Judges Scientific (JDG.L): Podcast & Update

Updated analysis on CEO change, growth runway, Geotek, and valuation

I recently discussed Judges Scientific with James Emanuel from Rock & Turner. Our conversation included my updated thoughts on several significant developments at the company this year, including:

Whether to view the Geotek acquisition as a red flag on Judges’ acquisition runway and management incentives

Succession: The recent news that David Cicurel is moving from CEO to Chairman

Recent headwinds: Geotek, US academic funding, China

Valuation after the share price decline

You may find the discussion particularly helpful because James has published a series of articles on programmatic acquirers and challenged several of my thesis points.

James’ articles and podcasts on acquirers include:

The video of our discussion on Judges Scientific is available in full and for free at the link above. Paid members additionally have access to:

A cleaned transcript (below)

Our 35-page Special Report on Judges Scientific

Monthly updates like this

A library of content at the Table of Contents

Most of our reports require well over 100 hours of work and thousands of dollars in research expenses. A subscription gives you all of that for just $397/year, saving you enormous time and cost. Join the over 6,000 free subscribers and 300 paid subscribers who have upgraded in the 12 months since the newsletter was launched, or go here to learn about what you can expect as a paid subscriber:

Judges Scientific (JDG.L) is a serial acquirer of niche scientific instrument businesses in the UK. The company has delivered 22% returns on incremental capital for 20 years by my estimates and 25% p.a. shareholder returns. Cofounder David Cicurel remains Chairman and is someone with high integrity, a clear customer focus, strong capital allocation skills and owns shares worth around 170x his base salary. The stock trades at 15x my estimate of underlying FCF and I believe can still deliver a 25%+ IRR going forwards, potentially plus a short/medium term bounce back given recent declines.

Timestamps to the Podcast

[01:27] Introduction to Chris Waller and the appeal of Judges Scientific

[05:56] Overview of the business model: Niche instruments and high returns

[09:40] The growth algorithm: Buying at 5x EBIT

[13:17] Why founders sell to Judges cheaply

[26:29] The Geotek acquisition: Breaking the playbook or opportunistic?

[35:26] Management succession

[42:38] Evaluating the new leadership team

[59:48] The 50% share price drawdown and current headwinds

[01:10:48] Incentives, shareholder base, and valuation

[01:13:47] Final Verdict: Buy, Hold, or Sell?

James Emanuel: Welcome back to the Rock and Turner podcast. I’m James Emanuel. Joining me today is Chris Waller from Plural Investing. He has done a great deal of research on the programmatic acquirer in the UK named Judges Scientific.

So to start with, Chris, do you want to give us a quick introduction of who you are, what you do, and why you were drawn to Judges Scientific?

Chris Waller: Thanks, James. And thank you for having me on this podcast and everyone listening today.

I run a global small cap fund based out of New York. I grew up in the UK, but I’ve been based in New York since 2016. I’m looking for seven to eight what I call “hidden gems” in the small cap markets, typically in the US, Canada, or UK. Generally, I look in the more boring sectors—consumer and industrial businesses.

These are small cap companies that are usually the leaders in a niche industry. For a small cap to be a leader in a niche, that niche probably is not very well covered by the sell-side or even by the buy-side investor base. So there’s an opportunity there, if you do a lot of in-depth research, to understand that industry and business significantly better than most investors. That’s really why I try and fish in those waters.

The centerpiece of my research process is really around trying to do this “scuttlebutt” research—speaking to around 20 people in an industry prior to investing in a company, and then trying to speak to people like that on an ongoing basis and attending industry events like trade shows. That’s really how I try and get that understanding of a company.

Judges, that we’ll talk about today, is a company very much in that vein. It’s a small business that acquires even smaller businesses that are even more niche. So it fit in with my style of investing. I was able to speak to a number of people in the industry who recommended the company strongly. I thought it was undervalued as well, which is what got me initially interested.

James Emanuel: So you run quite a concentrated portfolio. I’m guessing you look for companies that you can buy and hold for the long term. What’s your average holding period?

Chris Waller: Yeah, so seven to eight stocks, typically for a three to five-year initial timeframe. The fund is about five years old and there are several of the biggest positions that were held in the fund at the beginning. So it has been five years and that has played out. So, yes, we do hold for the long term.

