GCI Liberty (GLIBA) Rights Offering: What is John Malone up to?

Update on GCI Liberty rights offering, Malone subscription, and valuation

On November 5, GCI Liberty (GLIBA) announced a $300mm rights offering, equivalent to ~30% of its market cap. An offering, particularly one of such size, surprised me and the market and caused the stock to fall ~5%.

John Malone is Chairman of GCI, owns 7.2% of the company, has been buying shares since the spin-off, and had stated in June that GCI was underlevered and may launch a sizeable buyback if the stock does not appreciate significantly post spin.

So why is Malone now issuing shares?

As I outlined in the recent Special Report, most investors think of GCI as an Alaskan telecom, but the company should instead be viewed as Malone’s next advantaged acquisition vehicle.

This article will explain how the rights offering supports this strategy and:

Increases GCI’s acquisition capacity by $300mm and accelerates the use of its tax shields

Will not dilute attentive shareholders

Allows you and Malone to increase ownership in GCI at a discounted rate

GCI Liberty (GLIBA) spun out from Liberty Broadband in July 2025. The company is Alaska’s dominant telecom operator with 90% market share in its key business yet trades for 10x underlying FCF. Investors have overlooked the spinoff because Liberty Broadband was 13x larger and is being acquired.

But John Malone did not ignore the spinoff. He is Chairman of GCI, owns 7.2% of the company, and has been buying stock. He structured the spin to turn GCI into an advantaged acquirer and “the beginning of a new Liberty Media”. GCI is an ideal acquisition vehicle because it benefits from two substantial tax shields and has ~$1bn of acquisition capacity over three years, equal to its current market cap.

We see limited risk over three years given GCI trades on 10x FCF, our Base case has 155% upside, and the Bull case is that we are at the beginning of GCI being transformed into an advantaged acquirer.

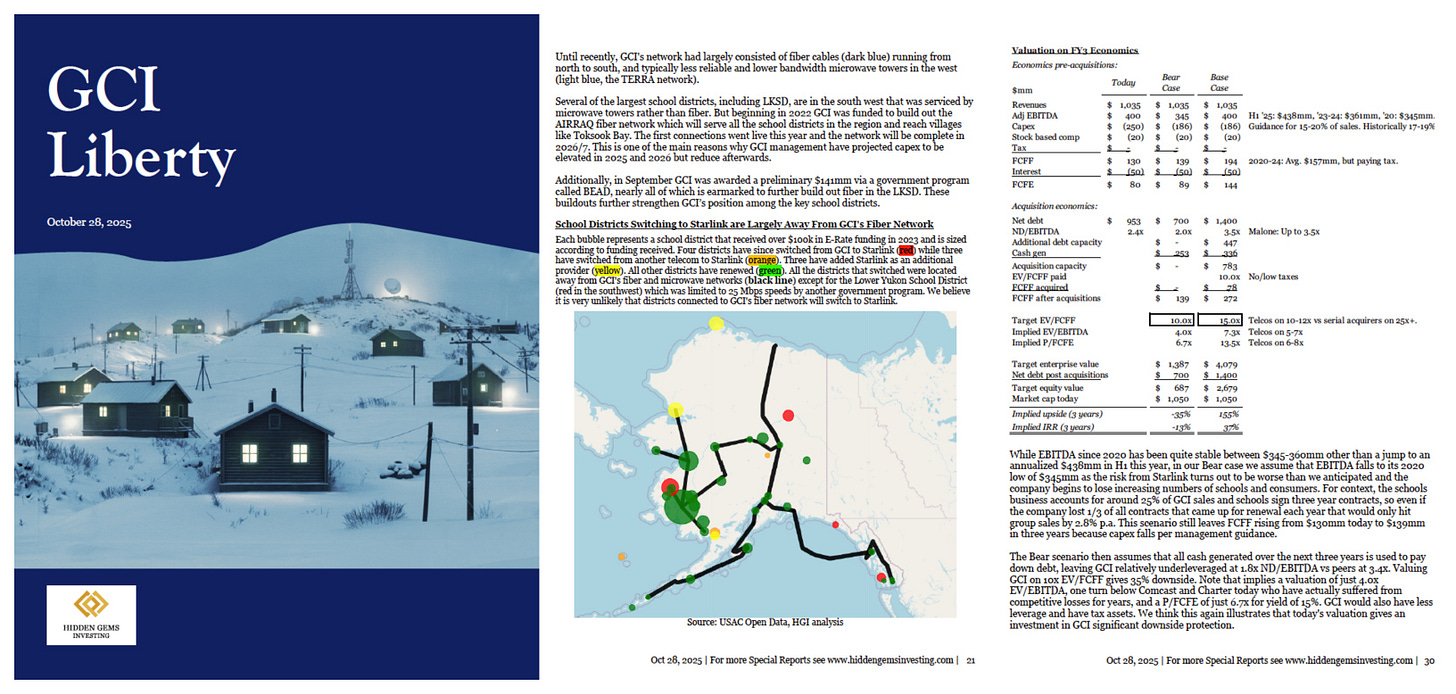

Click here to read our 30 page report on GCI, based on interviews with 17 industry sources (preview image is above).

The Rights Offering

The full details of the offering can be found here, but the key details are:

$300mm offering size

C Shares (GLIBK) will be offered at a 20% discount to a stock’s volume-weighted average price (VWAP) over a 10 day period set prior to the offering

Each share on Nov 25 will be issued a fraction of a right to subscribe to the offering, with 1 right entitled to buy 1 new share.

There will be an oversubscription privilege

The rights will be tradable under the symbol “GLIBR” from Nov 26

I will unpack the meaning of all these points below, but everything should be viewed in the context of this key line in the press release:

John C. Malone, Chairman of the Board of GCI Liberty, has advised GCI Liberty that he intends to exercise in full his basic subscription privilege and exercise his oversubscription privilege to acquire any and all shares remaining available following appropriate proration allocations by the subscription agent. Dr. Malone may also acquire rights in the open market.

My translation: Malone will be buying every share others leave on the table, and perhaps you should too. (Not investment advice.)

And while several of Malone’s other companies have done similar offerings post spin, including Liberty Ventures in 2012, Liberty Broadband in 2014, and Liberty Braves in 2016, none included the same commitment from Malone.

This means that Malone is willing to buy the entire $300mm offering, although I do not believe that will be necessary in practice.

Here are the economics behind the rights offering: