TerraVest Industries (TVK.TO): Serial Acquirer | Special Report

Deep dive on TVK's business model, valuation, and management with excellent track record and stock ownership

Situation Overview

Terravest Industries (TVK.TO) stock has delivered shareholder returns of ~30% p.a. for the last decade and we believe can come close to that going forwards. The company’s most senior members of management all earn relatively low base salaries and have the vast majority of their net worth in the stock. All are highly experienced and most are fairly young – CEO Dustin Haw is the key and is 40 – giving them a strong incentive and long runway to continue compounding capital. (See p. 22-29 for more background on management)

The company follows a roll-up strategy of acquiring, restructuring, and operating businesses that are generally mom & pops across storage tanks and pressure vessels (est. 55% of revenues), boilers and furnaces (25%), and oil & gas equipment (20%). We believe that Terravest creates value by acquiring businesses for an average of 11x P/E then restructuring to cut that to 7x, with restructuring the more important and where management spends most of its time.

Terravest does not speak to sell-side analysts, hold earnings calls, or give investor presentations. The stock is largely undiscovered among institutional investors and we believe will continue to do well as management executes, more investors take notice, and stock liquidity increases.

Key Insights

1. We see a long runway for future acquisitions. Although Terravest tends to be the largest player in its industries and even dominates some niches, they face many small competitors with founders who retire, and some of its industries see distressed sellers in downcycles. There are also adjacent industries where businesses use similar raw materials and production processes. (See p. 6-9)

2. Restructuring gains are typically found by shifting mindsets to focus on profits over revenues, combining purchases of steel and parts to gain volume discounts, labor reductions, and sharing resources. Terravest has been particularly successful at this in its storage tanks businesses, with some struggles in boilers and furnaces. (See p. 10-21)

3. Key risks: Many of Terravest's owned companies have industrial, oil & gas, and cyclical exposure, although we believe this is not as great as some investors fear. Management have done well in previous downturns and taken advantage of distressed sellers. Some businesses are likely to decline over time due to environmental concerns. And not every acquisition has worked out. Nevertheless, management’s strong execution means there has not actually been a three year period when Terravest's EBIT has declined. (See p. 33-34)

Research Methods

In addition to utilizing secondary sources such as company filings, transcripts, and services such as Tegus, the information in this report was gathered by speaking with primary sources. This included conducting long-form discussions with:

Terravest’s CEO

11 former employees at companies that Terravest has acquired, ranging from C-level to middle management.

Executives at 3 customers

Executives at 2 competitors

1 other relevant source

We spoke with some sources more than once. Information that could reveal the identity of the sources above are redacted from this report with the exception of Terravest’s CEO, given Terravest is a publicly traded company. While Plural Investing LLC gained many insights from these conversations, no information that was both material and non-public was shared.

We think you will enjoy this writeup more in a pdf format. Click “Download” below:

Want to receive more reports and insights? Subscribe and upgrade to paid:

Table of Contents

Research Methods

Economics

Storage Tanks

Boilers and Furnaces

Management

Valuation

Variant View & Catalyst

Economics - Business Model & Acquisitions

Economic Snapshot

Business Model

Terravest's business model is to:

Acquire: Typically in the industries of storage tanks (propane, ammonia, heating oil, fuel, water), oil & gas equipment (midstream parts like separators), and residential boilers and furnaces. Sellers are generally mom & pops and distressed or less price sensitive sellers.

Restructure: Takes 1-3 years to complete and varies case-by-case, but often involves bulk discounts on raw materials such as steel and valves, consolidation of factories, labor reductions, cross-selling, and always an increased focus on profits.

Operate: A decentralized approach where businesses receive limited interference from the core Terravest team, which is just a handful of people.

We believe that Terravest creates the most value in the acquisition and restructuring phases, with restructuring the more important and where management spends most of their time. While Terravest are entrepreneurial and cost conscious operators post restructuring, in our view areas such as R&D, IT, and formal procedures are not generally best-in-class. Although to be fair to management, some of that is deliberate given the decentralized model.

We see a long runway for the company to successfully continue its approach. Most of Terravest's industries are filled with small competitors while some are also cyclical, which results in distressed sellers from time to time. There are also adjacent industries where businesses use similar raw materials and production processes. Higher interest rates and more expensive debt also makes it easier for Terravest to compete against private equity firms for acquisitions.

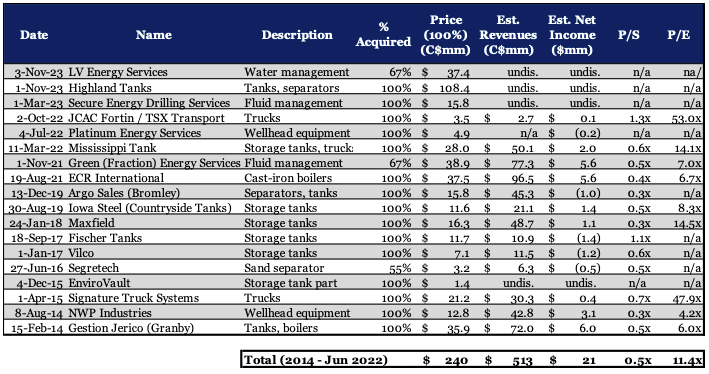

(Source: Terravest filings, Plural estimates)

Terravest typically pays 0.5x P/S for companies with limited amounts of debt. These businesses have an aggregate net income margin of 4.1%, but many are loss making. By restructuring these businesses, Terravest is able to increase margins to an average of 6.5% and reduce the P/E paid from 11.4x to 7.2x

(Source: Terravest filings, Plural estimates)

The P/E of 7.2x implies a 14% return with no organic growth, which is similar to our estimates for Terravest's post-tax ROCE and ROTC of 15% and 16% respectively. We estimate that organic growth at the group level averages 0-2%.

