GCI Liberty (GLIBA): Spinoff, Dominant Telecom, John Malone | Special Report

Deep Dive on GCI Liberty: John Malone's next Liberty Media, business model, Starlink risk, and valuation as an advantaged acquirer

Situation Overview

GCI Liberty (GLIBA) spun out from Liberty Broadband in July 2025. The company is Alaska’s dominant telecom operator with 90% market share in its key business yet trades for 10x underlying FCF. Investors have overlooked the spinoff because Liberty Broadband was 13x larger and is being acquired. The spinoff was small and not relevant to the deal.

But John Malone did not ignore the spinoff. He is Chairman of GCI, owns 7% of the company, and has been buying stock. He structured the spin to turn GCI into an advantaged acquirer and “the beginning of a new Liberty Media”. His existing Liberty Media team will work for GCI too, giving it an exceptional management team and deal flow for a small cap.

GCI is an ideal acquisition vehicle for two reasons. First, it benefits from substantial tax shields with a $1bn step-up in tax basis from the spin that can offset future profits, and 100% first year depreciation of capex under the One Big Beautiful Bill Act that will be very meaningful given capex is typically 15-20% of revenues. Acquired businesses will likely not have to pay tax once they are part of GCI.

Secondly, GCI has ~$1bn of acquisition capacity over three years, equal to its current market cap. The company has a cash cow business to build around and is already under-levered.

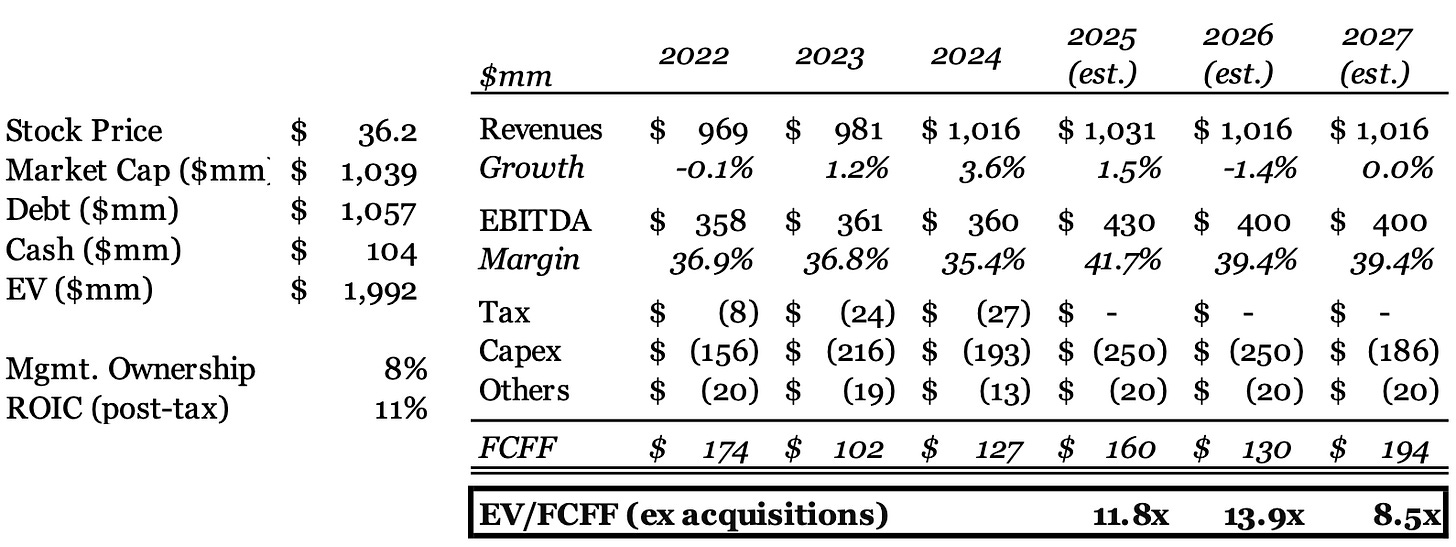

We see limited risk over three years given GCI trades on 10x FCF, a lower multiple than telecoms suffering from cord cutting. Our Base case has 155% upside, and the Bull case is that we are at the beginning of GCI being transformed into an advantaged acquirer.

Key Insights

1. GCI’s key business is providing broadband to rural hospitals and schools in Alaska. The company has 90% share of funding and that is unlikely to change given the state’s small population and harsh climate make the economics poor for new entrants. (see p.9-17)

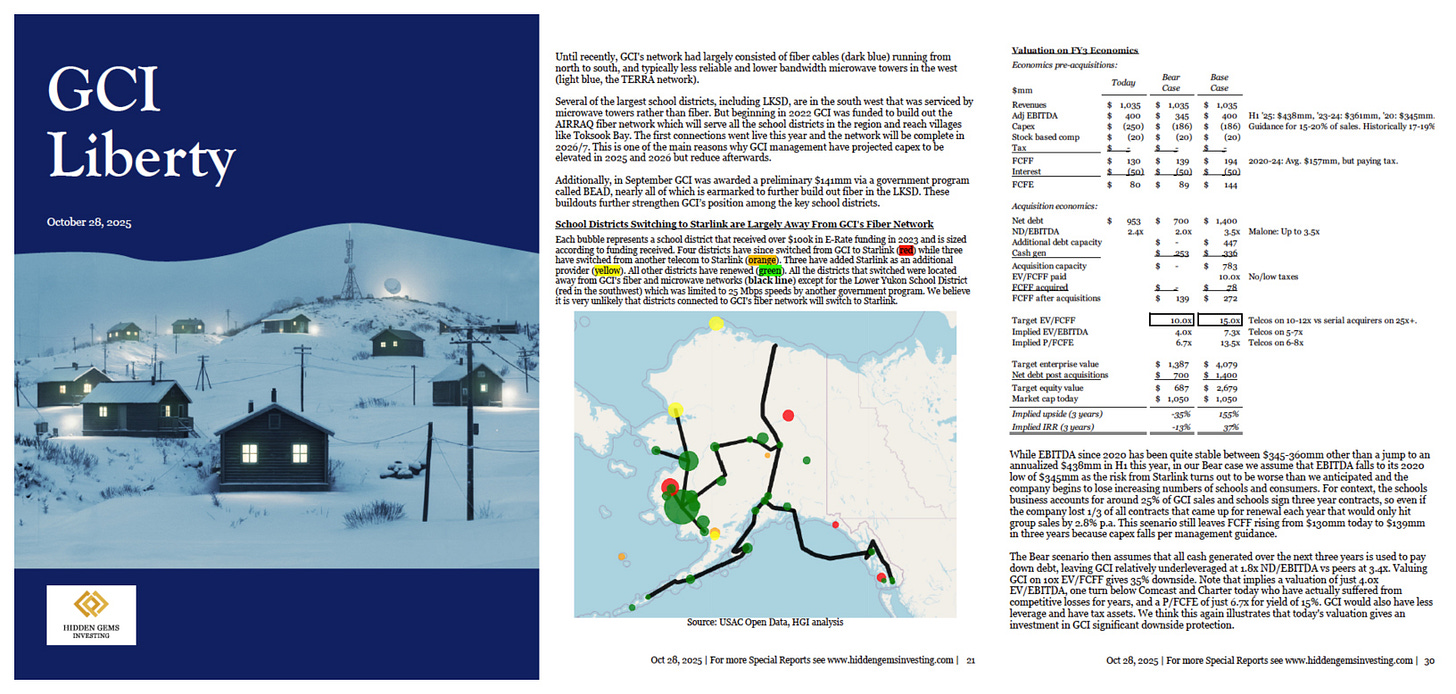

2. The biggest threat GCI faces is from Starlink, which is cheaper in remote areas and could pressure the size of GCI’s contracts. But Starlink has problems around reliability, latency, security, and bandwidth and we think is a manageable risk. Starlink is unlikely to win hospital customers but will take some remote schools and consumers. (p.18-23)

3. Malone has an outstanding record creating value from spinoffs, acquisitions, and tax shields. We think he is incentivized to allocate the best $1bn deals to GCI ahead of his other Liberty companies. (p.24-32)

Research Methods

In addition to utilizing secondary sources such as company filings, transcripts, and services such as Tegus, the information in this report was gathered by speaking with primary sources. This included discussions with GCI Liberty and:

7 former employees of GCI

6 business customers of GCI

2 competitors to GCI

2 other relevant sources

We spoke with some sources more than once. Information that could reveal the identity of the sources above are redacted from this report unless sources gave their permission. While Hidden Gems Investing gained many insights from these conversations, no information that was both material and non-public was shared.

We think you will enjoy this writeup more in a pdf format. Click “Download” below:

If you are a free subscriber and would like to view an example of our Special Reports before upgrading, click here to view our report on TerraVest for free. Now is a particularly good time to upgrade because prices are increasing on December 31 - but any subscription now locks in today’s rate for life. Most of our reports require over 100 hours of research and thousands of dollars in research expenses. A subscription gives you all that work, saving you enormous time and cost.