Deep Dive on ContextLogic (LOGC)

$6.7 stock with $6.7 in cash and $10-15 in total intrinsic value

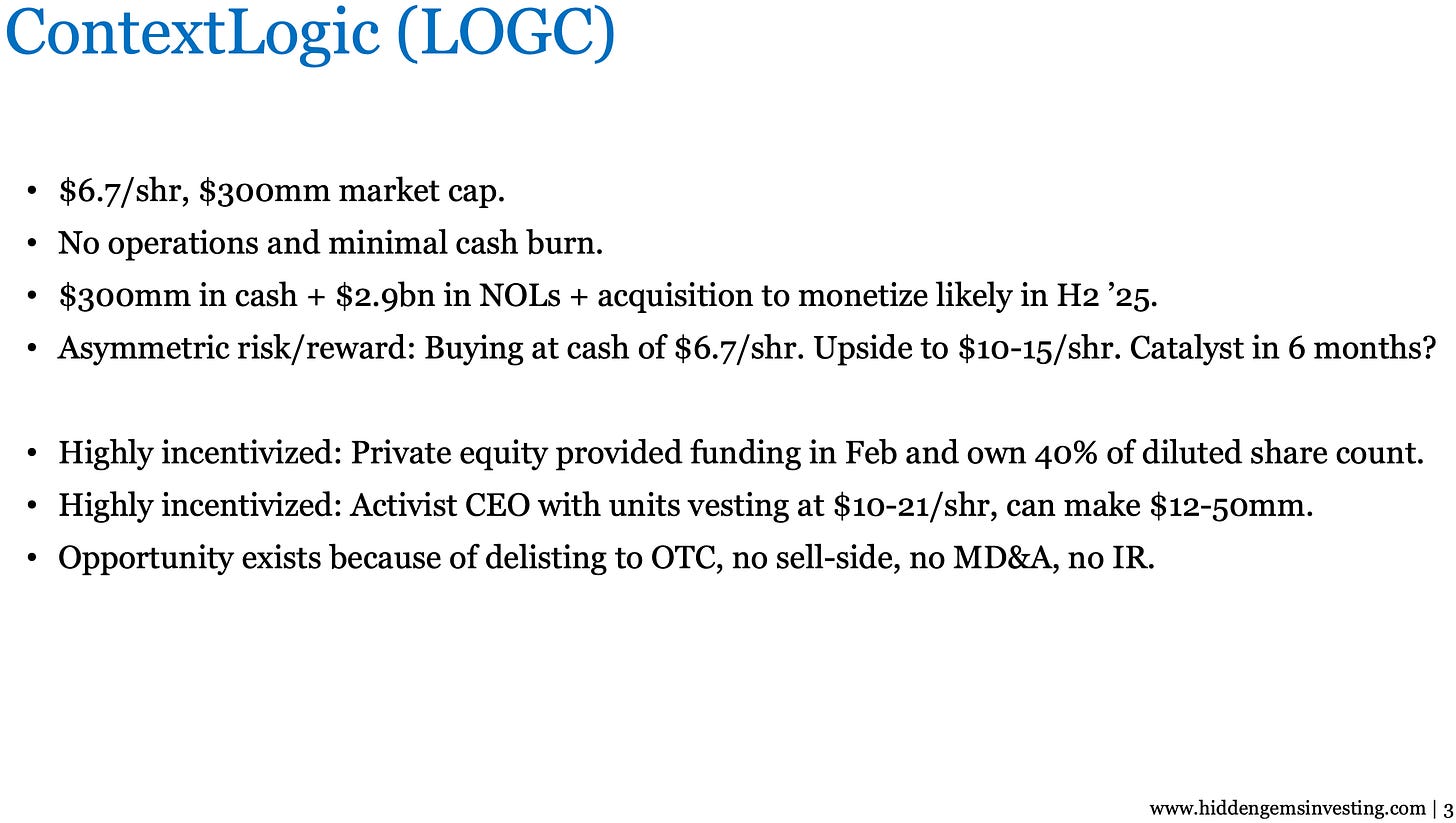

ContextLogic has no operations, $6.7/shr in cash, and Net Operating Losses worth up to a theoretical $13.4/shr. The stock trades at the cash value of $6.7 and in my view the company is likely to make an acquisition over the next six months that acts as a catalyst to monetize the NOLs.

Part of the reason this opportunity exists is technical: ContextLogic has no operations and so the stock was recently delisted from the NASDAQ to the OTC, which led to forced selling. The delisting will not hinder ContextLogic’s acquisition catalyst in my view and the company will simply uplist post acquisition. Investors now have an opportunity to buy the stock before that.

I have prepared a presentation and slide-by-slide discussion below, but you can download the presentation in full here if you prefer:

ContextLogic has a $300mm market cap and a $300mm in cash.

The company has no operations, just $300mm of cash and $2.9bn in Net Operating Losses (NOLs). The NOLs allow the company to shield future profits from taxes.

Essentially this means ContextLogic has to acquire a profitable, tax paying company. That acquired business will no longer have to pay taxes and become more valuable as a result of that, which is how the NOLs get monetized.

I like the risk reward here because the stock is trading at the cash value, so you are not taking a lot of risk. And if management succeed in monetizing these tax assets, I think the stock can be worth $10-$15/shr.

The company also has a very aligned and incentivized management team who are likely to make an acquisition. Private equity firm BC Partners provided funding for an acquisition in February, which is usually the biggest hurdle in these situations to make an acquisition. BC Partners own convertible debt that converts into 40% of the diluted share count, so the is a major partner aligned with shareholders.