(Source: Terravest filings, Plural estimates)

While Terravest has a strong track record in acquiring businesses, not every case has worked out. Some businesses are in the heating oil or cast-iron boiler industries and are likely to decline significantly over time due to environmental concerns. Others are exposed to oil & gas prices and have barely remained profitable since the price of oil collapsed in 2014. And on rare occasions management have been surprised to discover the condition of the companies they acquired.

Nevertheless, we believe that Terravest's strong track record is no fluke and is repeatable. In fact, its excellent CEO Dustin Haw began running the company at the age of 30 and is still only 40 today. His added experience likely makes him a significantly better CEO today.

(Source: Terravest filings, Plural estimates)

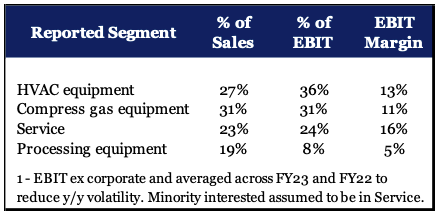

Although the company reports four divisions, we interpret its split of earnings differently because many acquisitions are consolidated into one division but offer products suitable for in multiple segments. For instance, Highland Tanks was acquired in November 2023 and will be consolidation into one division, but offers various types of tanks and pressure vessels as well as grease removal systems and water treatment systems. We think about Terravest's profitability as split roughly:

Storage tanks and affiliates (55%): This includes pressure vessels primarily storing propane but also ammonia and industrial gases, and tanks for fuel, heating oil, and water. Although these products reach different end markets, post acquisition Terravest extracts similar benefits from bulk buying steel and other parts. We believe this is the segment where Terravest is able to increase profitability most significantly. We think of trucks with propane pressure vessels attached as part of this segment too. Demand for products in this division are moderately cyclical and driven primarily by general industrial demand and cold weather, with oil & gas exposure fairly low. There is a significant replacement demand as well.

Boilers and furnaces (25%): This segment is made up of ECR and Granby's boilers and furnaces subsidiary. These companies primarily sell standard efficiency cast iron boilers which over time are likely to be regulated out of existence for environmental reasons. The companies sell a smaller number of high efficiency furnaces. Demand is driven by the replacement for boilers (not cyclical) and the housing cycle (cyclical).

Others (20%): This segment is largely related to oil & gas drilling in Western Canada and includes natural gas, midstream equipment, and some services. These businesses are a smaller portion of Terravest's profits than revenues, because several of them have had low levels of profitability since the collapse of oil prices in 2014.

This report focuses on Terravest's ability to restructure and outlook for the businesses in the storage tank and boiler segments. While the outlook for these businesses is important, they are generally growing or declining at low single digits levels through the cycle. In the instances where they are declining, we believe that management are well aware of that reality and unlikely to take the cash generated by those companies and spend it on R&D to innovate their way to growth. Instead, that cash is likely to be redeploy that into future acquisitions. We therefore think that Terravest's repeatable restructuring processes are key to the value of the company.

Storage Tanks

Unit Economics

Terravest's companies sell storage tanks and pressure vessels of many sizes. These store propane, ammonia, industrial gases, fuel, heating oil, water, and others.

Using propane pressure vessels as a case study, these can typically be put into three US Water Gallon sizes (‘gallons’):

Residential: 300-1,000 gallons. These go outside a home and provide heating. For context, a 2,000 sqft home uses 800-1,500 gallons of propane per year for heating depending on the temperature.

Trucks ('Bobtails'): 2,000-5,000 gallons. These are owned by propane marketers like Amerigas and transport propane to residential storage tanks.

Industrial: 10,000-120,000 gallons. These are typically used for storage at propane distribution facilities or near oil & gas wells where propane is produced as a byproduct.

(Source: Terravest presentation)

One of the products Terravest sells is 60,000 gallon pressure vessels, which are very large tanks that typically store propane near oil wells or at propane distribution centers. We estimate that Terravest has often been able to increase gross margins on this product by around three-quarters after acquiring and restructuring a company.

(Source: Plural estimates)

Although Terravest often makes many changes to the companies it acquires, we believe the largest are in:

#1 - Mindset:

Many of the companies that Terravest buys were primarily focused on revenues and growth. Terravest is focused on costs and profits.

Terravest will shut unprofitable operations, pay salespeople on margins rather than volumes, reward staff throughout the company with a profit share, and reorganize its businesses so that each one is focused on manufacturing its highest margin products. For example, after acquiring Argo Terravest shut one of its two facilities, partly because that facility produced tanks that could be produced more efficiently at Maxfield. For similar reasons production of some process equipment shifted from Maxfield to Argo.

In some cases Terravest has invested in modernizing production. For instance, the company invested $8.5mm into a new 110,000 ft plant that consolidated production from several acquisitions into single site in Cowansville, Quebec, in 2019. Some manufacturing processes were modernized and production capacity doubled.

#2 - Buying power:

Terravest is the largest player in most of its storage tank markets and that scale is the company's largest and most sustainable competitive advantage.

While many of the acquired companies buy steel from distributors, Terravest buys directly from mills and its scale gives it bulk-buying discounts of 10-30%. This is a critical saving as steel is often over half the cost of producing a tank. Similarly, Terravest achieves savings procuring valves and other parts.

