August 2025 Update

JDG, WOSG, JET2, XPEL, MACF

Don’t forget to read the latest Special Report on Judges Scientific, based on 16 interviews, and update on ContextLogic.

Hidden Gems Investing has reached over 4,300 free subscribers and 250 paid subscribers in the eight months since the newsletter was launched. Thank you for subscribing, and upgrade to paid to access our best content. An annual membership is just $347 and subscribers are protected against future price rises. Go here to learn about what you can expect as a paid subscriber.

Judges Scientific (JDG.L)

Judges released a disappointing trading update, with a strong recovery from the Geotek subsidiary being offset by cuts in US government research funding. Organic revenue growth was +7% and adj EPS +15%, but management lowered full-year adj EPS guidance to 285p-330p (+0.7% to +16.7% y/y). Previous consensus expectations were at 367.2p, meaning this is a cut of 10%-22%.

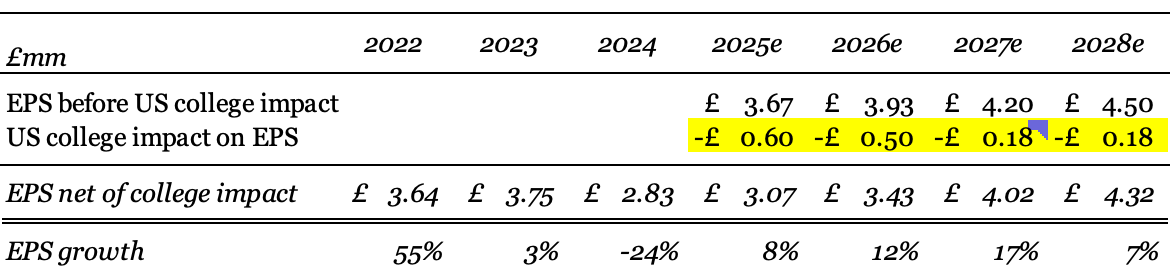

The US accounts for around 30% of sales, and revenues were -20% in H1. Having spoken with management, my sense is that virtually all of the guidance reduction is because of a near complete halt in spending by US colleges. The CFO stated that this is hitting around 55-60p of EPS (the EPS cut was 37-82p with a midpoint of 60p), and that college spending can't get worse because it can't go negative.

So, unless they are exaggerating (unlike them) or other macro issues come up, I think this is the bottom on this issue. The stock has fallen by the high end of the cut in guidance which essentially extrapolates lower college spending into perpetuity and is a large overreaction in my view.

The size of the spending reduction has caught me and the industry by surprise. As recently as March, management had guided earnings to be in line with expectations and bought stock in the open market. Most industry sources I spoke to over the last month had downplayed the significance of US budget cuts given the multi-year funding cycle.

What has become clear is that, beyond the proposed cuts to research grants, the broader uncertainty colleges are currently facing is causing nearly all of them to halt discretionary capex.

For context, the current proposed cuts to the 2026 budget call for 20-50% reductions at several institutes, including a 40% reduction in budget for the National Institute of Health (NIH) and over 50% reduction for the National Science Foundation (NSF). Those institutions provide grants to scientific research projects at colleges.

The proposed cuts are having a substantial impact on grants that were already made.

A website called Grant Witness has been set up to track the termination of grants. The website is not perfect as it partly relies on scientists self-reporting cuts, but the data is helpful. The table below shows, by month, the termination of grants at the NIH, reinstatements of terminated grants, grants that were already authorized but are now frozen, and terminations at the NSF:

What this shows is that terminations peaked in March (net $3.48bn) and May (net $2.0bn) and have since reduced substantially. Then, court orders led to most of the terminations made before May being reinstated (e.g. $1.8bn in June). Very few of the terminations post-May have been reinstated, but that may come through further court orders. Meanwhile, House and Senate committees are also working on proposals to essentially eliminate the cuts.

That is not the end of it, however, with the Trump administration escalating the issue to the Supreme Court and looking to get the reinstatements removed. The administration is also targeting colleges on issues like DEI and threatening or cutting college funding more broadly.

Against this backdrop of huge uncertainty, Judges told me that college spending on new scientific instruments has largely stopped as colleges wait for clarity on what future funding will look like. When I challenged management on whether orders could in fact get worse because funding cuts may have a delayed impact, they pushed back, stating that spending is already near zero. Any further impact would have to come from US companies cutting back more broadly, which is not happening currently.

And while sentiment is very weak right now (Judges’ stock has almost halved from its peak 12 months ago), I can see earnings growing around 12% in 2026 because I think we have just passed the moment of peak uncertainty.

Columbia became the first college to settle with the Trump administration two weeks ago, and Brown settled last week. Both colleges will now have funding restored. Harvard is suing for $2.7bn in lost funding and hoping for a decision by September, ahead of the following academic year.

As we increasingly get resolutions uncertainty should reduce significantly, like we are seeing with trade deals. In my base case I am now modelling an 80% recovery in college spending levels in 2027 vs 2024, i.e. a 20% permanent cut, which I assume drops through to a 70% recovery in lost EPS. This will likely be backend loaded unless we get significantly more resolutions before the new academic year begins in September.

Assuming the rest of the business grows organically at 7%, this implies that the long-term impact to Judges is fairly minimal.

I've edited the valuation scenarios used in the Special Report to reflect the lower FCF estimates, without changing the logic for the other variables (you can read more about the logic used in the “Valuation” section of the Special Report. I have not changed the Bear case FCF in 2027 because that already assumed a hit from US funding and other sources.

Overall, these scenarios suggest the risk/reward on Judges today is very attractive. The stock is trading at what I think is a reasonable Bear case for intrinsic value over the next three years. While the size of US college spending cuts has certainly surprised me, there should be a substantial reversal over the next few years as we get resolutions. Judges’ problems with Geotek and spending in China in 2023-24 have largely reversed, and lower valuation multiples in the sector may make acquisitions easier.

Watches of Switzerland (WOSG.L)

Special Report, Notes from the trade show, Podcast

US tariffs on Switzerland are clearly having an impact on WOSG. Before I discuss that, I think it’s worth recognizing that the US market for Rolex remains healthy and that WOSG’s position within it continues to strengthen.

On July 3, WOSG reported full-year results:

Revenues = £1,652mm, +8% in constant currency. +12% in H2.

UK +2%, +6% in H2. The opening of the Old Bond St store exceeded expectations.

US +16%, +19% in H2. Roberto Coin was likely ~12% of that and is performing well post-acquisition. Management seems increasingly excited and has signed three leases for mono-brand boutiques.

Adj EBIT = £150mm (+11% y/y). Adj EBIT margin = 9.1%.

Guidance for fiscal 2026:

Constant currency revenues +6-10%.

Adj EBIT margin to decline 0-100bps, assuming a 10% tariff. I will discuss this more below, but I believe it aligns with my simple model of an X% tariff = an X% decline in US EBIT or a 0.5 * X% decline at a group level.

Others:

WOSG took a £45mm impairment and incurred £6mm in store closure costs, both of which were excluded from adj EBIT. All but one store that was impaired was in the UK, including 16 non-Rolex stores that were shut. The only US store that was impaired was the recently opened One Vanderbilt store in mid-town Manhattan, which also does not carry Rolex.

I think the last point on impairments is worth emphasizing. The impairment was on more than 16 stores, but is likely a large number on a per-store basis. For context, in the Economics section of the Special Report I estimated that for a 3,500 sqft multi-brand store, the non-Rolex initial capex would be just under £2mm. I think this again suggests that WOSG’s Rolex business probably has 30%+ store-level returns on capital and is most of the company’s value, but that the non-Rolex business is a cost of capital business. My understanding is that most of WOSG’s capex for the coming year will be allocated towards Rolex investments.

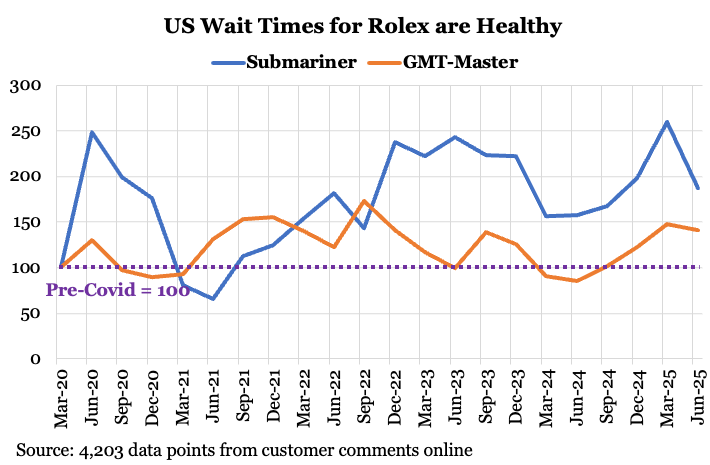

The growth in Rolex sales and WOSG’s share of that will be the key determinants of the company’s long-term success in my view, and both look healthy. WOSG’s guidance for 6-10% sales growth likely implies Rolex growth of 10%+, Rolex’s declines in the secondary market have now plateaued for around nine months, and my data suggests that waiting lists remain healthy.

Meanwhile, WOSG’s share of Rolex sales in the US is growing. Data from tracking the list of stores on Rolex's website suggests that the total number of Rolex stores in the US declined from 276 in November 2024 to 257 in April 2025 and 253 in July 2025, as Rolex continued its decades-long policy of shrinking the store count and reallocating watches to the best stores.

WOSG’s Rolex store count actually increased by two in this period, meaning its share of stores increased from 6.9% to 8.1%. WOSG’s market share is higher than 8.1% because its stores tend to be bigger.

And despite the investor concern since Rolex acquired Bucherer, Bucherer has actually shut one store.