Naked Wines (WINE): Concerns & Competition | Special Report

Deep Dive on WINE's business model, competitive risks, and valuation. (WINE.L)

Executive Summary

Naked Wines is the David fighting against the Goliaths of the wine industry. Yet this time, there is no guarantee that the underdog wins.

The company sources over 200 wines from small independent winemakers and sells them directly to consumers. In Naked’s key market of the US, this DTC approach saves costs by cutting out the distributors and retailers that form part of the traditional ‘3-tier’ system. The company’s business model is also capital-light and we estimate Naked could deliver ~100% returns on tangible capital if it successfully scales up.

The business is led by the young and impressive CEO Nick Devlin, who is a wine lover and highly incentivized to make his career at Naked. We think he is using the right strategies to scale the company, focused on delighting the customer, and fostering a strong culture.

However, the key competitive advantage in this industry is scale, which our data and sources suggest far outweighs the benefit of the DTC model. Naked has just over 1% market share and is competing against businesses that are multiples its size. In addition to fierce competition from other DTC players, the company will increasing compete with giants in adjacent industries:

Vivino is an aggregator that has 5 times more users. It lets you compare and buy from tens of thousands of wines, while the size of its user base incentivizes retailers and distributors to offer discounts. Our data shows that Vivino offers better value-for-money in Naked’s core market of premium US wines. That is the opposite of what Naked portrays to investors.

Drizly is an aggregator that is even larger than Vivino. The company was acquired by Uber in October 2021 and is now bundled with the food delivery service UberEats. Bundling two complementary services allows Uber to lower customer acquisition costs and increase loyalty.

Doordash is an even larger food delivery service than UberEats. It too recently started wine deliveries. That has only been possible because Covid is acting as a catalyst in many states to change the laws governing alcohol delivery from restaurants.

We think Naked could be worth £10-15/shr in three years if competition increases only modestly and the company is able to scale up and deliver ~100% returns on tangible capital. But given the importance of scale and the possibility of a winner-takes-most market, the worst case scenario is that the company fails completely. And while Naked is taking the right steps, which of these scenarios plays out is to a large extent dependent on the actions of others. It is at the mercy of giants, and that makes it hard to value. For this reason, we passed on investing in it.

One final point: Plural Investing LLC is not long or short shares in Naked Wines. Our decision was to pass on an investment, not to short the stock. This publication should not be seen as a short report. We believe the company has both strengths and weaknesses, which are discussed transparently in this report. We may decide to invest at a later date if circumstances change.

Table of Contents

Research Methods

Industry Overview

Competitive Advantages

Economics

Ownership & Management

Valuation

Variant View & Catalyst

Research Methods

In addition to utilizing secondary sources such as company filings, transcripts, and services such as Tegus and InPractice, the information in this report was gathered by speaking with primary sources. This included conducting long-form interviews with:

Naked Wine’s CEO and investor relations staff

3 executives at other direct-to-consumer wine companies

6 producers

5 importers

4 distributors

Numerous short discussions at wine expos

Surveys of 2,500 people

Some sources were interviewed more than once. The names of the sources above and information that could reveal their identity are redacted from this report, with the important exception of conversations with the current senior management of Naked Wines, which is a publicly traded company. While Plural Investing LLC gained many insights from these conversations, no information that was both material and non-public was shared.

The full transcripts from these conversations are not included in this report. Instead, the information was used to either provide the background to write the report or to provide a modest number of quotes. Quotes from publicly accessible services were sometimes used to substitute for a similar point made by a private source. We particularly recommend the service InPractice.

Quotations in this report should not be considered verbatim, even when highlighted in italics and in quotation marks. Although extensive notes were typically taken and best efforts were made, it is likely that the exact wording of quotes is not perfectly accurate in some cases.

We think you will enjoy this writeup more in a pdf format. Click “Download” below:

Want to receive more reports and insights? Subscribe and upgrade to paid:

Industry Overview

Roughly 5bn bottles of wine were sold in the US in 2021 for a total price of $50bn, or $10/bottle. $18bn of this wine was purchased off-premises, meaning it was not consumed on a site like a restaurant or bar but instead bought at a location like a grocery store, liquor store, or online. Consumers are increasingly buying wine directly from wineries (DTC), with that market growing to $4bn in sales.

Naked Wines is a DTC player that allows customers to buy wine online and have it delivered to their homes. Naked is the largest player in this market with $220mm in sales, but that equates to just over 1% share of the off-premise market and 5.5% of the DTC one.

The 3-Tier System

Wine in the US retails for much higher prices than most countries due to its '3-tier' regulatory system.

In our conversations with numerous participants in the wine industry, it became clear that the 3-tier system is the centerpiece of the US wine industry - It is essential to understand that this system significantly increases the complexity and costs of selling wine in the US and acts as the backdrop to much of what is happening in the industry today.

The 3-tier regulations are laws initially passed after the Prohibition period, designed to increase the cost of alcohol and discourage drinking. These laws stated that alcohol had to pass through three separate entities: a producer, distributor, and retailer. Each player had to mark alcohol up a minimum amount, thereby adding cost to each layer. For some wines there are even more tiers, such as a wholesaler or an importer for foreign wines. Many wines are now also sold through aggregators such as Vivino, which adds a fourth tier.

The result is that when you pay for an average $13 bottle of wine, only $1.8 is going towards the wine itself. That increases to a still tiny $2.7 if the costs of the cork, label, and bottle are included. Because the wine producer, distributor, and retailer all incur sales & marketing, fulfillment, and administrative costs, these expenses make up most of what you pay for.

Source: Plural estimates based on conversations with industry participants.

While most of the 3-tier laws were repealed in 1975, its legacy and well funded lobbying means that each state today still has a different set of restrictive regulations.

21 states have so-called franchise laws. These laws make it very hard for a producer to leave a distributor once they have signed with the distributor. That gives the distributor a monopoly on the brand and gives the producer very little power in the relationship.

17 states are so-called control states. In these states distributors have to sell to the state, which then sells to retailers. This adds a further layer of cost and allows the state to control distribution. In Pennsylvania for example, you can only buy alcohol at state liquor stores.

It is important to understand that the distribution market today is dominated by two distributors - Southern Glazer's and Republic National Distributing - who want the market to stay as it is.

Rising DTC players such as Naked Wines, FirstLeaf, and Winc cut traditional distributors and retailers out. These companies have taken advantage of changing regulations that allow consumers in most states to buy wine directly from producers registered in that state. By obtaining a producer's license across multiple states, DTC companies are able to sell wine directly to consumers online and deliver it to their homes.

A DTC producer benefits from not being in the 3-tier system and so can cut many of the marketing and G&A costs that normally gets duplicated across the tiers. It can also eliminate all costs associated with physical retail space and instead incurring a relatively small amount of marketing and G&A cost to operate a website. For these reasons, we estimate that a $13 bottle of wine being sold through the 3-tier system can instead be sold for between $8.9-$14.6 per bottle by a DTC producer, depending on how much scale that producer has.

Source: Plural estimates based on conversations with industry participants.

As one producer who sells to a DTC company told us:

"It’s much easier… and we don’t have to worry about the 3 step distribution. When you’re dealing with online you cut through all of that. We would normally sell to an importer, to a distributor, to maybe a wholesaler, to a retailer. Everyone is taking a little bit so it makes a big cost difference to the end customer. Our prices are the same. The online retailer has a big cost advantage… five years ago I was [skeptical]. But once you start working with them it’s actually easy. We don’t have to give them promotional allowances or any other costs."

The growth in DTC companies originally resulted in lobbying from distributors to ban them, but that battle appears to be over. Instead, lobbying is now focused on restricting DTC's effectiveness, although that has largely been ineffective too.

One example was a bill tabled in Tennessee in 2021 that would have made it illegal for the fulfillment houses of DTC companies to ship wine to consumers. The bill was later withdrawn after thousands of consumers opposing the it wrote to legislators. Naked Wines had encouraged its customers to do so.

Regulation could also work in Naked's favor by acting as a barrier to entry. Each state has its own laws, which will be easier to navigate for a large company like Naked than new entrants. In addition, the fact that each state is different means that any changes in laws will only affect one state at a time.

The key players in the industry today are producers, distributors, retailers, aggregators, and DTC companies:

Producers

Making Wine

While there are many stages to making wine, here are the three main ones:

The first step is to harvest grapes. These are grown at a vineyard, with annual harvests generally in August to September in the northern hemisphere and January to April in the southern hemisphere. This is an uncertain process as the grapes are vulnerable to weather conditions such as rain, heatwaves, and frost.

The grapes are taken to a winery where they are pressed to extract the juice, which only takes a few hours. Yeast is added to the juice, which is then fermented for anywhere from a week to two months. That transforms the sugar in the juice into alcohol. The wine is then filtered.

Finally, wines that retail for over $20 a bottle typically go through an aging process. This can be in concrete or stainless steel tanks. The most expensive wines are aged in oak barrels. The oak has pores which allows a controlled amount of oxygen to interact with the wine. The wine gains flavor from the oxygen and the oak. This can take anywhere from three months to three years. Top quality wine may even be aged for five years.

Some winemakers making cheap wines cut this process down to just one stage by buying their grapes and not aging the wines.

US Wineries

US wineries produced 3.8bn bottles of wine in 2020, and the remaining bottles consumed by Americans were imported. The vast majority of wineries are small operations.

Source: https://winesvinesanalytics.com/statistics/winery/

Making wine is a very tough business.

The average winery sold 370k bottles, which results in around $1.9mm in sales as the winery itself collects around $5 per bottle on average, and just $88k in EBIT. For the large majority of wineries selling under 60k bottles, sales are around $300k and EBIT is $10k-$15k. Wineries are also exposed to unpredictable sales due to weather conditions, marketing, and distributor decisions. Most small wineries do not have contracts with distributors and so face substantial uncertainty each year. As one producer told us:

"We're in it for love, not for money… I built a $65 million turnover business. And it was cashflow negative. And it got to the point where I said, why am I doing this? I had three wineries, planted 1200 acres of vineyard, employed 150 people, and I didn't sleep at nights. I sold it all. We started again, what we have now is a virtual model. We own the brands, we control the distribution, but we contract all the growing, all the production, to someone else. So all that capital investments is not our concern. But we can control the distribution, which is where the only bit of profit really is, is in distribution. Production is hell. You do it for love."

The largest producers in the US are:

E&J Gallo

Constellation Brands

The Wine Group

Treasury Wine Estate

Most big wineries are getting into DTC themselves, although they are generally building a website for each brand, rather than aggregating them together. According to Treasury in March 2022:

"Treasury Wine Estates, one of the world’s largest wine companies, has chosen Fluent Commerce’s distributed Order Management System (OMS) to streamline stock management and enhance the online experience for customers shopping via its online brand stores… Partnering with global experts in Order Management consulting and implementation, Bridge Solutions Group, a Pivotree Company, Treasury Wines Estates now has a single view of global inventory and the ability to more efficiently fulfill online orders direct to the customer.”

Constellation in March 2021 acquired a DTC company and moved the Founder into a position to run all of Constellation DTC operations:

"Troutman and Scherotter now lead the DTC team at Constellation’s Wine & Spirits division — with Scherotter serving as VP of DTC Operations. They are working to shift the focus from legacy DTC channels like tasting rooms and hospitality centers toward digital, using data insights to drive customer engagement, acquisition and retention. “We partner really closely with the brand marketing team at Constellation to continue growing the brands, but just doing it with more channels in mind,” Troutman explained. “So whereas they have always been oriented toward more traditional consumer goods marketing of upper funnel awareness and equity building, for the first time ever, we’re looking at how to engage consumers and have them consider direct purchases."

Importers

Producers from outside the US sell their wine to an importer, that then sells to a distributor. This extra layer adds another set of costs. Importers generally charge producers both a fixed fee and a margin on the wine they sell to distributors. From our conversations with importers, both fees are substantial and can double the price of the wine being sold to the distributor.

Importers justify the fixed fee by providing storage space and consultancy to the producer and acting as their sales and marketing to potential distributors. Despite this, importers generally do not provide guaranteed sales to foreign producers, meaning those producers can end up paying significant fixed fees without receiving any sales in return. Since an importer often works with hundreds of different wines, the producer has little transparency on whether its wines are being prioritized when the importer markets to distributors.

Distributors

The distribution market is dominated by Southern Glazer's and Republic National Distributing, who together have over 50% market share. These distributors have thousands of wines that they work with and so, like with importers, it is very hard for a producer to know if they being made a priority. Even after a producer's wine joins the distributor's list, the process of marketing 'internally' to the distributor is often more important than 'externally' to retailers.

The main job of a distributor is to find a retailer to buy wines. The sales process for supermarket chains tends to involve applications and a lot of meetings. Local wine merchants and restaurants tend to be much more informal and may require attention such as specific shelf displays with information about the wine.

Inventories are stored in a series of temperature-controlled warehouses. Wine is then typically shipped through Fedex or UPS, although some distributors have their own delivery vehicles.

Retailers

The final retailer of the wine can be large chains (e.g. Costco, Walmart, Trader Joe's, ALDI, and Lidl), smaller local liquor stores, or on-premise destinations such as restaurants and bars.

Aggregators

The boom in e-commerce has fuelled the growth in several online marketplaces that aggregate wines being sold by traditional retailers. While these marketplaces give customers convenience by making it easy to search through thousands of wines and have them delivered to their home, they add another layer of cost that effectively acts as a fourth tier.

Vivino

Vivino is perhaps the most innovative aggregator, and brings together over 15mm wines, 58mm users, 85mm user reviews, and 237mm user ratings of wines on a 1-5 scale. The result is a vast database of wines that can be easily sorted by factors such as wine type, ratings, price, popularity, etc.

The website and app also allows you to scan a wine label and matches it to the wine, allowing you to review its ratings, reviews, tastings, notes, suggested food pairings, and other information.

Vivino is a pure-marketplace, meaning it acts as the middle-man between the traditional retailer selling the wine and the customer. While it handles the payment process, it is the retailer itself that sells and delivers the wine.

While Vivino is a private company and provides limited information about its user base, the CEO disclosed in 2019 that it had 35mm users globally and 8mm monthly active users, which implies one out of every 4.4 users is active monthly. Since Vivino's app today says it has 11.3mm users in the US, the same ratio would suggest that there are around 2.5mm monthly active users.

In contrast, Naked Wines states that it has just under 900k active 'angels' (users who make a monthly deposit), which judging by its revenue split suggests around 450k users in the US. That means Vivino is 5.5 times larger than Naked Wines in the US.

Drizly

Drizly is an online aggregator for alcohol sales in general. While there is very little information on the company's size, it appears to have significantly more users than Vivino as its apps are consistently ranked far higher for downloads and it has a 7x higher score on Google trends in the US over the last 12 months.

However, Drizly is less innovative than Vivino, with far more limited tasting, notes, suggested food pairings, reviews, and ratings. We took a sample of 100 popular wines available on both Drizly and Vivino and found that the wines had an average of 25 times more ratings on Vivino.

Drizly was acquired by Uber for $1.1bn in February 2021, while Vivino valued at $600-800mm that same month.

DTC

There are many companies using a DTC approach today, with Naked being the biggest at just over 1% share of the off-premise market and 5.5% of the DTC one.

DTC companies have historically been met with skepticism by wine producers, with several telling us that these companies have in the past taken leftover wine at cheap prices, wines from a bad vintage, or the worst grapes. The lack of transparency and detail on some DTC websites as to where the wine is from and its vintage then raises suspicions that consumers are getting the worst wines, even if they come from established wine makers. Since customers buying premium wines are more likely to expect to know these details, DTC websites have so far struggled to attract them.

However, these practices are starting to change. Some companies, including Naked Wines, now provide lots of information on there websites about the wines and several sources told us they were impressed by this.

By analyzing thousands of customer reviews, we find that Naked ranks second highest among eleven companies in the wine or food delivery industries. These reviews were scrapped from websites online, and only the fraction that were organic (not invited or directed by the companies) were included. That left 36k reviews. Natural language processing was then used to categorize each review as positive, neutral, or negative. Each company's ranking was then calculated by taking the % of reviews that were positive and subtracting the % that were negative. Naked's score of 33% was calculated based on 63% of reviews being positive and 33% being negative. Note that these reviews were also analyzed for each company over time, and in the case of Naked sentiment has been relatively stable.

Competitive Advantages

By far the biggest source of competitive advantage in the wine industry is scale.