The company's scale also means it can sometimes afford to stock more inventory than a mom & pop. For instance, Terravest can buy $10mm in steel plates and can sit on that inventory, whereas the previous owners may have risked bankruptcy if they invested that into working capital and orders did not quickly follow. In the case of Maxfield, greater steel inventory means it can now delivers tanks in 10-14 weeks vs 20-26 weeks for its mom & pop competitors who have to wait for steel to be delivered to them. That matters because oil & gas customers are often waiting on tanks to be delivered before they are able to begin drilling. Maxfield now often charges 5-10% higher prices because of its delivery speed.

#3 - Shared resources:

Terravest often consolidates multiple facilities into one. For instance, Argo was acquired in 2019 and had two facilities, one of which was shut in 2022 after its lease came up for renewal. Production was then moved to Platinum Energy Services, another Terravest acquisition. Platinum is ten minutes drive from Argo's remaining site, and that allowed the two shops to share welders and manufacturing capacity. This was a significant benefit given the struggle to find skilled labor and resulted in increased utilization.

Terravest sometimes has several businesses that make similar products and so depending on production schedules, backlogs, and location the company selects the shop which maximizes delivery speed and minimizes costs. Terravest’s businesses can also share leads. For instance, US tank manufacturers Countryside Tanks and Mississippi Tank often share leads with Canadian operations like Maxfield in order to provide customers with the best results.

Industry Overview

Terravest's tank businesses operates primarily in Canada and the northern United States.

In Canada, nearly half of all propane (ex what is used by producers) is consumed for industrial purposes. This is primarily in the oil & gas and mining industries, where propane is used for heating remote locations, power generation, vehicle fuel, smelting and refining, and injection into oil reservoirs for enhanced oil recovery. Propane is also a valuable byproduct of oil & gas drilling and Terravest's tanks are used to store the gas. Around one-third of propane is used to heat residential and commercial buildings, while the rest is used for by farmers to heat crops, and as a fuel for vehicles[1].

In the US, 54% of propane was used for residential homes in 2020, with 23% for commercial offices, and 10% for agriculture[2]

Although Terravest serves many of these markets, its key customers are propane retailers like Amerigas and Suburban Propane who supply propane for residential and commercial heating.

While heating with propane is typically cheaper than electricity and heat pumps in colder climates, it is usually used in locations that do not have access to a natural gas pipeline. The vast majority of homes in the US are heated through natural gas or electricity. According to the U.S. Energy Information Administration’s 2020 Residential Energy Consumption Survey, propane is used as a primary heating fuel in 4.2 percent of U.S. households, with a high of 16 percent in North Dakota (a northern state where there is less infrastructure) and a low of 2 percent in Arizona, California and Texas (warmer southern sates with more infrastructure).

Unlike natural gas, propane is not piped directly into homes or office buildings. Instead, Terravest sells 'bobtail' trucks with a storage tank to propane retailers. These trucks collect propane from the retailer's regional large storage tanks (also sold by Terravest) and drive to homes and offices, typically filling up a storage tank next to the building. The propane is then piped into the building's heaters, cookers, and other appliances.

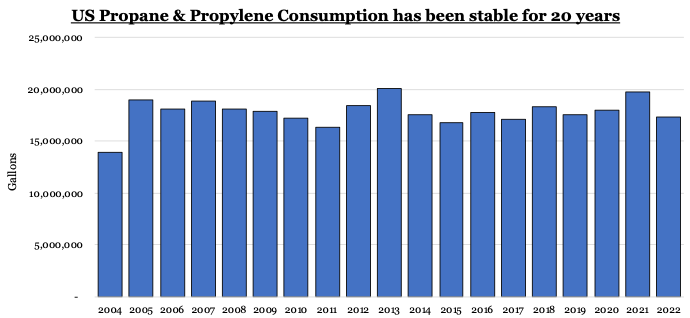

While propane is used by a relative small set of consumers, there is an investor misperception that consumption has been in structural decline.

(Source: EIA, https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=WPRUP_NUS_2&f=W)

Nevertheless, it is likely that propane will increasingly become a low-single-digit declining market in the future due to regulatory pressure. Politicians and regulators in the US and Canada generally believe that propane is a dirty fuel because it is a byproduct of fossil fuel drilling. In fact, propane has a carbon intensity similar to natural gas and renewable blending methods bring that down even further.

(Source: https://www.lpgasmagazine.com/2022-state-of-the-industry-propane-retailers-face-raging-forces/)

In our conversations with the major propane retailers in the US and Canada, we found that all of them were frustrated by what they see as regulatory misperception. However, we got the impression that they thought it was unlikely this would change significantly and that politicians are focused on making electricity the primary fuel source for heating, even though the carbon intensity of electricity can be higher. As a result, all of the major propane retailers are gradually diversifying away from propane.

Nevertheless, the US systems means that regulations and building codes differ by state and Canadian local governments tend to be more favorable so we see the move against propane to be a multi-decade process.

The demand for Terravest's tanks tends to be more cyclical than propane demand. While the propane market is flat and steel tanks can last for decades with the replacement of valves and re-painting, only some of Terravest's demand is to replace tanks that are leaking or at the end of their regulated life span.

Much of the demand comes in the form of growth capex in a no-growth market because companies tend to prefer buying new tanks rather than old tanks from competitors. For instance, if a residential home moves from one propane supplier to another, for insurance reasons they typically have to switch their propane tank to one provided by the new supplier. That new supplier is likely to have purchased a new tank from a company like Terravest, while the old supplier is left with an old tank that is not reused. In fact, suppliers sometimes do not even redeploy tanks from their own old customers to new ones.

