Is TerraVest Still Cheap? (TVK.TO) | Updated Valuation & Outlook

Deep dive on TerraVest Industries (TVK.TO) after the stock's strong performance

TerraVest Industries (TVK.TO) recently presented at the Eastern Energy Expo, a trade show where exhibitors also included Xerxes (Mattr - MATR.TO), and many of their competitors.

Since Hidden Gems Investing published a Special Report on TerraVest the stock has risen from C$45 to C$160, and this article summarizes my latest thinking, including:

TerraVest’s current earnings power after four recent acquisitions, an equity raise, and fiscal Q2 results.

Whether the company can keep generating 20%+ returns from reinvested earnings.

Whether the stock remains undervalued.

Hidden Gems Investing published a 35-page Special Report on TerraVest for free in January 2024, but all subsequent reports are only available to paid subscribers. Click “upgrade to paid” to join over 200 members who have converted from free to paid in the last six months. Subscribers are protected against future price rises and you can go here to learn about what you can expect as a paid subscriber.

All published research on TerraVest can be found at the Table of Contents.

Situation Overview

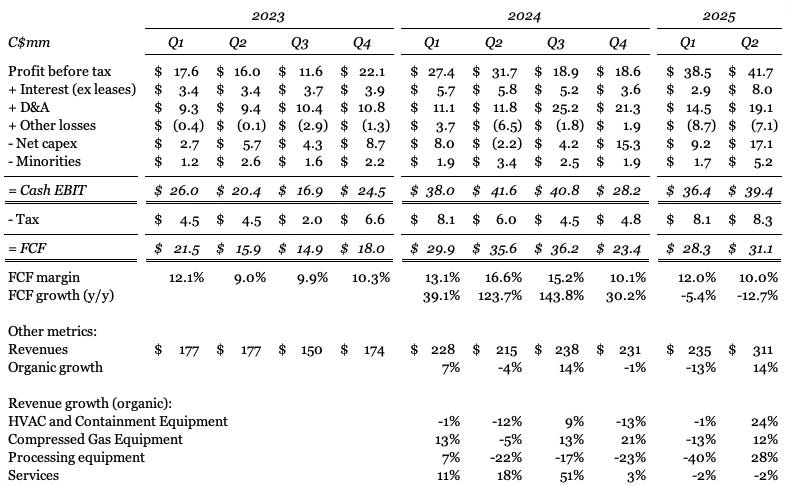

TerraVest recently posted fiscal Q2 results, with organic growth of 14% reversing the Q1 decline of 13%.

Q1 had been weak, with management citing timing issues for the Compressed Gas (-13%) and Processing Equipment (-40%) divisions. These largely reversed in Q2, with revenue growth in the divisions up 12% and 28% respectively. The company’s outlook statement was effectively identical to Q1 and positive.

I calculate FCF was $31mm, down 12.7% against an unusually strong Q2 last year when TerraVest’s high margin Services segment saw 18% organic growth. Organic FCF will likely be down significantly in Q3 given the prior year included 51% organic growth (!) for the Services segment.

Adjusting for these factors, I estimate that TerraVest’s run-rate FCF or earnings power before its recent acquisitions is about C$110mm.

Four Acquisitions

In March, TerraVest announced it had acquired EnTrans for an initial US$546mm, a sum greater than what it had paid for all acquisitions over the last decade combined.

EnTrans is primarily a manufacturer of tank trailers and has facilities across the US and Mexico. The company operates in niche markets and is usually the leader, with management claiming 50% market share in some cases.

EnTrans should fit nicely with TerraVest’s existing portfolio, benefit from procurement and cross-selling synergies, and act as a platform for future bolt-on acquisitions.

While we don’t know what FCF EnTrans generates, TerraVest did disclose the acquisition price was 7x EBITDA, implying EBITDA of US$78mm or C$111mm. I had assumed in my April update that 60% of this converted to FCF, or C$67mm.

This FCF estimate was probably too high.

TerraVest’s Q2 results revealed that:

If Entrans had been acquired on October 1, 2024, TerraVest’s consolidated sales and net income would have stood at C$856mm and C$72.6mm respectively, for the six months ended March 31, 2025.

Given TerraVest’s actual sales and net income were C$546mm and C$63.7mm respectively, this implies EnTrans generated C$311mm of revenues and C$8.9mm of net income in the six months. The C$18mm of annualized net income is well below my C$67mm FCF estimate.

While timing, capex below depreciation, and other factors likely explain some of this difference, I think it would be prudent to conclude that EnTrans' conversion of EBITDA to FCF is at best 50% rather than 60% for FCF of C$55mm. That implies TerraVest paid 14x FCF for the business, which is higher than the 10-11x it normally pays, but not surprising given the size of acquisition.

TerraVest made three more acquisitions post Q2 for a total of C$90mm. No financials were given but assuming the usual 11x FCF price these likely generate C$8mm of FCF.

In total, that means TerraVest’s earnings power today is: C$110mm run-rate + C$55mm EnTrans + C$8mm for three acquisitions = C$173mm.

The company’s enterprise value is: C$3,486mm market cap + C$919mm net debt at Q2 + C$90mm for three acquisitions - C$321mm equity raise = C$4,174mm.

The stock is therefore now trading at an EV/FCF of 24x.

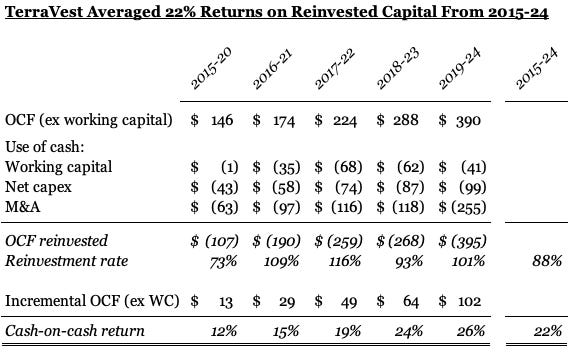

In my view, by far the most important question for investors should be what returns TerraVest is able to generate going forwards on incremental capital deployed.

TerraVest is a serial acquirer and investors tend not to price in management deploying capital at strong returns via acquisitions until after it happens.

ND/EBITDA after the equity raise is 2.1x, just below the historic average of 2.4x.

With net debt today at C$688mm and the company generating C$173mm of FCF per year, debt will reduce to about C$280mm in three years after interest payments and dividends are accounted for. Assuming TerraVest levers back up to 2.4x EBITDA implies the company has C$500mm of buying power (C$325mm in current EBITDA x 2.4 - C$280mm net debt = C$500mm).

Over the last decade, management have been excellent capital allocators. By my estimates they have reinvested 88% of earnings at 22% post-tax returns:

If TerraVest can continue reinvesting capital at these rates then I believe the stock is actually undervalued at 24x. If it cannot, however, then I think the stock’s returns may be disappointing from here.

Answering what future returns will be was the biggest focus of my time at the Eastern Energy Expo, and my conclusion was that TerraVest’s incremental