I should also have mentioned at the beginning: I run this fund, Plural Investing, but I also started a newsletter on Substack called Hidden Gems Investing, where I publish some of the research that I do. One of the things I do is I try and write a roughly 30-page research report on these companies after doing that research.

The reason I started doing it is I found it gave sources in an industry a reason to talk to me. If I would talk to 20 sources and share this type of research with them in return, particularly in industries that don’t have a lot of research because they’re so niche, it was valuable. Eventually, I realized, why not distribute this further? Anyway, that’s why I started the newsletter.

James Emanuel: Thanks, Chris. So we’ve touched on Judges Scientific at a very high level. They’re a programmatic acquirer. What does that mean?

Chris Waller: It means that acquisition is their business. So they don’t have their own operating model as such. They have a portfolio of smaller companies and they all run relatively autonomously. So there’s no integration involved.

James Emanuel: And incidentally, for those not familiar with the terminology—at least the terminology that I like to use, which is borrowed from McKinsey—I always refer to a serial acquirer as a company that buys similar companies that need to be integrated. So they’re looking for synergies between those companies.

A programmatic acquirer is a company like Constellation Software, which buys lots of autonomous companies which run entirely independently. There’s no integration required. They don’t look for synergies. And Judges Scientific fits into that latter bracket.

So Chris, the name Judges Scientific gives us a hint at the kind of companies that they target. Do you want to just give us a little bit more detail on that?

Chris Waller: Judges is a UK listed company, just under £400 million market cap. It trades for about 20 times free cash flow on its guidance this year—I think probably 15 times its underlying earnings power.