Capex by residential propane suppliers tends to be flexed down during recessions, with one major US supplier saying they would cut capex by around one-third by deferring the replacement of bobtail trucks and regional storage centers.

Demand for tanks in Canada also tends to be cyclical, particularly as it is driven by industrial (oil & gas) use. If fewer new wells are drilled there is less need for tanks to store the propane byproduct.

(Source: CapitalIQ)

All the major propane retailers are customers of Terravest and the market is highly fragmented:

(Source: Suburban Propane Presentation)

In Canada, major customers also include oil & gas production and midstream companies such as Suncore Energy, Encana Energy/Ovintiv, Husky Energy, and Wolf Midstream.

Competition

We see Terravest's storage tank businesses as largely split into three groups that gain synergies from each other. Note that these are not perfect groupings as the businesses often sell into multiple regions and sell non-storage tank products (particularly the businesses in Western Canada). But geography matters because storage tanks are heavy and often expensive to transport, making competition primarily local.

Western Canada (Alberta):

Maxfield

Argo Sales

Platinum Energy Services

NWP

RJV

Eastern Canada (Quebec, Ontario):

Granby

Pro-Par

Signature Truck (In Michigan but close to Canadian border and a Granby subsidiary)

Fischer Tanks (In Michigan but close to Canadian border and a Granby subsidiary)

United States (primarily Northeast)

Highland Tanks

Mississippi Tanks

Countryside Tanks

Each of these groups and businesses compete in fragmented markets that largely consist of mom & pops. While Terravest's market share is hard to estimate, we believe that in Canada it is typically the largest player by a distance and in some cases has share as high as 60%. Terravest faces around four to six competitors in most Canadian markets.

Competition is stronger in the US, where Terravest is one of the leading players. While there are also many mom & pops there are also more sophisticated companies such as Worthington Enterprises and Arcosa.

Boilers and Furnaces

Unit Economics

Terravest's companies ECR and Granby sell a variety of residential heaters. These are primarily:

Boilers. Mostly traditional cast-iron boilers that have standard (i.e. low) energy efficiency.

Furnaces. Electric furnaces.

(Source: Terravest presentation)

We believe that Terravest has been significantly less successful in generating synergies from these businesses than from storage tanks. The company's boiler and furnace businesses consist of brands that were merged into Terravest via the company Granby in 2014 and the C$38mm acquisition of ECR in 2021, with ECR being a larger portion of revenues. We believe that Terravest has yet to generate meaningful synergies from ECR and encountered an array of problems. Nevertheless, ECR was acquired for an estimated 6.7x P/E and limited capex has been invested in it, with the low price meaning that it has probably worked out to be a reasonable investment despite these issues.

The most common product that ECR sells is the cast-iron boiler for residential homes.

(Source: Plural estimates)

Like in its storage tank businesses Terravest attempted to make many changes to ECR, with the largest being:

#1 - Mindset:

While acquired companies tend to be focused on revenues and growth, Terravest is focused on costs and profits. This led to Terravest reducing R&D on higher efficiency boilers and projects like blending natural gas with hydrogen. Some employees at ECR believed this was short sighted because the company's cast-iron boilers probably have a limited future as regulation increasingly demands higher efficiency.

To be fair to Terravest, management were well aware prior to the acquisition that cast-iron boilers have a limited life and are in contact with the US Department of Energy about when that may be. Management believe that because of the cheap price paid for ECR, Terravest will make its money back if cast-iron boilers are regulated away quickly and could make a multiple of its money if regulation is slow.

An alternate strategy would be for Terravest to buy in higher efficiency boilers and heat pumps at a later date, which may require less capital than developing the technology in-house. Our sources suggested this strategy could be difficult to pull off however as the technology and parts typically reside with European companies who see the US market as small and a low priority. Terravest acquired ECR from a European company called Baxi which still supplies them with parts for high efficiency boilers when required, but which leaves ECR vulnerable to a sole supplier.

#2 – Modernization:

Terravest attempted to automate manufacturing, an idea that was likely inspired by the success of its Cowansville facility which was opened in 2019. However, this automation was significantly pared back as it turns out some of manufacturing stages are easier with human intervention.

Terravest consolidated ECR's Dunkirk and Utica plants into one at Dunkrik, which resulted in gains from increased utilization.

Little buying power:

Unlike in its storage tank businesses, Terravest was unable to gain significant volume discounts at ECR. The key component required in boilers is a heat exchanger, which ECR sources entirely from Waupaca Foundry. However, ECR makes up a small fraction of Waupaca's revenues and so was unable to gain any discounts. ECR's sourcing from Waupaca is also a risk, as Waupaca's primary focus is on autos and farming equipment rather than boilers and ECR would be without a supplier if Waupaca discontinued the business.

Management turnover:

Like many of the companies that Terravest acquires, ECR was a mom & pop business run by founders who retired with the acquisition. That led to disorganization at the company which was exacerbated when Terravest promoted an internal candidate to President and dismissed him soon afterwards. Multiple sources told us that the leadership at ECR has been poor for many years, with Terravest largely letting the business run itself.

Other concerns:

Our sources also told us that Terravest were caught off guard by the state of the business after it was acquired. Aside from the people issues, ECR is also a company that was assembled over two decades by acquiring other mom & pops. That led to many brands and different boilers that require different parts for servicing. Our understanding is that ECR had thousands of individual parts in its inventory, much of them old parts that were effectively abandoned inventory which Terravest had assumed was valuable.

Industry Overview

The market for gas boilers and furnaces typically grows at low single digit rates per annum. The boiler market is very stable as most units are for replacements, while the furnace market varies with the housing cycle.