While selling a wine directly to the consumer does indeed reduce costs, we found that the importance of this is significantly outweighed by cost advantages that come from gaining scale. A wine sold through the 3-tiers via scaled up producers, distributors, and retailers is significantly cheaper than one sold by a small DTC company.

In addition, the scale of aggregators and food delivery giants allows them to use innovative strategies like bundling or discounts that could overcome the cost advantages of a DTC player.

Naked's Cost Advantages are Relatively Small Today

Naked Wines frequently claims that it sells the same quality of wine for a fraction of the price traditional retailers charge. In its investor presentations, the company typically illustrates this with two slides. The first says that Naked can sell the same $60 bottle of wine for $25, an impressive 58% reduction.

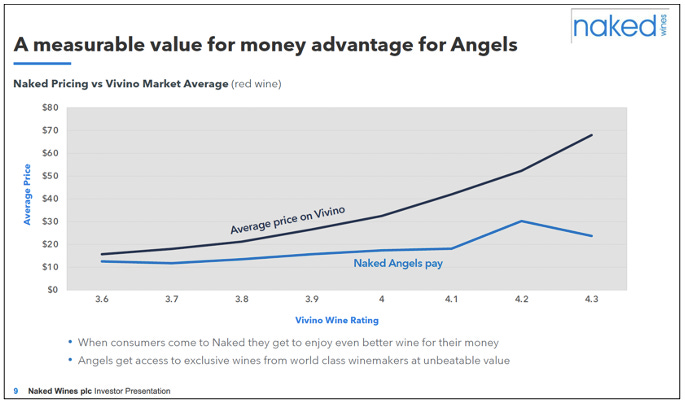

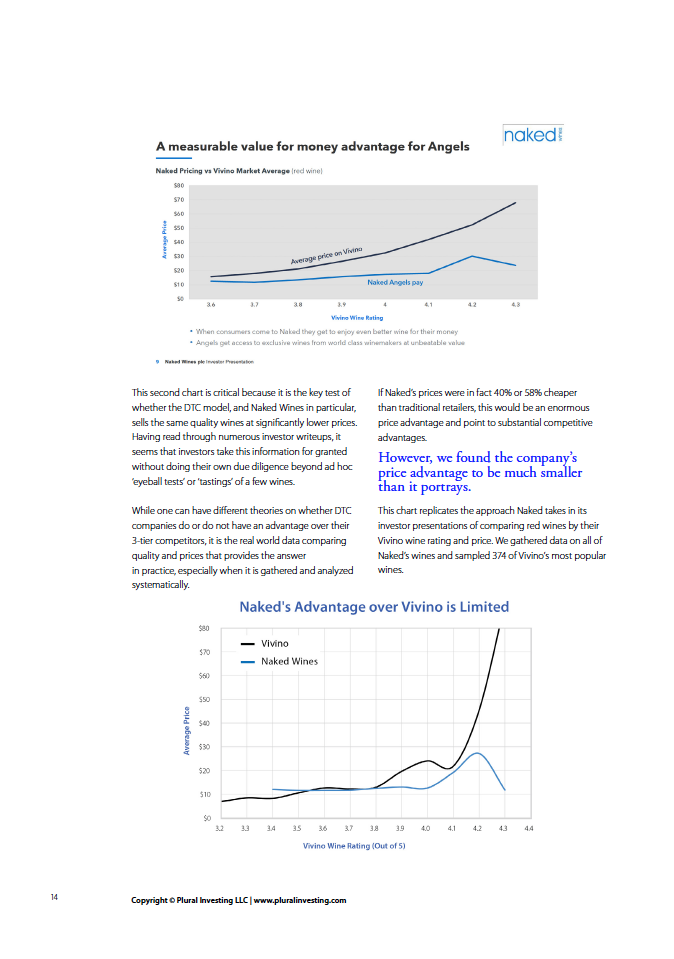

The second slide shows that as the quality of a wine measured via its Vivino wine rating goes up, its price does too. Naked shows that its prices (blue line) are on average 40% cheaper than Vivino's (black line) for the same quality of wine.

This second chart is critical because it is the key test of whether the DTC model, and Naked Wines in particular, sells the same quality wines at significantly lower prices. Having read through numerous investor writeups, it seems that investors take this information for granted without doing their own due diligence beyond ad hoc 'eyeball tests' or 'tastings' of a few wines.

While one can have different theories on whether DTC companies do or do not have an advantage over their 3-tier competitors, it is the real world data comparing quality and prices that provides the answer in practice, especially when it is gathered and analyzed systematically.

If Naked's prices were in fact 40% or 58% cheaper than traditional retailers, this would be an enormous price advantage and point to substantial competitive advantages. However, we found the company's price advantage to be much smaller than it portrays.

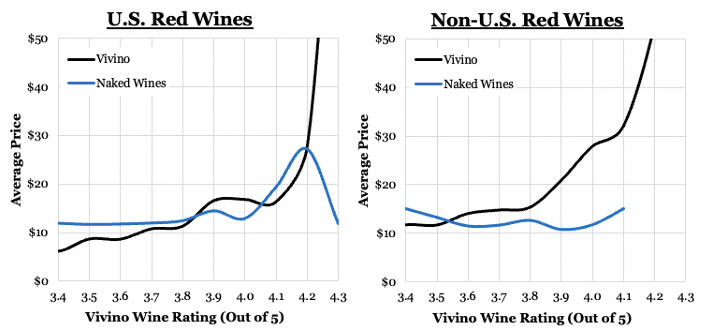

This chart replicates the approach Naked takes in its investor presentations of comparing red wines by their Vivino wine rating and price. We gathered data on all of Naked's wines and sampled 374 of Vivino's most popular wines.

The sampling methodology on Vivino was as follows: For each of eight countries (Argentina, Australia, Chile, France, Italy, New Zealand, South Africa, and the United States), red wines were sorted on popularity. Then, at each wine rating from 3.4 to 4.3 we collected data for the five most popular wines. That resulted in a potential 400 wines being sampled (8 countries x 10 ratings x 5 samples). The actual number of samples was only 374 because some countries did not have five wines at every wine rating. The total number of samples collected translates to just under 40 of the most popular red wines on Vivino for each wine rating.

Crucially, we did not then simply average their prices to calculate the Vivino average price for that rating. Instead, we did a weighted average based on each wine's popularity. That is important because some wines are far more popular than others. For example, the most popular 4.1 star wines sell for around $18 and have thousands or even tens of thousands of customer ratings, whereas other 4.1 star wines sell for $50-100 but typically have less than a thousand or even less than a hundred ratings. This suggests that when faced with two wines of the same rating but very different prices, customers tend to pick the cheaper one, which makes common sense. For that reason, we calculated the average price for each rating by weighting each wine by the number of customer ratings it had received as a proxy its number of customer orders.

Nearly all of Naked's wines are rated between 3.4 and 4.0 and we found that for those seven ratings the company was over 10% cheaper than the Vivino average twice, more expensive by over 10% twice, and within a 10% range the other three times. These ratios were consistent across different types of red wines.

We did find that Naked's white wines rated 3.4 - 4.0 were on average 28% cheaper than Vivino's, but those wines only account for a quarter of Naked's inventory.

Returning to red wines, we found that the chart above can essentially be split in two: (1) Naked is around 20% more expensive than Vivino for wines produced in the US rated between 3.4 and 4.0, but (2) around 20% cheaper for wines produced internationally. That is disappointing for Naked because two-thirds of wine consumed in the US is produced domestically.

The data suggests that in Naked's core market of premium (but not luxury) US red wines, it is in fact more expensive than Vivino. It is cheaper than Vivino in the lesser categories, but still not by anywhere near as much as the company claims.

It is also worth remembering that Vivino aggregates thousands of retailers and typically lists the one selling a wine for the lowest price, so Naked's prices would look better when compared to the average retailer rather than the Vivino average (which is usually the best retailer). Nevertheless, the data is far less impressive than the company portrays and Naked is and will be increasingly competing against aggregators like Vivino that show customers the best prices.

This analysis also shows that a DTC model does not always result in lower costs than the traditional 3-tier system and therefore Naked's business model does not seem to be a substantial competitive advantage.

As an aside, we were curious to know where Naked got it's Vivino data (the black line) from. It appears that the numbers are actually from this article and chart published by Vivino itself: https://www.vivino.com/wine-news/how-much-does-a-good-bottle-of-wine-cost.

When reviewing the article's HTML code we found that the article was written in June 2017. Since Vivino has grown enormously in the five years and so is aggregating many more retailers and likely finding lower prices, these prices would be far lower if using data from today. In fact, in our sample of wines up to a 4.0 star rating we find that that the median price of each rating is 20% to 38% lower today than the data from 2017.

For these reasons, while the data Naked shows in its presentations are technically true, we think our analysis is a better portrayal of how its prices compare vs traditional retailers in practice. We sent our data and conclusions to Naked and asked for a comment on multiple occasions, but have received no direct reply on these findings. The company did speak to us about other topics.

The Key to the Wine Industry is Scale

We also collected data on all the wines of two other large DTC companies, Winc and Firstleaf. When extending the price comparison analysis, we find that both companies tend to be significantly more expensive than Vivino. This again shows that a selling wine directly to the consumer is not necessarily cheaper than through the 3-tier system.

Interestingly, the ranking from cheapest to most expensive (Vivino > Naked Wines > Winc > Firstleaf) matches their order from largest company to smallest. That gets to the key competitive advantage in this industry - scale. In our view, the data shows that the importance of scale significantly outweighs the advantages the DTC model has over the 3-tier system.

Indeed, one major DTC company admitted to us that scale was "certainly" more important than bypassing the 3-tier system. That is one of the reasons why this company has pivoted in the last few years from being a pure DTC provider to selling its wines through the traditional 3-tier system to distributors.

Naked themselves often talk about the benefits of scale. In an interview with Good Investing in February 2021, the CEO Nick Devlin singled out how scale reduced production and distribution costs in particular:

"There are two big types of scale economies that we see.

One is on that logistics distribution side. In particular, in Australia, in the USA, we’re moving a big bulky product over long distances through multiple warehouse sites. The more volume you drive and the more scale, on a per-unit basis you’re driving down those costs. That’s my favorite type of efficiency because we’re driving out costs that benefit no one. We’re driving up lifetime value of our customers because our profit margins are becoming higher. For the customer, all they’re seeing is actually a better experience. We’re able to operate our sites more efficiently, build higher service levels, and support more differentiated delivery propositions. It’s a real win-win.

I think the other area where there’s absolutely scale benefits and it comes back to us always thinking about two participants in the business, the consumer and the winemaker. On the winemaker side, as I see the business growing, we’ll absolutely add more wines and more winemakers, but we intend to grow revenue faster than we grow the range. We’re driving volume per SKU. For winemakers, that means we’re helping improve their economics. We’re reducing their cost to produce per bottle. We’re helping them be able to buy more fruit and get in a better fruit pricing and input cost pricing and we’re helping them fill up their wineries, which means better utilization of their fixed assets. All of that means they get more efficient businesses and we’re able to share in that"

In our conversations with industry participants, we found that scale had significant benefits across all three tiers of production, distribution, and retailing. The table below shows how the costs of a typical $13 bottle of wine are split in the traditional 3-tiers, for a DTC provider with limited scale, Naked Wines today, and a DTC provider with large scale.

Source: Plural estimates based on conversations with industry participants.

The table shows that buy cutting out the 3-tiers, a DTC company can cut out $1.5 per bottle in marketing expenses for the producer and another $0.6 for the distributor for a wine that would traditionally be sold for $13.

Avoiding the need for a brick and mortar retailer saves another $2.7 per bottle, although that is offset to some extent by an extra $1.1-$2.3 in cost to run the website, app, and online marketing.

Added together, this gives a DTC company around $3 per bottle in savings over the 3-tier system - a significant 25% cost advantage on a $13 bottle of wine. Clearly, that is core to the thesis of investing in Naked Wines.

However, that is outweighed by the advantages of scale.

The table above also shows that a large DTC company can sell that bottle of wine for $8.9, whereas a small one can only sell it for $14.6, a nearly $6 difference due to scale. These cost savings are across the board. Around half is at the producer level, where greater scale gives a winery more power in bulk purchasing, working capital to pay for better equipment, and spreading fixed costs. $1.2 is saved in lower fulfillment costs. Another $1.2 is saved in spreading the relatively fixed costs of running the website, app, marketing, and G&A expenses.

The difference to scale of nearly $6 per bottle is around double the $3 advantage of being a DTC company instead of going through the 3-tiers. That suggests the advantage of the DTC model can be overcome by a 3-tier players with greater scale.

While it is hard to be precise with these numbers, as a sense check we can return to the price comparison analysis which shows that Winc's prices are on average 60% higher than the Vivino's, while Firstleaf's prices are 120% higher. While Winc and Firstleaf are smaller than Naked Wines, they are still two of the biggest DTC companies. The fact that their price disadvantage vs Vivino is so much larger than what the table above suggests implies that the importance of scale is even greater than the numbers we have laid out.

Sources also pointed out to us that Naked has not taken off in the UK and Australia. While those countries do not have 3-tier regulations, they also have a small number of supermarkets chains that dominate the market. Those chains are able to use their scale to drive costs down, which has made it harder for Naked to compete.

We draw two key conclusions to draw from the various analyses above:

Achieving scale is more important than shifting from a 3-tier model to DTC.

The best model is to have a DTC approach and have scale.

The vulnerability Naked has today is that it has the better model (DTC) but has limited scale. It is competing against companies that have an inferior model, but vastly more scale. Since scale matters far more, there is a chance that this is a winner-takes-most industry and that Naked is outcompeted by larger competitors before it can achieve both massive scale and a DTC model. Unfortunately for Naked, the outcome will be largely determined by the actions of others and so is outside of their control. In other words, this is a David vs Goliath contest where there are no guarantees that the underdog prevails.

At the Mercy of Giants

To succeed, Naked will not only have to outcompete the numerous other DTC companies, it will also have to survive against several types of giant companies:

Traditional players (e.g. a wine sold from Gallo to Southern Glaser's to Walmart)

Aggregators (e.g. Vivino, Drizly)

Food delivery companies (e.g. Doordash, Uber Eats/Drizly)

Meal kit providers (e.g. Hello Fresh)

While we do not know whether or how some of these companies will evolve over time, we think Naked is particularly vulnerable to aggregators and food delivery companies. We highlight some of the biggest threats below.

Vivinio

As discussed extensively, Vivino already offers customers lower prices than Naked in its core market of premium US red wines. Vivino also gives customers other advantages like orders of magnitude more choice, delivery generally within 60 minutes rather than days or weeks, and far more customer reviews providing insight into each wine.

As Vivino grows, there is a risk that its advantage over Naked increases. In our conversations with industry participants, it became apparent that some of them are already offering Vivino especially low prices because of the size of Vivino's customer base. By offer special deals or discount prices on Vivino, a wine retailer is able to attract large numbers of customers and even drive traffic to their own websites and stores. Selling at a discount or even a loss on Vivino is therefore a form of marketing for these retailers. Distributors are also working with the retailers in some cases to offer lower prices. So rather than adding a fourth layer of costs, Vivino is able to squeeze the other layers and reduce costs.

Even more concerningly for Naked Wines, it appears that Vivino is also pushing towards a DTC model. In an interview with the service Tegus in 2019, Vivino's CEO stated that:

"But the long-term vision here, just to be clear about that... in one hand, I have a drinker, and the other hand I have a producer. Anyone who was in that channel that doesn't contribute is going to die. This is the nature of disruption…we're also going to move backwards in the channel and whereas our retailer might have a 12% marketing fee, a producer might have 30% marketing fee, right? And the more producers we get, obviously, that changes our commission, our marketing fee structure completely… Like why not go all the way from production straight to the user if there's a good platform for that?

… And one way of doing that is having a more predictable product where you put things together and ship at bigger scale and all those things which makes it more efficient, both from a shipping and picking and all those things. So that was the mindset here. And I think one of the products will be like a $100 product for six bottles, so pretty good and at extremely good value. So we have scale already in our offers and all our things. We just get deals that nobody else gets. So, in that sense, it's super exciting. And we have all the data to say what's good and what's bad and what you like and so on. So, it's that story we're going to bring together when we start or we've start testing this, so we're excited."

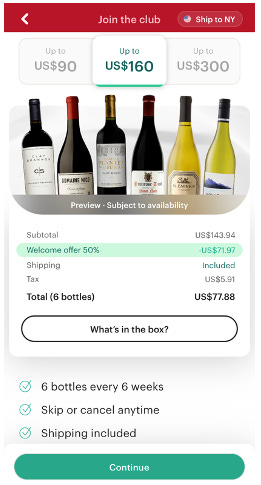

And in June 2021 Vivino launched its own wine club, offering six bottles of wine every six weeks for $90, $160, or $300. The wines are selected based on the user's activity and 'taste profile' and several of the wines are generally significantly discounted from their normal retail price.

Source: Vivino app

Drizly

Like Vivino, Drizly is an aggregator. Drizly accepted a $1.1bn acquisition offer from Uber in February 2021 and the deal completed in October that year. While the two companies will retain separate apps, Uber has said that Drizly will increasingly feature within the Uber Eats app. Uber's initial strategy appears to be to position Drizly as one app within a family of apps that share customers, thus increasing customer stickiness, reducing customer acquisition costs, and giving advertisers more options across apps.

In February 2022, Uber's CEO stated on an earnings call that:

"And this is an area we've been investing a lot into over the past year, both organically but also through the acquisition of Drizly and Cornershop. Our belief, our conviction is that by offering selection depth across categories, we are able and will be able to move from a once-a-week use case to actually a daily use case delivering whatever consumer needs, whenever they need them, every day. And we're happy with our progress to date since launching in 2022, this grocery and new verticals offering."

Adding in May 2022 that:

"And then as far as the super app versus multi-app consumer experience, the way that we're doing it is on the consumer side, we're looking to get the best of both worlds. Think about it in the same way that Facebook has a family of apps. They've got Facebook and Instagram and WhatsApp, they're kind of loosely coupled. Same thing with Google; they got Google and Google Maps and Google Mail, again, they are coupled. You have 1 identity, 1 payments, et cetera. We're looking to achieve the same thing multiple apps, whether it's Uber or Uber Eats or Cornershop, your identity is the same, Drizly, your sign-up is the same. We treat you the same way. Your customer experience is consistently excellent. You've got the Uber One membership that flows across all of those apps to save you on delivery fees. And at the same time, within each app, we're constantly cross-promoting one platform to the other."

Through these initiatives, the Uber/Drizly combination raises the lifetime value of an Uber customer and reduces the cost of customer acquisition. That will make it rational for Uber to significantly increase its marketing expenses to acquire wine drinkers, in addition to the increased cross-marketing between the Uber and Drizly apps. In fact, it could make sense for Drizly to off wine prices below cost if that attracts more customers into the Uber ecosystem.

The result of that increased marketing for the same number of potential customers is likely to push up Naked Wine's own customer acquisition costs.

Food Delivery Services

There is also the option for Uber Eats and Drizly to be bundled together in a more ambitious way.

We did a survey of 2,500 Americans and found that that of the wine they drink off premise, around 40% is with a meal. That suggests up to 40% of Naked's addressable market could be targeted by food and meal-kit delivery services if those services decided to offer wine too.

As wine is often drunk with a meal, the Uber Eats app could suggest wines on Drizly to pair with that meal. And since Uber Eats knows the location of your home and the restaurant you are ordering from, it could ensure that these wines are sold from liquor stores near the delivery route. A delivery rider could pick up your food, pick up wine on a route towards you home, and deliver both at the same time. That would result in very little extra delivery cost and all the additional revenues to the liquor store would come at no operating cost to them. Uber/Drizly could therefore offer customers the ability to add wine to their meals at very attractive prices.

Bundling meal and alcohol delivery is the path that another giant, Doordash, has taken. The company announced in September 2021 that it would be delivering alcohol across 20 states and that:

"DoorDash has built an alcohol catalogue including 30,000 SKUs available for purchase across thousands of retailers and restaurants nationally, whether it's to-go drinks from a favorite local restaurant or a celebratory champagne from a nearby local store. Additionally, with the recent roll out of DoubleDash, customers in select markets can now bundle alcohol with their restaurant meal on certain orders."

DoubleDash is a new feature that allows customers to bundle orders from multiple nearby locations, such as a restaurant and a liquor store.

It is important to recognize that Doordash's move into alcohol delivery has only been made possible regulations that recently started changing as a result of Covid-19. Prior to Covid, state laws generally made it hard or impossible for restaurants to offer alcoholic beverages for home delivery. With restaurants struggling to survive during Covid, many states temporarily relaxed these laws to permit alcohol delivery. In some states those laws were made permanent, while in others the experience of alcohol delivery acted as a catalyst to discuss changing those regulations. In New York state, for instance, temporary laws allowing those alcohol deliveries expired after 15 months, but the state Senate and Assembly passed a budget in April 2022 to bring them back until 2025.

The recent changing of these laws has allowed UberEats to deliver alcohol in 22 states and DoorDash in 20 states. According to Bloomberg Second Measure, these two companies combined account for 83% of all food deliveries in the US. Grubhub, which accounts for 14%, now also delivers alcohol in 10 states.

In our view, Covid triggered a substantial opening up of in alcohol delivery laws that has resulted in all the major food delivery companies entering the industry. In that sense, it is analogous to awakening of sleeping giants.

As these delivery giants invest further into alcohol delivery they will increasingly offer customers the ability to order wines that pair well with their meals at a reasonable incremental cost and quick delivery. That will reduce Naked Wines' customer loyalty and drive up customer acquisition costs. In the Economics section of this report, we suggest that could even reduce Naked's LTV/CAC to 1.0x.

----------

We have not seen investors talk about these new and substantial competitors that Naked will increasingly face. Whenever we have discussed our concerns with them, some of them appear to be unaware of some of the changes these companies are making. Among the others, the pushback we generally get is that (1) these are not direct competitors, and that (2) it would make more sense for them to acquire Naked Wines than invest organically.

On (1), our counter argument is that Naked and these new competitors…all sell wine. Since around 40% of wine drunk off-premise is with a meal, meal delivery companies are a competitor for those wines. Aggregators such as Vivino are competitors for all wines, and our analysis suggests Vivino is cheaper than Naked in its core category of premium red wines.

On (2), we agree that it would make sense for a few of these companies (like Hello Fresh) to acquire Naked, but that is not a guarantee that will happen. We also don't think acquiring Naked makes sense for its key competitive threats (Vivino, Uber/Drizly, Doordash), as those companies are pursuing a different model to DTC.

Economics

Economics Snapshot

Business Model

Naked Wines runs a website and app where customers can sign up to be 'angels' and put $40 per month (£20/month in the UK) into a digital wallet. Angels can then use the cash in that wallet to order from close to 250 wines on a recurring or ad hoc basis. Since angels have no obligation to buy on a recurring basis and can also withdraw their deposits from the wallets, this is a semi form of subscription.

The idea behind the angel model is that the monthly deposits provide a stream of predictable cash flow that can be used to pay small independent winemakers up front and in some cases put them into business. Giving winemakers this cash flow enables them to pay for better facilities and equipment and in return offer Angels better wine at better prices.

Customers also get to feel good about themselves and Naked builds on this by encouraging a community element where angels and winemakers can talk to one another on the website or app. Winemakers are portrayed as being grateful for angel funding, and significant background on each winemaker and wine is typically provided on the website. In practice, very few angels actively engage with the Naked community.

The company's sales are split roughly 50% in the US, 40% in the UK, and 10% in Australia, while contribution margins are ~35% in the US and ~25% in the other countries. This report focuses on the US because that is by far the biggest opportunity the company in terms of market size and advantages of cutting out the 3-tier system. The UK and Australia do not have 3-tier systems and the UK in particular can be thought of as an increasingly legacy business.

Three-quarters of wines supplied by Naked are made by US winemakers. All wines are exclusive, although winemakers typically sell similar wines to other companies. The wines are generally premium wines with a Vivino rating of 3.7 and price of $11-13 per bottle, higher than the average retail price in the US of ~$10 and wine rating of 3.6.

Several competitors admitted to us that Naked does a good job with its website and marketing.

The company fulfills customer orders through 3rd-party fulfillers. The business model is therefore capital-light.

Relationship with Winemakers

Naked is building an innovative model where it effectively acts as an incubator for independent winemakers. Most winemakers are individuals or families with a passion for making wine but with limited access to capital and little time or knowledge to deal with marketing, logistics, and customer analytics. This leaves them vulnerable to changes in microclimates, customer tastes, and financial conditions, and makes winemaking a very tough business to be in.