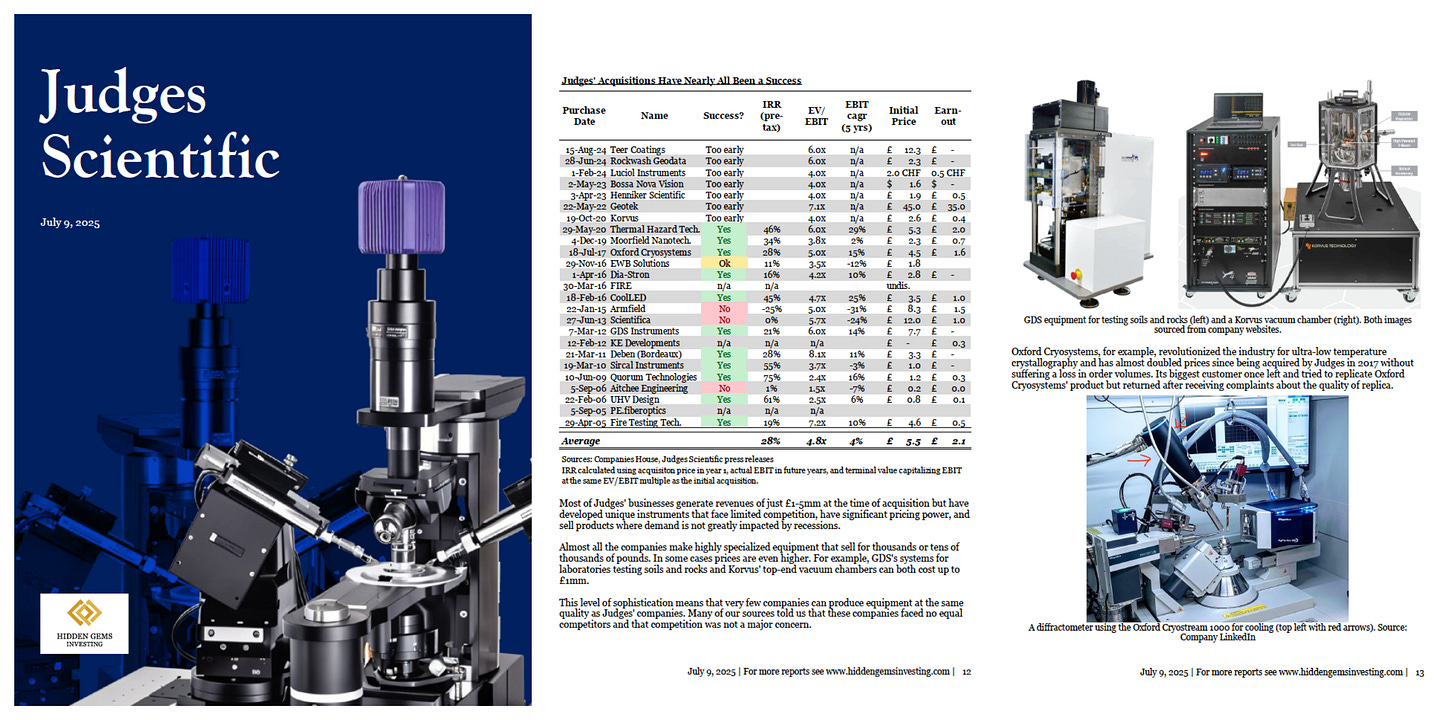

As you say, they do acquisitions of small companies, typically £5 to £10 million deals, of scientific instrument companies in the UK. These are companies that are selling typically expensive and niche instruments like vacuum chambers, ultra-low temperature instruments, and instruments analyzing different rocks and soils. These products typically sell for anywhere from £1,000 up to £1 million for the most expensive system. So very high value. In many cases, these companies invented the particular instrument or niche that they’re in.

They are UK companies, but revenues are split about one-third in the US, one-third in Europe, and one-third rest of world, with China being a big component of that.

They have a very good track record. Over the 20 years Judges have been doing this, they’ve generated about a 20% return on incremental capital, by my estimate. The stock has returned just over 20% as well over that period of time.

So these are good businesses: very good return on capital, leaders in the industry, and sort of 7% to 9% organic growth over this period of time.

Judges is quite selective. They’ve done 25 deals in 20 years. Typically, they’re buying at about 5x EBIT, although there’s one bigger acquisition that we’ll touch on, Geotek, which was more expensive than that.

So very disciplined in their acquisition multiple, very return on capital focused, not a lot of synergies—but they don’t necessarily need them at that multiple and with that organic growth. Their growth algorithm would be sort of 13% post-tax return based on their initial acquisition price and then 7% to 9% organic growth. That’s how you get to the 20%.

That’s really the business model. Their model relies on a very high integrity, hands-off approach, which is why people sell to them cheaply. They have a founder, David Cicurel, who’s just moved up to Chairman and we’ll talk about. They’ve been very, very successful, and I expect them to continue being that successful.

James Emanuel: And in terms of your research process, you touched on it earlier, you go deep and you interview lots of people. For this particular piece of research, I think you said that you conducted an interview with nine former senior management executives and seven other external sources. Are you able just to give us a little bit more color on that?

Chris Waller: I think with a company like this, it’s really important to understand: do they have an advantage as an acquirer? I don’t think it’s good enough just to be an acquirer. There needs to be some reason why you’re able to get good deals or you’re able to extract some extra value in some way. So I think speaking to people who were either the founders of businesses that sold to Judges or they were at the C-level is important to get those insights.

What was really interesting about this company was, probably more than any other I looked at, the feedback from the industry was very, very consistent in terms of why they sold their companies—which was really around Judges’ hands-off approach and about some of the future prospects of the business.

James Emanuel: So the company was listed in 2003 at 95 pence with a £2 million market cap. By 2023, it reached a peak of £600 million market cap, which is a 35% CAGR. Very, very impressive. Today, it’s had a bit of a drawdown. In fact, it sits at half that level, £300 million market cap, which is still a 24% CAGR, which really puts it in the kind of top decile of performance, if not higher. What exactly is the model here?

Chris Waller: I looked at the 25 acquisitions they’ve done so far, and on average they pay about 5x EBIT. That, I think, is by far the most important factor in the success of this company and the discipline that they’ve had in very rarely going above that. That’s why they’re able to buy in that revenue at such a good return.

Now, they do have a little bit of margin expansion over this 20-year period. I think revenue growth has averaged 7%, EBIT growth has averaged 9%. That margin expansion is not really because of any synergies. Some of that’s just the natural growth of the business.

But we could talk a little bit more about what they do once they make those acquisitions. Really three things they do: