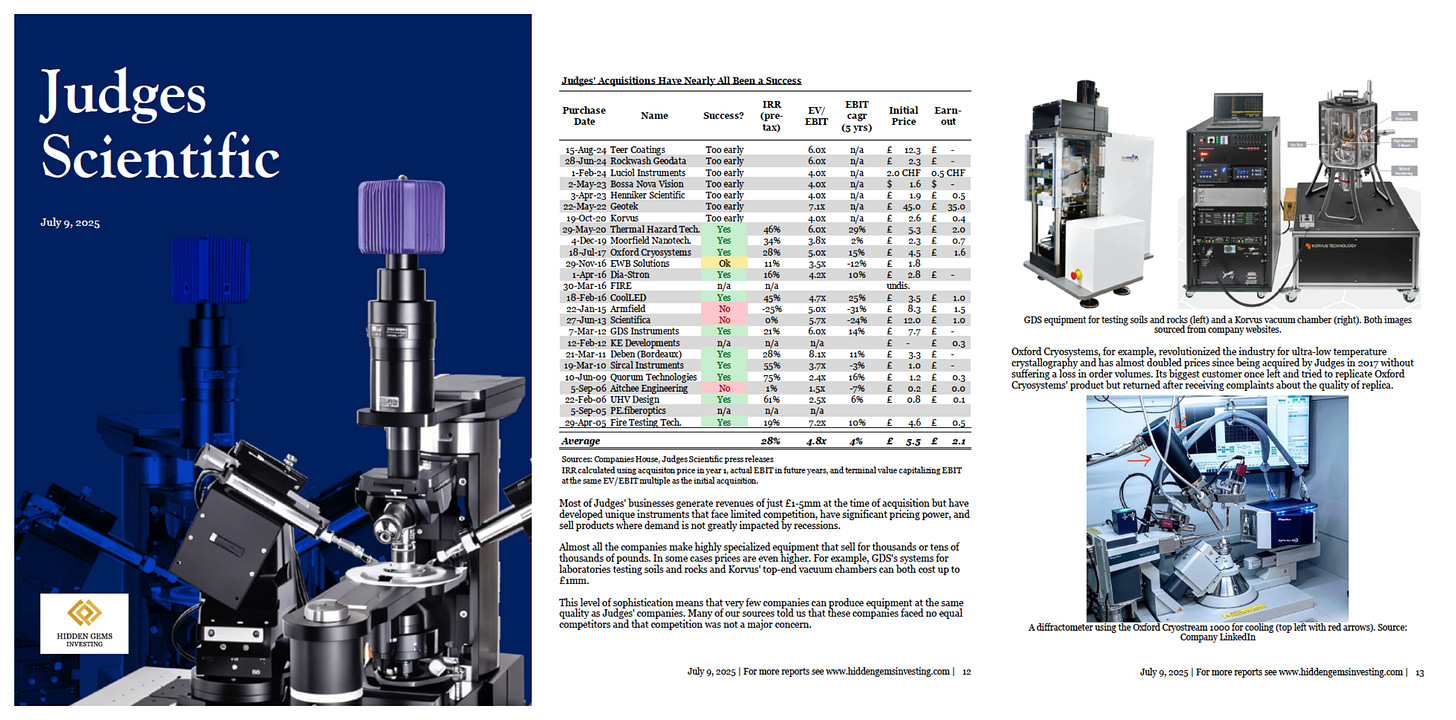

Judges Scientific is a serial acquirer that has delivered 25% p.a. shareholder returns over the last 20 years. The company buys small scientific instrument businesses in the UK that are leaders in attractive niches, face little competition, and have significant pricing power. Organic EBIT growth has averaged 9% over 20 years.

Founders sell to Judges for just 4.8x EBIT on average because the company behaves with integrity and takes a hands-off approach post-acquisition with no cost cuts, synergies, or intervention in how the business is run. This and Judges’ discipline on paying low multiples is why it has generated 22% p.a. returns on incremental capital deployed by our estimates. Founder David Cicurel owns over £50mm in stock and options worth around 200x his base salary.

Watches of Switzerland (WOSG.L)

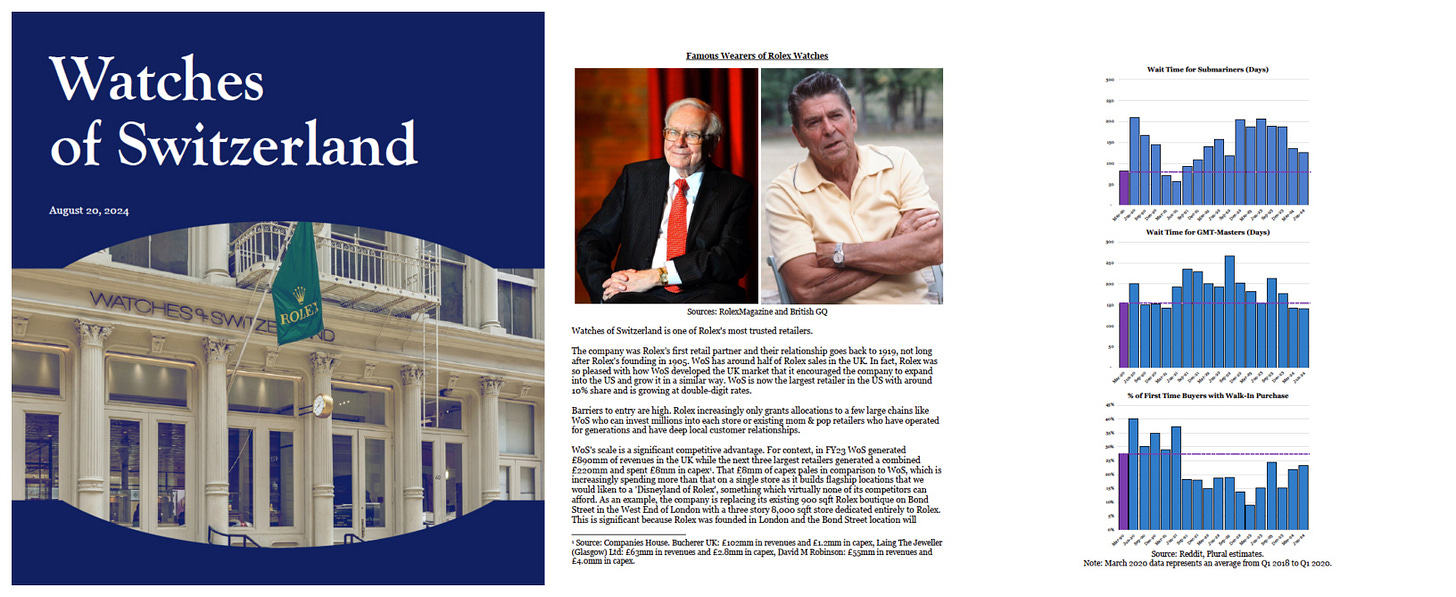

Watches of Switzerland is a retailer and partner to Rolex and other watch brands. Most of the company’s value lies in its relationship with Rolex, which only sells through authorized retailers like WOSG. That makes WOSG’s economics far superior to a typical retailer and more like a subsidiary of Rolex.

Management are competent, experienced, and well incentivized, with CEO Brian Duffy owning £25mm of stock. Duffy joined in 2014 and has grown WOSG’s share of Rolex sales in the UK from 35% to 50%. This encouraged Rolex to entrust WOSG with replicating its strategy in the US, where it is now the number one player with 10% share and has grown at 30% p.a. for the last five years.

The stock has fallen 75% since 2022 after Rolex acquired another retailer and the luxury watch bubble burst. Investors are concerned that WOSG’s relationship with Rolex is in danger, but our work suggests it is not and that the US offers a large opportunity for WOSG to deploy capital at 20% returns.

Jet2 (JET2.L)

Jet2 is a UK package holiday business and is run by an outstanding management team that has compounded EPS at 24% p.a. over the last decade. This has been achieved by providing the industry’s best customer service, which resulted in much greater customer retention than competitors and market share increasing from 2% to 20%.

Yet the stock trades on 6.5x P/E for a company with net cash, double-digit growth prospects, the best competitive position and management team in the industry, and a track record of gaining share during downturns. The company has bought back over 20% of the diluted share count since late 2024, and continues to buy back stock today.

ContextLogic (LOGC)

ContextLogic had no operations, $6.7/shr in cash, and Net Operating Losses worth up to $13.4/shr. The stock traded only slightly above its cash value and was likely to make an acquisition that acts as a catalyst to monetize the NOLs.

That acquisition was annouced in December 2025, with ContextLogic partnering with Abrams Capital to acquire US Salt. The company has now transitioned into Abrams Capital’s permanent capital vehicle and will be a serial acquirer of high quality businesses.

Macfarlane (MACF.L)

Macfarlane is one of three leading providers of specialty packaging in the UK. The company generates a 25% post-tax ROTC, has sustainable competitive advantages, almost no debt, and is run by an honest and competent management team.

The stock trades on 8x FCF because of a slowdown in UK macro, the fact it is a boring small cap, and receives limited promotion from management or the sell-side.

Kyndryl (KD)

Kyndryl is a leading IT infrastructure services provider that was spun out of IBM in late 2021. The company primarily manages traditional on-premise data centers and private or hybrid clouds, but also provides other IT outsourcing services such as handling applications and security.

But there were several clues that suggested Kyndryl would turn itself around. CEO Martin Schroeter was an IBM-lifer who knows the business well and came out of retirement to take the job. He owned stock that very material to his net worth. Other insiders also bought shares frequently.

Hidden Gems Investing published on Kyndryl at $14/shr and a close-out position at $35/shr.

Naked Wines (WINE.L)

Naked Wines is the David fighting against the Goliaths of the wine industry. Yet this time, there is no guarantee that the underdog wins. The company sources over 200 wines from small independent winemakers and sells them directly to consumers. In Naked’s key market of the US, this DTC approach saves costs by cutting out the distributors and retailers that form part of the traditional ‘3-tier’ system.

However, Hidden Gems Investing found several concern signs. The key competitive advantage in this industry is scale, which our data and sources suggest far outweighs the benefit of the DTC model. Naked has just over 1% market share and is competing against businesses that are many multiples its size. Our data collection found this meant Naked did not have the price advantage over other players investors thought.