Naked understands this and so increasingly signs winemakers to multi-year contracts and pays a significant portion of that up front. By working with Naked, a winemaker gains:

Cash up front to pay for their initial costs

Financial certainty through 1-5 year contracts at fixed prices

Scale through the size of Naked's customer base

Data and analytics on customer feedback

Fulfillment provided by Naked

Marketing provided by Naked

This is a very good deal that allows a winemaker to substantially de-risk their business and focus on their passion for making wine.

Financial uncertainty is the biggest worry most wine makers have, and every producer we spoke to said they would be interested in a model where they were paid up front and/or had guaranteed revenues. As one start-up winemaker hoping to produce 25,000 bottles per year told us on being paid upfront:

"Yes I would be interested because it would be a huge relief to have some sold. They might allow winemakers to pre-sell the wines. They cover costs of the harvest. You have a lot of upfront costs."

A more established producer told us:

"A vineyard has a payback of about 10 years, if you're lucky. The first 3 years you have no income with all the infrastructure, irrigation, pumps, weeds etc. The fourth year you get half your income, the fifth year is your first crop. You've invested $1mm/acre to get to that point. So it takes another 5 years to get it back. Then you're got to build your winery, stainless steel storage, it just never stops. So I can imagine if Naked can offer financial support that would be very well received. But I've not heard that."

When Naked works with a winemaker, it agrees to buy a fixed number of bottles at a fixed fee per bottle. This is typically over one year, but can stretch up to five years. Winemakers typically get paid in two or three installments, thus transforming a historically volatile and unpredictable revenue stream into a guaranteed one.

Winemakers getting started are often paid one of these installments up front to provide them with working capital, which allows them to pay for better grapes, equipment, and barrels. That helps as they would typically spend less as they have limited working capital and don't know what their future revenues will be.

Naked also helps some winemakers source items such as bottles and corks, which typically results in lower costs.

This model makes Naked similar to a venture capitalist and incubator like YCombinator in Silicon Valley. By offering capital up front and pooling the risk of many winemakers it is able to earn a premium and lock in its best wine makers. Around 10% of Naked's winemakers sell all their volumes to the company and that number is likely to grow.

Source: Plural estimates based on conversations with industry participants.

Naked typical starts a new winemaker off at 10,000 bottles per year to learn about them. At that level, the winemaker is making just ~$55k in revenues from Naked.

By working with Naked a winemaker saves on sales and marketing costs, which would usually be around 30% of sales. The biggest marketing expense is hiring someone. By the time a winemaker is producing 30,000 bottles per year that are likely to need a full time salesperson, costing ~$60,000 or ~$2.0 per bottle. The cost per bottle reduces with greater scale. Other costs include going to wine fairs (often in other countries), giving out free bottles to critics, competitions, and potential clients, traditional direct market, and digital marketing. More premium wines tend to require less marketing as a % of sales because they often already have a brand and history. They may also have won competitions or received good critical reviews. The leading critics are Robert Parker, James Suckling, Wine Spectator, and Wine Decanter.

Winemakers of all sizes get a scorecard from Naked every six months with data such as the percentage of customer likes of their wines from the website, with anything below 75% unlikely to be continued.

If Naked likes a winemaker, it tries to bring them up to 250,000 bottles per year so that they are financially stable and can rely on Naked either exclusively or for a substantial portion of their sales. A winemaker is making around $825k in revenues at that point and $55k in EBIT.

At that stage Naked lets a winemaker to grow at their natural rate. On an earnings call in June 2021, CEO Nick Devlin stated that Naked's top ten winemakers were selling over 600,000 bottles of wine per year on the website, which equates to around $3mm in revenues.

Naked uses its customer data to help winemakers, although we have not come across any specific examples of best-selling wines created this way. Founder Rowan Gormley has likened this to Netflix helping content producers, saying in an April 2018 earnings call that:

"People think that the winemaker selection thing is a bit of an art. It's not that much of an art when you've got the data that we've got. We've got now 7.5 million customer ratings. So we have a very good -- like Netflix know what movie is going to work before they've made it, we know which wines are going to work before we've made them. So we have a very good feeling for what the product must look like and feel like and what the pricing needs to be for it to be a winner."

Naked's innovative approach to working with producers is an advantage and is the 'Netflix of wines' argument that the company and some investors make. However, we don't see it as a sustainable competitive advantage as it can be copied relatively easily. Netflix, for instance, has seen its approach copied by numerous competitors. It's advantage today is arguably its scale. On the other hand, Naked has just over 1% share of the off-premise market in the US and has a scale disadvantage against several potentially large competitors.

Fulfillment

Naked is partnered with the company Wineshipping for all its fulfillment needs. Wineshipping has six warehouses and partners with UPS, FedEX, and GSO for last-mile delivery. The company is used by some of Naked's competitors and is available to all of them.

Customer

Naked's typical customer is a middle-class working professional in the 35-65 age range.

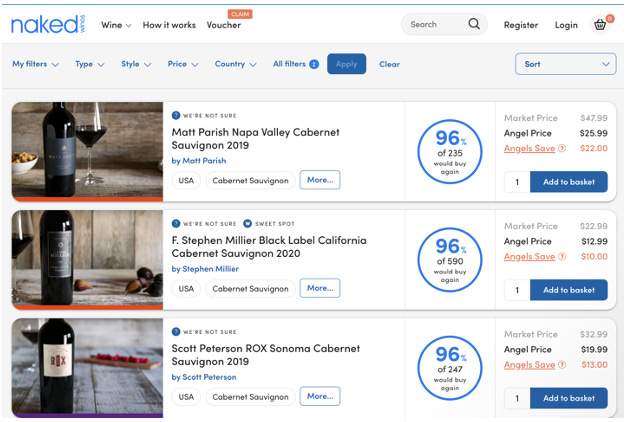

The website and app lets customers filter through wine by factors such as type, style, price, or country and provides a variety of sorting options. There are two important features to point out. First, customers can rate wines by whether they would buy it again. Wines are then displayed with the % of customers who would buy again. Second, Naked learns what types of wines a customer likes over time and ranks wines it think you will like higher, in a similar style to how Netflix suggests content for you to watch.

The company say that the biggest reason customers leave is over poor delivery, such as the wine being left outside your home when you are not there. The second most common reason is when customers build up a balance in their angel's wallet but don't use it. Other reasons are usually finance or health related.

Naked says that the they are focused on improving the customer experience further through better website speed and reliability, the shopping experience, and extending programs such as 'Never Miss Out' and the 'Wine Genie'.

One problem the company continues to suffer from is a perception among some potential customers that its wine is poor quality, despite the data suggesting otherwise. Several of our sources said they did not trust where the wine was from as this was not transparent and that it might be from less prestigious regions or vintages. But when shown specific wines, some of these sources admitted that the information was more transparent on Naked's website than they realized and that the wines were from good regions. Unsurprisingly, Naked does not think they are getting enough credit for the quality of their wines, and are entering more wines for awards and reviews and focused on highlighting this better on their website.

Naked's main form of marketing continues to be through vouchers, which typically claim to give customers $100 off their first 12 bottles of wine. The company is increasing its use of other advertising and has good data on their effectiveness.

Unit Economics

By triangulating commentary from the company and our sources, we find that Naked has good economics today with an LTV/CAC of 2.2x and IRR on marketing spend of 41%. Unsurprisingly, our estimates are slightly lower than the company's, with a 5 year payback on gross profits of 2.18x vs Naked's stated 2.6x.

Our CAC is calculated using an average marketing spend per new customer in the years ending March 2019 and 2020. Results since 2020 are excluded as they have benefitted significantly from Covid lockdowns encouraging customers to sign up. Note also that we use all marketing spend in our calculation rather than the lower "replenishment market spend" the company sometimes reports. We used a generous 35% incremental EBIT margin, which is higher than our estimated incremental margin at a company level.

While these estimates suggest Naked has strong unit economics today, they also highlight that it has a limited margin of safety.

For instance, in the Competitive Advantages section of this report we highlighted that around 40% of wine consumed off-premise is drunk with a meal and that all the major food delivery companies have recently starting pushing into the alcohol delivery business. If that were to reduce a Naked customer's order frequency by 10% and customer retention by 10pp, the company's LTV/CAC would drop to just 1.2x.