(Source: Energy Star, Plural calculations)

The boiler market can be further divided into two: (i) Standard efficiency cast-iron boilers, which is what Terravest's ECR and Granby primarily sell. (ii) High efficiency boilers and furnaces. Terravest sells some of these but they make up a small part of its business.

The key trend in the market is that the US Department of Energy reviews and typically raises the minimum efficiency requirements every seven years. The last time this was raised was in 2016 and implemented in 2021, when minimum annual fuel utilization efficiency (AFUE) levels were raised to 84%. The maximum efficiency that a cast iron boiler can achieve is typically 84%-89%, meaning that the next increase in AFUE levels could regulate many of Terravest's boilers out of existence entirely, or more likely out of new home builds.

In order for Terravest's ECR subsidiary to stay in business in the long run it will have to transition to high efficiency boilers, but Terravest has cut the company's R&D department and our sources were mixed on whether it would be difficult for ECR to find an alternate source. Terravest may also choose for the company to enter a managed decline and liquidation.

High efficiency boilers are almost always developed in Europe, because tougher environmental regulations there mean the high efficiency market is an order of magnitude larger than in the US. In fact, Terravest acquired ECR from Baxi, a European company that manufactures high efficiency boilers and supplies ECR with products. But future supply could be vulnerable now that Baxi no longer owns the company.

Yet even as regulators in the US demand higher efficiencies, ECR's revenues are unlikely to decline rapidly. Regulations differ by state and city, and consumers with an existing cast iron boiler are very unlikely to switch because the existing piping and ductwork in their homes is designed for a cast iron boiler and is expensive and time consuming to rip out. Most of ECR's revenues today already come from replacements and that is likely to continue.

Competition

Terravest's boiler and furnace markets consist of a small number of businesses and mom & pops that dominate the market. The company's main competitors in cast-iron boilers are Weil-McLain (private) and Burnham Commercial ($105mm enterprise value / $250mm revenues), while in high efficiency boilers they are Lochinvar (private) and Navien (private).

Our sources pointed us to a Consumer Report survey that highlighted Terravest's key brands (in blue below) as average or below average. Burnham Commercial's brands are highlighted in red as a comparison.

(Source: Consumer Reports' 2021 and 2023 Summer Surveys)

Our sources characterized these as friendly markets with limited competition. The decision on which brand's boiler to go with is usually made by the builder installing the boiler, who typically goes with the brand they are familiar and has spare parts and tools for rather than price. Convincing that builder to change is hard as they are more likely to go to a different distributor that stocks the brand they are looking for.

Nevertheless, the market is efficient enough that companies have limited pricing power. A customer would very likely kick up a fuss if a company tried to raise its prices more than a few percent per annum as this is a small industry where everyone knows each others prices.

Customers are large distributors such as Home Depot and Ferguson, who need boilers to fill out their product range rather than because they sell in large volumes.

Management

Senior Management

Members of management from left to right - Pierre Fournier (Pres of Granby), Dale Laniuk (Board member & ex CEO), George Armoyan (Founder & CEO of Clarke), Charles Pellerin (Executive Chairman of Terravest and board member at Clarke), Yves Legault (ex VP of Operations), Dustin Haw (CEO), Mick MacBean (Board member), Blair Cook (Board member of Terravest and Clarke)

(Source: https://www.granbyindustries.com/en-us/granby-industries-officially-in-operation-in-cowansville/)

Terravest was founded in 2004 by Dale Laniuk. Laniuk's background is in welding and farming and he had been convinced by a private equity firm to put his businesses into an income trust for tax purposes. The trust then did five acquisitions and ultimately failed.

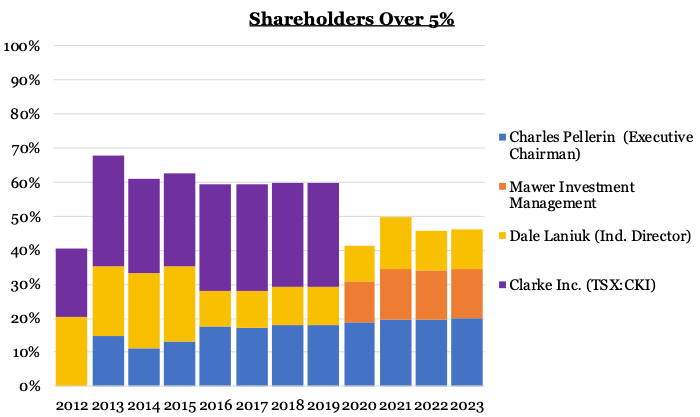

In 2006 Clarke (TSX:CKI), a publicly traded Canadian investment firm, acquired 10% of the company around C$6-C$12/shr. Clarke's Founder & CEO George Armoyan is a value investor typically focused on identifying businesses trading for cheap valuations, with a view to being an activist and bringing change. He is generally a long term shareholder who is willing to hold and invest through down cycles. Clarke's main investments are in hotels, residential real estate, industrials, oil & gas services, and marketable securities.

Armoyan viewed Terravest as a stock trading below liquidation value and with valuable tax losses. He ultimately joined the board and increased Clake's position to 31.5% by 2013 after the stock declined to around C$2/shr.

(Source: Clarke presentation)

In 2012 Dustin Haw, then in his 20s, was hired out of university after completing a PHD in physics by Armoyan to work as an analyst for Clarke. Haw was soon sitting on Terravest board meetings with Armoyan and effectively running the company.

In 2014, Terravest acquired Jerico, which operates under the brand Granby. Granby was a business owned 75% by Clarke and 25% by Charles Pellerin, a Canadian business person who had inherited several businesses and whose full-time employment was as a partner at an accountancy firm. Pellerin became Chairman of Terravest and has since been running the company with Haw.

Clarke and Armoyan eventually exited in 2020 when all Clarke shares were paid to its shareholders as a dividend. Terravest's stock had appreciated to C$17 and Armoyan's deep value instincts had led him to be keen to get out for a while.

Since then, Clarke and Armoyan have had no formal involvement with Terravest. Pellerin (now Executive Chairman) and Haw (CEO since 2017 but effectively running the company since 2014) lead the company. Nevertheless, Terravest board members Pellerin and Blair Cook are both on Clarke's five person board.

Mitch Gilbert, with 14 years’ experience in investment banking in Canada, had joined the company in 2013. He now works as Chief Investment Officer, primarily focused on sourcing and negotiating acquisitions. Haw takes over due diligence alongside Gilbert and seeks additional advice from the relevant operating presidents at Terravest. Pellerin is involved throughout and usually speaks with Haw weekly.

Haw also leads the business on a day-to-day basis. Although each business segment has its own President, Haw gets into the weeds on operations.

Together Pellerin, Haw, Gilbert, and the operating presidents form the core team at Terravest. The company has no senior head office staff other than CFO Marilyn Boucher its headquarters is part of one of Granby's facilities. An investment in Terravest is largely an investment in this group of people, as Terravest's companies have limited organic growth and the future value of the business will be largely determined by how these people (and Haw in particular) allocate FCF.

The company's board is effectively run by insiders with the governance (comp) committee consisting of the entire board, including the CEO. There were no separate governance meetings held in 2023. This structure more closely resembles a fund rather than a company.

Nevertheless, we believe management have high integrity and all of the core team have had very high share ownership. They have treated shareholders well and often bought shares in the open market.

(Source: CapitalIQ)

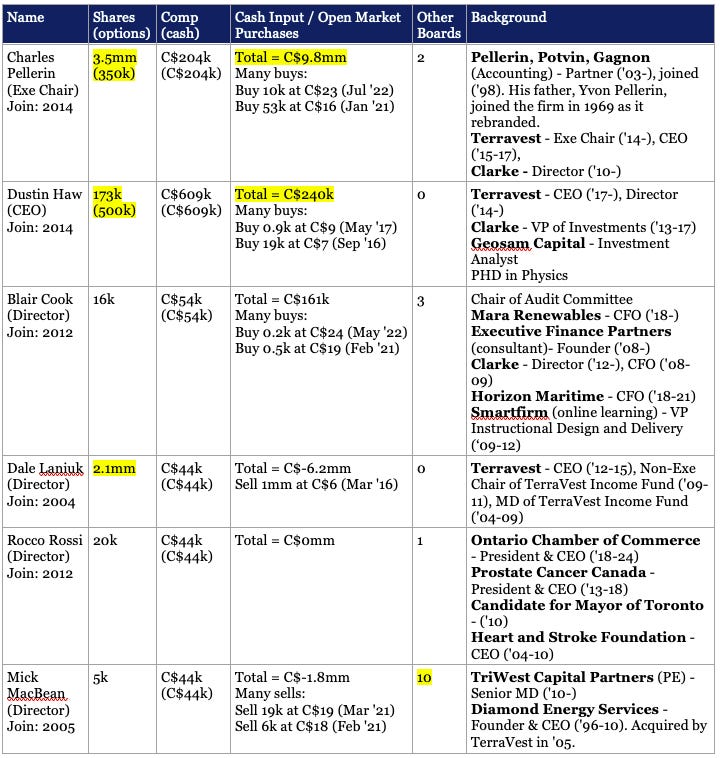

Board of Directors:

(Sources: Terravest filings, CapitalIQ, others)

Other senior management:

(Sources: Terravest filings, CapitalIQ, others)

Management Comp

Management pay is very low, with most board members getting paid C$44k-54k and the CEO averaging C$811k from 2021-23. Terravest's Executive Chair, CEO, CIO, President of Compressed Gas, and President of HVAC are all extremely incentivized through shares. If the stock compounds at 15% until 2032 their shares and options are worth ~C$505mm, ~C$80mm, ~C$55mm, ~C$55mm, and ~C$11mm pre-tax. That is before any additional options they are likely to be granted between now and then. These sums would likely constitute the vast majority of their net worth.

Almost nothing is disclosed about the criteria for management's annual bonuses, but those are less significant than normal given their financial incentive is clearly for the stock to compound. Our guess is that operating presidents are incentivized on EBITDA.

(Source: Terravest filings)

(Source: Terravest filings)

Management Quality

Since 2013 Terravest has delivered total shareholder returns of ~30% p.a vs 13% for the S&P 500. Since 2019, these returns are ~30% p.a. for Terravest and 15% for the S&P 500.

We believe that CEO Dustin Haw has high integrity and excellent capital allocation abilities, while other members of management score well but are below Haw. In our view one of Terravest's weaknesses is that the management bench is not deep.

We received many references from our sources on Terravest's core team including eight on Haw. Seven of Haw's references were positive, with sources emphasizing his character, intelligence, and financial focus.

Capital allocation and strategy:

From FY19-FY23 management generated and allocated cash in the following ways:

Operating cash flow (ex SBC, WC) = C$287mm

Working capital = C$-61mm

Net capex vs D&A = C$-84mm vs C$126mm (includes some goodwill amortization)

M&A = C$-117mm

Dividends = C$-37mm

Debt = C$81mm

Equity (inc SBC) = C$-29mm -> But they issue shares in some acquisitions. Share count is 18.1mm today vs 17.6mm 5 years ago.

