GCI Liberty (GLIBK) Podcast & Presentation

John Malone's plan for a "new Liberty Media" acquisition vehicle

I recently discussed GCI Liberty (GLIBK) with John Mihaljevic from Latticework by MOI Global. Our conversation covered:

John Malone’s vision for GCI to become “a new Liberty Media”

Three advantages GCI has as an acquisition vehicle

The existing Alaska business’ dominant competitive position

Why Starlink is a manageable risk

Why I see well over 100% upside over three years

The video of our discussion is available above. Paid members additionally have access to:

A 30-page Special Report on GCI Liberty based on interviews with 17 industry sources

A cleaned transcript of the podcast (below)

The 23-page presentation from the podcast (below)

Monthly updates like this.

A library of content at the Table of Contents

Most of our reports require well over 100 hours of work and thousands of dollars in research expenses. A subscription gives you all of that for just $397/year, saving you enormous time and cost. Join the over 7,000 free subscribers and 300 paid subscribers who have upgraded in the 14 months since the newsletter was launched, or go here to learn about what you can expect as a paid subscriber:

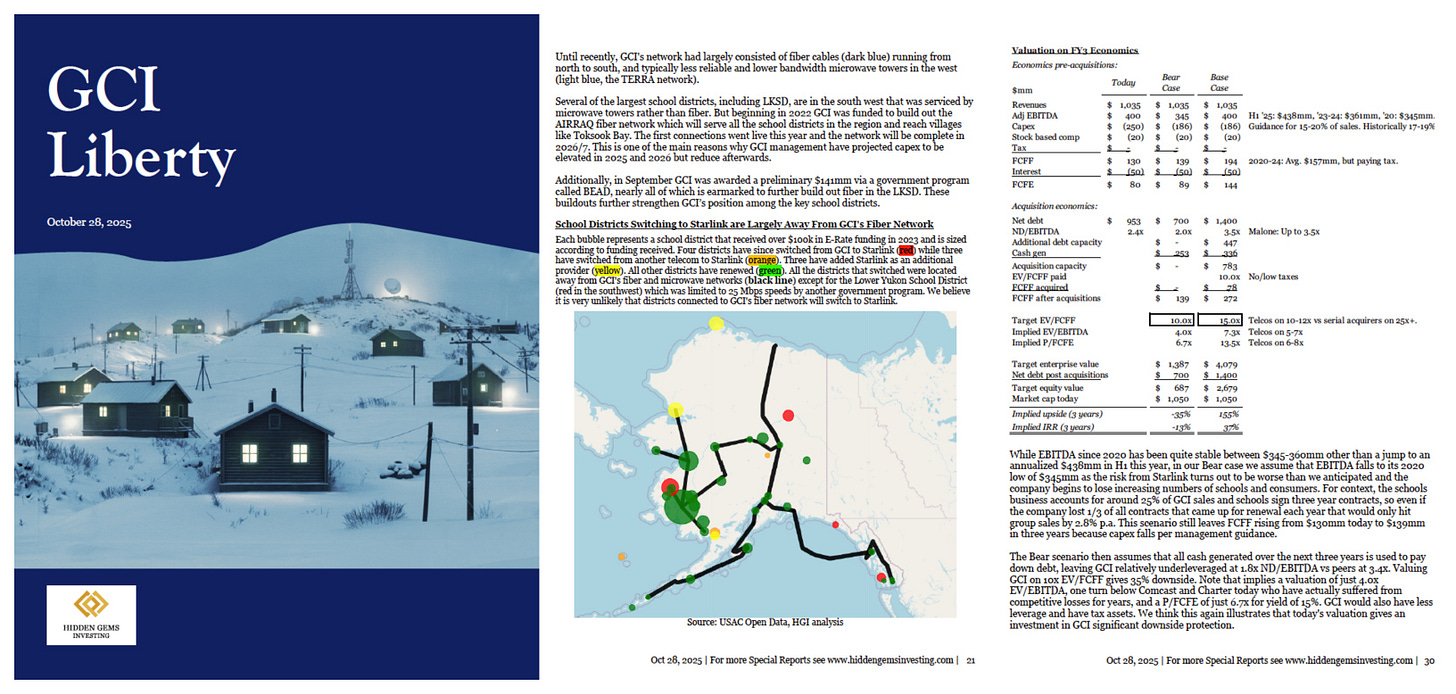

GCI Liberty (GLIBK) spun out from Liberty Broadband in July 2025. The company is Alaska’s dominant telecom operator with 90% market share in its key business yet trades for 10x underlying FCF. Investors have overlooked the spinoff because Liberty Broadband was 13x larger and is being acquired.

But John Malone did not ignore the spinoff.

He is Chairman of GCI, owns 7.2% of the company, and has been buying stock. He structured the spin to turn GCI into an advantaged acquirer and “the beginning of a new Liberty Media”. GCI is an ideal acquisition vehicle because it benefits from two substantial tax shields and has ~$2bn of acquisition capacity over three years, greater than its current market cap.

We see limited risk over three years given GCI trades on 10x FCF, our Base case has 155% upside, and the Bull case is that we are at the beginning of GCI being transformed into an advantaged acquirer.

Click here to read our 30 page report on GCI, based on interviews with 17 industry sources (preview image is above).

Timestamps to the Podcast

[01:45] Introduction to GCI Liberty

[05:50] The spin-off and why this opportunity exists

[07:00] John Malone: vision, insider buying, and the $300m rights offering

[10:15] The Alaska telecom cash cow and dominant position

[16:00] The Universal Service Fund and ‘use-it-or-lose-it’ subsidies

[22:10] Starlink risk deep dive

[32:30] Advantaged acquirer: Huge tax shields, $2bn buying power, best-in-class management

[35:40] Valuation scenarios with acquisitions

[43:20] Q&A