On the other hand, we also highlighted how the cross marketing from companies like Uber/Drizly or the growth of Vivino could push up Naked's CAC. If that were to rise 20%, a number within its range of annual fluctuations in the past, the company's LTV/CAC would decline to 1.8x.

If increased competition affects both customer loyalty and CAC by these margins, Naked's LTV/CAC would drop to just 1.0x.

It also worth remembering that LTV/CAC for most companies tend to decline naturally as they typically acquire their most attractive customers first.

Normalized Margins

Source: Plural estimates based on conversations with industry participants.

Returning to the table above comparing the cost breakdown of a $13 bottle of wine in the traditional 3-tier system vs DTC with minimal scale, maximum scale, and where Naked is today, we can see that a DTC company with massive scale could produce the same bottle for a cost of just $8.9. At first glance, that suggests that if Naked reaches that scale it could charge the same $13 price and after alcohol taxes are deducted earn $4.1 per bottle, for an enormous 34% margin.

That misses two key points however.

First, Naked's model of working with smaller independent winemakers who generally produce 30,000-250,000 bottles per year means it is unlikely to ever match the cost efficiencies of winemakers producing millions of bottles per year. Those larger winemakers are able to buy grapes, bottles, cork, and labels in bulk, afford better equipment and give it higher utilization, and spread G&A costs. A more realistic production cost isn't the $3.7 per bottle that those winemakers can achieve excluding marketing, but $4.6 - an average between that number and where Naked is today. With that added cost, EBIT is $3.2 rather than $4.1 and margins are 27% rather than 34%.

Second, whether Naked holds on to its entire cost advantage depends on what competitors do. As discussed extensively in the Competitive Advantages section of this report, other companies are themselves bringing down costs either by replicating Naked's DTC model, gaining scale, and/or by bundling services together. For these reasons, we think an upside scenario is that Naked holds on to half of these addition margin gains and achieves a 'normalized' margin of 20% or $3.2 per bottle.

As a sense check, we note that the 12.5% margin per bottle the model gives Naked today is close to the company's 14% 'standstill' EBIT margin during FY21, which benefitted from the Covid environment. Our -10% margin for a small DTC company is less than the average -17% EBIT margin Winc has reported in the last three years.

Ownership & Management

Naked wines was founded by Rowan Gormley in 2008. Gormley is a South African who moved to the UK in 1987, initially working in private equity before joining Virgin in 1994 to work for Richard Branson. Gormley was hired by Branson on a gut feeling and with no defined role in mind. He ended up starting Virgin Money then left after a few years to launched a wine business, which ultimately became Virgin Wines in 2000 when Branson bought a stake in the company.

Gormley continued to run Virgin Wines and it was eventually acquired by the parent company of Laithwaites in 2005. He left in 2008 and launched Naked Wines later that year with several of his former colleagues. The business started by focusing on the UK, but expanded into the US and Australia in 2012.

In 2015 the company was acquired by Majestic Wines, a traditional brick and mortar wine retailer in the UK, with Gormley becoming CEO of the combined group. Yet with Majestic struggling and Naked continuing to grow, the decision made in 2019 to sell Majestic and focus solely on Naked Wines again. Later that year, Gromley himself left the business with 34 year old Nick Devlin rising to CEO.

Gormley gave an interesting interview to InPractice in April 2020 that provides some background on Naked Wines today:

"[At Virgin Wines] I had to take a big dose of humble pie to go, actually, maybe I do have this wrong. We, literally, ran out of money. One of my colleagues, a guy called Luke Jecks, who landed up setting up our Australian business, for Naked. Luke was the one who eventually said, look, if we look through the customers, most of the customers come and go pretty quickly, but there is this small group of customers who are really resilient and stick around and are very valuable. What makes those customers different, is they’re not buying big brands; they’re buying wines from small wineries. They are subscription type customers and if we just had those people, we’d have a great business. Let’s just reconfigure our whole business, round acquiring those people, instead of configuring it around selling wine. That’s what we did and we rescued it. But to do that, we had to get rid of 80% of the people, go from a fancy head office in London, to a much more humble headquarters in Norwich. We had to boot strap it. That was very tough, losing a lot of good people and good friends amongst them. But it was also a very valuable learning experience. In the end, that business became what is Virgin Wines today, and a lot of the thinking that went into Naked was formed through that experience, as well."

Ownership

Since its acquisition by Majestic Wines, the company has become increasingly owned by an impressive list of institutions. While the founders of Naked Wines and Majestic Wines have sold out or substantially reduced their ownership, shareholders who hold over 5% of the shares own over half the company today. That should give the company a stable base of long term shareholders.

Source: CapitalIQ and company filings

Board of Directors

The company today is led by Nick Devlin, who is doing a good job in our opinion and pursuing the right strategy of heavily reinvesting in the business to gain scale. He has bought meaningful amounts of shares with his own money and appears to be fully committed to Naked. In Devlin, Naked potentially have a young and upcoming CEO who can make his career at the company.

A notable board member is Justin Apthrop. The Apthorp family founded Majestic Wines, which acquired Naked Wines in 2015 before being sold off itself. The Apthrops reduced their ownership substantially in late 2020 and early 2021 between £6.3/shr - £8.1/shr, suggesting they thought the company was fairly or overvalued at those prices. They still own 4.1mm shares or 5.6% of the company.

All the other directors own little or no shares. They are on several other boards, which gives the impression they are more interested in collecting several director's fees rather than being invested in Naked. None of them have experience in the alcohol industry.

Changes in Senior Management

The company has been through several significant changes in senior management in recent years:

Founder Rowan Gormley leaves as CEO

Gormley left in late 2019, with several sources telling us that he failed to integrate the company he founded (Naked Wines) with its acquirer (Majestic Wines). Gormley's failure to convince Majestic employees to join his strategy and culture ultimately lead to Majestic being sold in 2019 and his departure shortly afterwards.

That was not how his departure was portrayed at the time. On his last earnings call in November 2019, Gormley said:

"This has been a 2-year long process, realigning the group to exploit the opportunity in the U.S. Nick will tell you more about the U.S. opportunity, but as it became clear to us just what the scale of that opportunity is and the extent to which our model is uniquely configured to take advantage of it, what became clear was we have to realign everything about the business to take advantage of it, key thing being the management team...my primary interest in this business is a shareholder, and I intend to remain a shareholder in the future. And for the value of Naked Wines to become what I believe it ought to be, it requires a different set of skills. And I am at heart a start-up person,...But now you need a different set of skills, which are about structured long-term thinking, organization and discipline, and no one's ever accused me of having those things."

However, in an interview with InPractice in April 2020 Gormley admitted to struggling to manage the Majestic team:

"The biggest mistake I made was in thinking, I just need to stick to my principles and stick to my guns and, over time, people will come to see that I am sincere and that, if I say red is red and blue is blue, I’m telling the truth and I will win them round. Actually, in the end, I don’t think it was true; I don’t think I succeeded in doing that. I think, by the time I left, probably the degree of buy-in to the management team’s actions was no higher than it was at the beginning. That’s after a lot of hard work and a lot of changes that we thought were positive, significantly improving the lot of the people who worked there. But it was still a very difficult thing to do."

And despite telling investors on his departure that "my primary interest in this business is a shareholder, and I intend to remain a shareholder in the future", Gormley sold all his stock in Q4 2020 and Q1 2021 when the stock was at £5.5-8.0/shr. That means both the Founder of Naked Wines (Gormley) and the founders of Majestic Wines (the Apthorp family) sold all or significant portions of their ownership as the stock initially reached £5.5/shr-£6.5/shr, suggesting they think the business is fairly or overvalued at those prices.

Nick Devlin is promoted to CEO

Nick Devlin first met Gormley while he was a consultant at OC&C, and joined Naked in 2015. He became the driver behind the growth in Naked's US business, by far the most important division of the Naked and Majestic group. He was the natural candidate to take over as group CEO after the sale of Majestic.

As Gormley commented on the November 2019 earnings call:

"Our first starting point was we need an American CEO. We interviewed a number of superstar candidates. And in the end, we concluded the best candidates already worked in the business. For both -- Nick is a guy of enormous talent, which you will see for yourself as time goes by. But he's also the person who proved himself in the U.S...He's also very passionate about wine. And people have accused me of being someone who's passionate about marketing and wine happens to be the product. Nick happens to be passionate about both of those, and I think that's a good thing."