Others = $-16mm

= Net change in cash = C$24mm

We believe that management focuses on generating returns on capital when making decisions, rather than chasing growth or building empires. Several of Terravest's businesses are in decline, and management are not in denial and not investing capital at bad returns to force growth.

Within Terravest's businesses, management tend to allocate capital in ways that reduce costs. As profiled throughout this report, that includes consolidating facilities, machinery that increase automation, pooling resources, labor reductions, and others.

Management tends to take cash generated by its businesses and make acquisitions of mom & pops in niche markets that have significant synergies with Terravest's existing companies. Terravest does not have a specific return hurdle to make these acquisitions, but generally expects to make well over 15%.

Terravest often faces limited competition for small acquisitions and competes with private equity for larger ones. Even larger acquisition tend to have few PE bidders given the industries are niche, small, and low/no growth. While Terravest does not take as much leverage as PE firms and so usually does not offer the highest bid, it has advantages because it can provide obvious synergies (e.g. reduce the cost of procuring steel by 20%) and because management come from the industry rather than a private equity background.

Most of Haw's time is focused on restructuring and increasing margins, rather than acquisitions.

Terravest also buys back stock from time to time, viewing the attractiveness of a buyback as about judging the return from its stock rising to intrinsic value vs the more certain return from making an internal investment. The company has not been afraid to be aggressively buy back stock when it is trading well below intrinsic value, buying back 36% of shares outstanding in 2012. Nevertheless, large buybacks are hard to do due to the lack of liquidity in the stock. The company tends to do tender offers when a large shareholder wants to exit, with Haw having a good idea of where the vast majority of shares are held. Beyond that, management do not pay much attention to public markets, hold quarterly calls, or speak to sell-side analysts.

Equally, management are not afraid to issue equity if a highly accretive acquisition is available that is too large to be funded entirely through debt.

Culture & staff:

Terravest's core team are highly entrepreneurial and cost conscious. The company does not pay for a corporate headquarters, nice presentations or investor relations staff - the CEO answers investor inquires himself. Management live off base salaries that are well below what comparable businesses tend to pay. This cost focus is true throughout Terravest's businesses.

The flip side to the focus on cost is that Terravest's culture is not particularly innovation or customer focused.

And while senior management are generally of a high quality, our sources and online employee reviews suggest that middle management could be better operators.

Valuation

Is this a one foot hurdle or three foot hurdle?

One foot. Terravest's businesses and management approach are relatively easy to understand.

How could this be a value trap?

Some of Terravest's business, particularly in cast-iron boilers, could enter structural decline.

Is this a cigar butt? Is this an appreciating/depreciating asset? Productive/Non-productive?

Terravest's businesses can resemble cigar butts, although they are not typically depreciating assets. However, management are well aware of this and excellent at redeploying capital elsewhere.

Is there an agency cost?

No, management is excellent.

Is this a turnaround story?

No.

Is this a company with big promises/hopes but little track record?

No. Terravest has a strong track record.

Is this a small company with apparently unique IP that could be squashed by big competitors?

No.

Is this a single product company and/or is there a fad risk?

No.

Base Case Valuation

We believe that Terravest shares can generate a 25% IRR over the next three years, meaning a double over that period.

Our valuation tries to account for Terravest's current FCF generation with no organic growth beyond margin improvements after recently acquired businesses have completed their restructurings, and FCF from future acquisitions. We use NOPAT, adjusted for capex being lower than depreciation, as a proxy for FCF.

(Source: Terravest filings, Plural estimates)

We estimate that Terravest is trading on 13x NOPAT after its existing acquisitions are restructured. That compares to an average of 15x since the management team took over in 2013, or 17x in the last three years as trading liquidity has increased and the company has gained recognition with investors. For context, industrial peers Worthington Industries and Arcosa trade at 18x and 25x, while successful roll-ups can trade at similar or higher multiples.

(Source: CapitalIQ)

For companies like Terravest where management are excellent at deploying FCF into new and adjacent businesses, we think it is important to value the company not only on its existing economics but also on the capital that will be deployed our investment horizon. At a 15% ROCE, half the capital in the company in five years will have been deployed after our investment.

Since that capital is unlikely to be deployed organically, the returns management can achieve on that incremental capital in new businesses will be crucial to the value of the company. We find that this is something the market typically does not price in to a stock, and is partly why we have focused this report on Terravest's process in repeatedly deploying capital at high returns in new businesses.

To estimate how much capital Terravest can deploy into new businesses between now and FY26 we look at current net debt, estimate cash generation in the interim, and assume an ND/EBITDA multiple of 2.4x in line with the company average since 2014 (it has peaked at 3.1x and bottomed at 1.9x). That implies Terravest has acquisition capacity of C$218mm over the next three years. This estimate is actually conservative because the newly acquired businesses will themselves bring EBITDA and generate cash.

At Terravest's historic acquisition multiples that implies the company will acquire C$30mm in additional NOPAT. We assume no organic growth in existing or new businesses beyond margin improvements from restructuring.

Assuming Terravest maintains a 17x trailing EV/NOPAT multiple, in line with the last three years and below its peer group, implies the stock can generate just above a 25% IRR for a double over three years.

(Source: Terravest filings, Plural estimates)

There is further upside potential in a bull case from Terravest's oil & gas focused businesses recovering from being barely profitable since oil prices declined in 2014, or from stock liquidity and investor recognition continuing to grow. Arguably the greatest success story of Canadian roll-ups has been Constellation Software, which has seen its EV/Cash NOPAT multiple expand from 15-20x two decades ago to around 50x today as its track record increasingly gets proved out, investors recognize it, the stock appreciates, and trading volumes improve.

Bear Case Valuation

Many of Terravest's businesses have industrial, oil & gas, and cyclical exposure, although we believe this is not as great as many investors fear. The largest decline in EBIT margins the company has seen since management took over was from FY15 to FY17 when margins declined from 13.1% to 7.6%. Margins rebounded to 10.6% in FY18 with absolute EBIT levels higher at C$28.6mm vs C$25.5mm in FY15, meaning there has not actually been a three year period when Terravest's EBIT has declined.

The company's storage tank and affiliated businesses (55% of profits) have significant demand from replacement and temperature. Boilers and furnaces (25% of profits) also has a large amount of replacement demand, although new home sales are important too. Oil & gas (20% of profits) is highly cyclical but there is often a delay between oil price declines and a drop orders for midstream equipment, the 2014 oil price decline had its full impact in 2016.

Management are also good operators in downturns given their cost focus. As an example Terravest's oil & gas businesses have been barely profitable since 2014, but many competitors have been loss making and gone out of business. The company actually grew profits through Covid in FY21, and even without wage subsidies earnings would likely have been roughly flat.

Finally, a modest downturn may enable management to deploy capital at more attractive rates by buying distressed mom & pops, like it has done in the past. In 2016 after the stock declined sharply, Terravest initiated a buyback and acquired around 5% of its shares.

Despite there not being a three year period when Terravest's EBIT has declined understand current management in a timeframe that has included several collapses in oil prices and the Covid recession, we assume in our Bear case that NOPAT initially halves then recovers to down 25% over three years. A 13x multiple implies 24% downside over three years.

While in the scenario outlined the stock would likely decline far more than 24% from current levels, we view risk as the permanent loss of capital. We think of that in practice as what could we sell the stock for in a Bear case if we owned it for three years and were not forced sellers. While Terravest traded down to 9x NOPAT in the past for nearly two years (2015-16), the stock quickly rebounded alongside earnings. With greater recognition of Terravest's track record and increased stock liquidity, with think that it is reasonable to assume at some point over three years we would be able to sell at 13x, in line with multiples during Covid.

(Source: Terravest filings, Plural estimates)

Variant View & Catalyst

Why does this opportunity exist?

While Terravest has started to accumulate a cult following largely among a small group of individual investors, the company remains mostly undiscovered. The stock is very tightly held among a small group of investors.

Market Cap: C$800mm

Volume: ~C$300k/day

Number of days float turns over (exclude 5%+ holders): 1,500 days.

Sell-side coverage: None

Buy-side coverage (Last 5 years):

Short ratio: <1%.

% of float owned by retail investors (CapitalIQ): 78%

Variant view and catalyst

While we believe markets struggle to price the ability of management to deploy incremental capital into new businesses, no particular variant view or catalysts are needed in the case of Terravest. The stock is mostly undiscovered and should perform well as management continues to execute and the company becomes more discovered.

Share Price

(Source: CapitalIQ)

Want to receive more reports and insights? Subscribe and upgrade to paid:

You may also be interest in our update in May 2025: Is TerraVest Still Cheap?

See all Hidden Gems Investing content on TerraVest at the Table of Contents.

Important Disclosures

As of the publication date of this report, Plural Investing, LLC and its affiliates (collectively, “Plural”) hold a position in Terravest (“the company”). Following publication, Plural may transact in the security of the company. No representation is being made that Plural will or is likely to hold the same or equivalent positions or allocations in the future. All expressions of opinion are subject to change without notice, and Plural does not undertake to update this report or any information herein.

This material does not constitute an offer or solicitation to purchase an interest in Plural Partners Fund LP (the Fund"), or any related vehicle. Any such offer will only be made via a confidential private placement memorandum. An investment in the Fund is speculative and is subject to a risk of loss, including a risk of loss of principal. There is no secondary market for interests in the Fund and none is expected to develop. No assurance can be given that the Fund will achieve its objective or that an investor will receive a return of all or part of its investment. This material is confidential and may not be distributed or reproduced in whole or in part without the express written consent of Plural Investing LLC (the “Adviser”).

The information contained in and accompanying this communication may be strictly confidential and intended solely for the use of the intended recipient(s). If you are not the intended recipient of this communication please delete and destroy all copies immediately. Emails may be interfered with, may contain computer viruses or other defects and may not be successfully replicated on other systems. Plural Investing LLC gives no warranties in relation to these matters. If you have any doubts about the authenticity of an email purportedly sent by Plural, please contact Plural immediately. Plural reserves the right to intercept and monitor the content of e-mail messages to and from its systems.

Certain information contained in this presentation is derived from sources believed to be reliable. However, the Adviser does not guarantee the accuracy, completeness, or timeliness of such information and assumes no liability for any resulting damages. Due to the ever-changing nature of markets, the deductions, interrelationships, and conclusions drawn from historical data may not hold true in the future.

This material contains certain forward-looking statements and projections regarding market trends, Fund allocation, and investment strategy. These projections are included for illustrative purposes only, are inherently speculative as they relate to future events, and may not be realized as described.

These forward-looking statements will not necessarily be updated in the future.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

[1] Source: http://propane.ca/wp-content/uploads/2022/08/CoBC-Market-study-2021.pdf

[2] Source: https://www.npga.org/wp-content/uploads/2022/05/Todays-Propane-546268.pdf