In the 2020 annual report, the Chairman at the time John Walden wrote:

"Nick has led our business in the important US market, demonstrated his ability to trade well in difficult conditions and been instrumental in developing and delivering our growth strategy. Finally, Nick embodies the Company’s philosophy that the best way to deliver value for shareholders is to look after our customers, winemakers and employees better than anyone else."

Three changes in Chairperson

John Walden joined as Chairperson in June 2019, with Gormley saying in November that year:

"What John has brought to the Board in addition to being a native American and having a familiarity with the market, which we didn't have before, is he's brought a new level of ambition. And I think it's -- a lot of U.K. mid- market companies with traditional nonexecutive role, people worry more about the downside than the upside."

Walden stepped down just over a year into the job in August 2020. The company claimed this was for personal reasons, but Walden became Chairman of YO! Sushi six months later in February 2021.

With Walden's departure, Director Ian Harding moved up to Chairman. Harding was scheduled for retirement at the 2021 AGM, so this was always meant to be temporary.

Darryl Rawlings then joined as a Director in early 2021 and became Chairman after the AGM. Rawlings was introduced by an investor and Naked says they wanted a Chairman with US and e-commerce experience. Harding had written in the 2021 annual report that:

"The Board agreed that our next Chair must have an excellent track record of delivering growth, innovating and scaling DtC digital businesses in a senior leadership role. It was also critical that they were someone who had achieved this in the US. Darryl fits our profile perfectly and is well equipped as Naked Wines embarks on the next phase of its growth story. Darryl is the founder and CEO of Trupanion Inc., an industry-leading, DtC, monthly subscription business that provides medical insurance for cats and dogs throughout the US and Canada. Since founding the business in 2000, Darryl has led the company’s consistent growth, which generated $500 million in sales in 2020 and now serves more than 860,000 enrolled pets. Darryl brings with him extensive experience in operating and scaling a subscription DtC business in the US, as well as corporate governance and public company experience as CEO of a NASDAQ listed company."

Shawn Tabak joins as CFO

Naked also brought in Shawn Tabak as CFO in 2020. CEO Devlin stated in November 2020 that:

"Shawn’s deep understanding of driving growth through a focus on customer economics and cohorts makes him ideally suited to the role at Naked. Additionally, his understanding of the US market will be highly valuable and recruiting this role in the USA, our largest market, is another key step in our transition from British startup to a US-led global pureplay."

Management Compensation

The CEO's compensation is reasonable and well structured, encouraging him to invest in high LTV/CAC customers, increase retention, and reduce tangible capital.

CEO comp (FY21):

Base salary = £306k

Cash bonus = 0-100%. Based on repeat EBIT (40%), payback from CAC (40%), net inventory per repeat customer (20%).

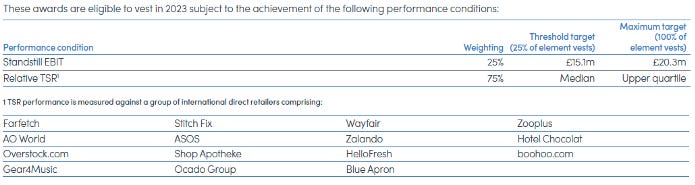

LTIP = 150% of base salary every two years. Previously 25% vesting if TSR is below median of UK-based store retailers, 100% vesting if in upper quartile. For July 2020 vesting, 75% based on relative TSR to global online retailers and 25% on standstill EBIT.

From the company’s reports:

Bonus:

LTIP:

CEO's Motivations

Nick Devlin is a wine lover and also highly financially incentivized by Naked's stock price.

Devlin joined Majestic Wines at the age of 30. We estimate that he had received total compensation of around £800k in his career prior to joining, translating to perhaps £100k-£150k in savings.

We estimate he has received total compensation of ~£2.5mm since joining Naked, of which at least £336k has been in LTIPs, leaving ~£2.1mm in cash compensation. After tax and spending that might translate into another ~£400k in savings, of which he has spent £134k buying more shares in Naked. What that means is Devlin's savings outside of Naked shares today is probably around £600k - £1mm, assuming he has benefitted from compounding over time.

The point is that his ownership of 82k shares and 256k in LTIPs in Naked are very material to him - at £3.5/shr these are worth up to £1.2mm and at the 52 week high of £9/shr they are worth up to £3.0mm.Perhaps just as significant is that he has on five separate occasions made open market purchases, which added 35k shares that were bought at a cost of £134k. Nearly half of the shares he owns were purchased himself.

Management Quality

Capital Allocation & Strategy:

From FY17-21 the company's cash inflow was:

OCF (ex SBC, WC) = £30mm

WC = £10mm

Net capex vs D&A = £-11mm vs £36mm

M&A = £64mm

Dividends = £-14mm

Debt = £-32mm

Equity (inc SBC) = £16mm

Others = £37mm from discontinued operations, £-18mm in other financing and investing activities

= Net change in cash = £82mm

In it's annual report, Naked states:

Our purpose. Connect everyday wine drinkers with the world’s best independent winemakers.

Our mission. To disrupt the wine industry for the benefit of our customers, winemakers and our people.

Our ambition. To go from impacting individuals to changing how an entire industry works by shaping the whole wine industry in our image.

Devlin's strategy is primarily based on (1) gaining scale and (2) improving Naked's brand/perception. He has liken the strategy for (1) as similar to Costco and (2) as similar to Dollar Shave Club. We believe he has the right strategy.

As discussed extensively in this report, scale is key in this industry. In conversations with us and publicly, Devlin has stated that the best way to gain scale is to reinvest across the business. On an earnings call in June 2021, he said:

"As we scale this business, all the economics improve. And ultimately, I very strongly believe that by sharing that improvement back with the consumers and driving retention rates and loyalty, you build a stronger business that's more competitively differentiated and harder to compete with. And that's the right way to drive long-term profitability. Because again, if you think about any subscription model, the higher your retention rate, the less money you spend acquiring customers to offset customers you lose, your long-term EBIT margin gets enhanced. So that's my preferred route to long-term value creation and a high EBIT margin at maturity. I'm not trying to take short-term price...And the priorities are going to be focusing on improving the ease and speed of shop for our customers; enhancing and elevating the winemaker content and sharing that more broadly; using our data more effectively to deliver wine recommendations and aid customer discovery, make it easier to find the perfect wine; and we're going to continue to innovate our subscription products. I think we've seen massive consumer appetite, but we believe we're only just scratching the surface of what's possible there.... Overall, a good example of it, I think, is our subscription products. So things like Never Miss Out, back-of-the-napkin math, we spent about £1 million of product and tech cost over about a 2-year period to build out these new products. And they're now generating somewhere in the region of £6 million of incremental contribution a year, which is growing rapidly. So these are the kind of opportunities we've got."

Over the longer term, Devlin's admiration for Costco extends to moving Naked away from generating all profits through transactions and instead earning through customers paying membership fees. By receiving a membership subscription, Naked would likely achieve higher customer loyalty and be able to lower wine prices. The company could then also pay winemakers who brought notable brands that increased retention.

The other core focus of Devlin's strategy is to improve the way Naked is perceived. One a call with us, Devlin stated that the "biggest difference over long term is the challenge and opportunity of how Americans think of wine as a category. There is the path of accommodation and disruption. I prefer disruption." He further explained that in the US there is a perception that the price of wine tells what quality it is. If Naked is to be successful in offering wines of the same quality at lower prices, it therefore has to improve how it is perceived. In other words, Naked needs a strong brand that gives the customer confidence that the cheaper wines they are buying are in fact good quality. Devlin highlighted to us the success of Dollar Shave Club, which is successful not just because its products are cheap but because it convinced people that a good razor does not have to be expensive.

Changing the perception of Naked is likely to require significant market spending across a variety of channels, which becomes easier as the company scales up. Naked is also focusing on less costly initiatives such as entering more wines into competitions and highlights the awards and background behind its wines on the website and app.

Track record of success:

Devlin does not have a long term track record, having only become CEO in 2020.

Customer focus:

It is clear from Devlin's comments and strategy of sharing economics with customers that he is focused on delighting the customer. As one minor example, in March 2020 the company wrote to their Angels and reminded them they could take money out of their account if they needed it.