The CEO Rishi Bajaj is also aligned, and is a activist hedge fund manager who came into this situation specifically to monetize the NOLs. He can make $12-50mm depending on whether the shares go to $10-$21 over the next four years.

The reason this opportunity exists is because ContextLogic used to be e-commerce website Wish.com, which lost a huge amount of money and caused the stock to decline 99%, which culminated in it recently being delisted from the NASDAQ to the OTC because the company no has no operating business. So it has completely changed, and the stock now has no sellside coverage and no investor relations - it's very much off the beaten path.

What is an NOL?

ContextLogic as Wish.com accumulated a huge amount of losses, of which $2.9bn can be used to offset future profits. At a 21% corporate tax rate theoretically up to $600mm of future taxes can be offset.

That's $13.4/shr on top of the $6.7/shr of cash - the stock is trading at $6.7.

While theoretically the company could be worth up to $20/shr, in practice the NOLs won't be the full $13.4/shr because the present value of those losses will be significantly less. It will take a period of time to monetize them, and management may not be successful in monetizing the entire amount by acquiring a business with enough profits soon enough.

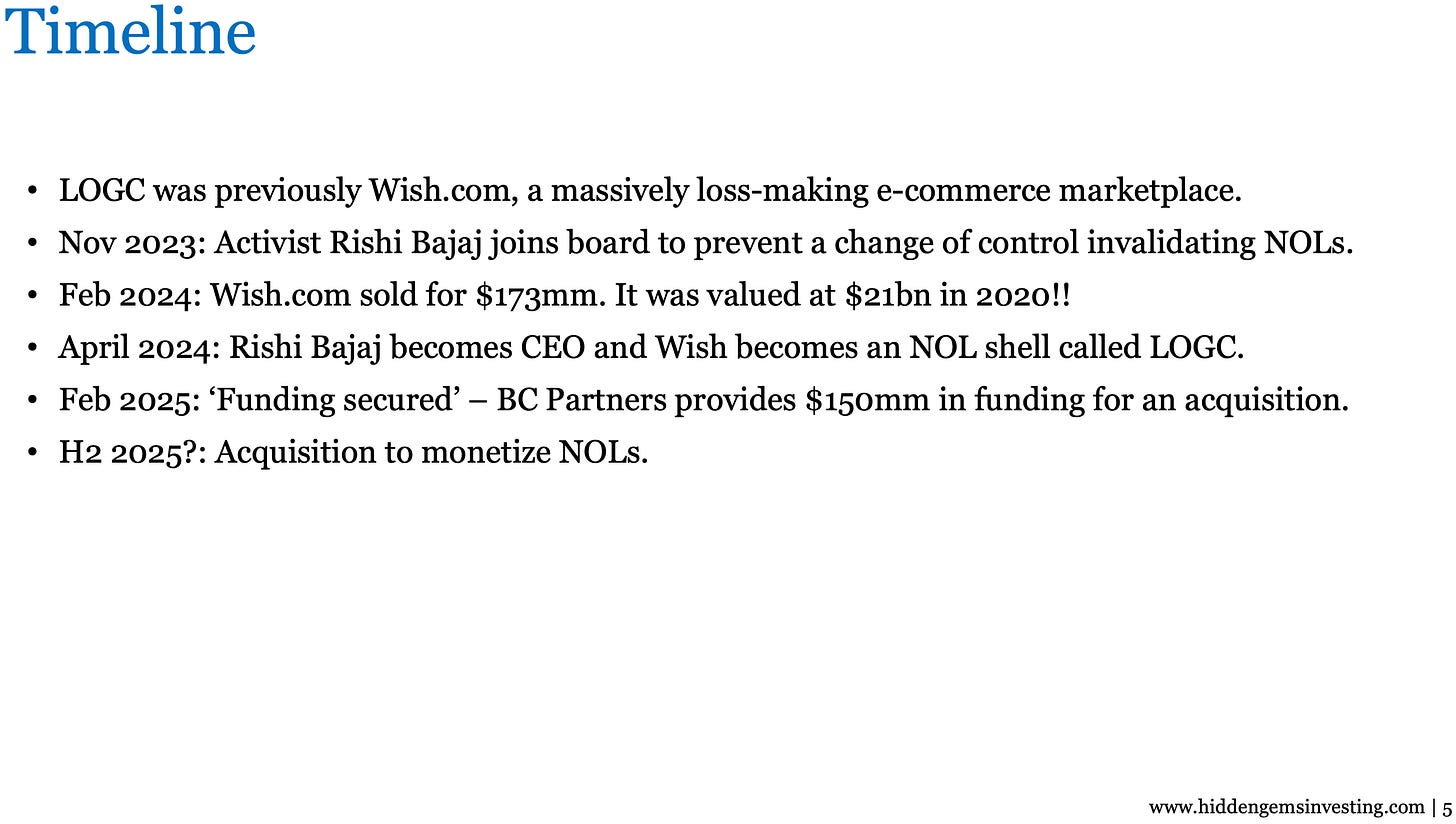

The background here is that activist hedge fund manager and current CEO Rishi Bajaj joined the company in November 2023 to prevent ContextLogic, then named Wish.com, selling the entire company.

A full sale would have meant a change of control which would have invalidated all the NOLs.

Bajaj instead sold the operations of Wish.com but retained the entity, since renamed ContextLogic, thereby ensuring no change of control and no loss of NOLs.

In February this year, ContextLogic got funding from private equity firm BC partners, which is a major hurdle it had to overcome to finance a future acquisition.

And my guess is that sometime in the second half of this year the company will go and make that acquisition, which will be a very important catalyst for the stock.

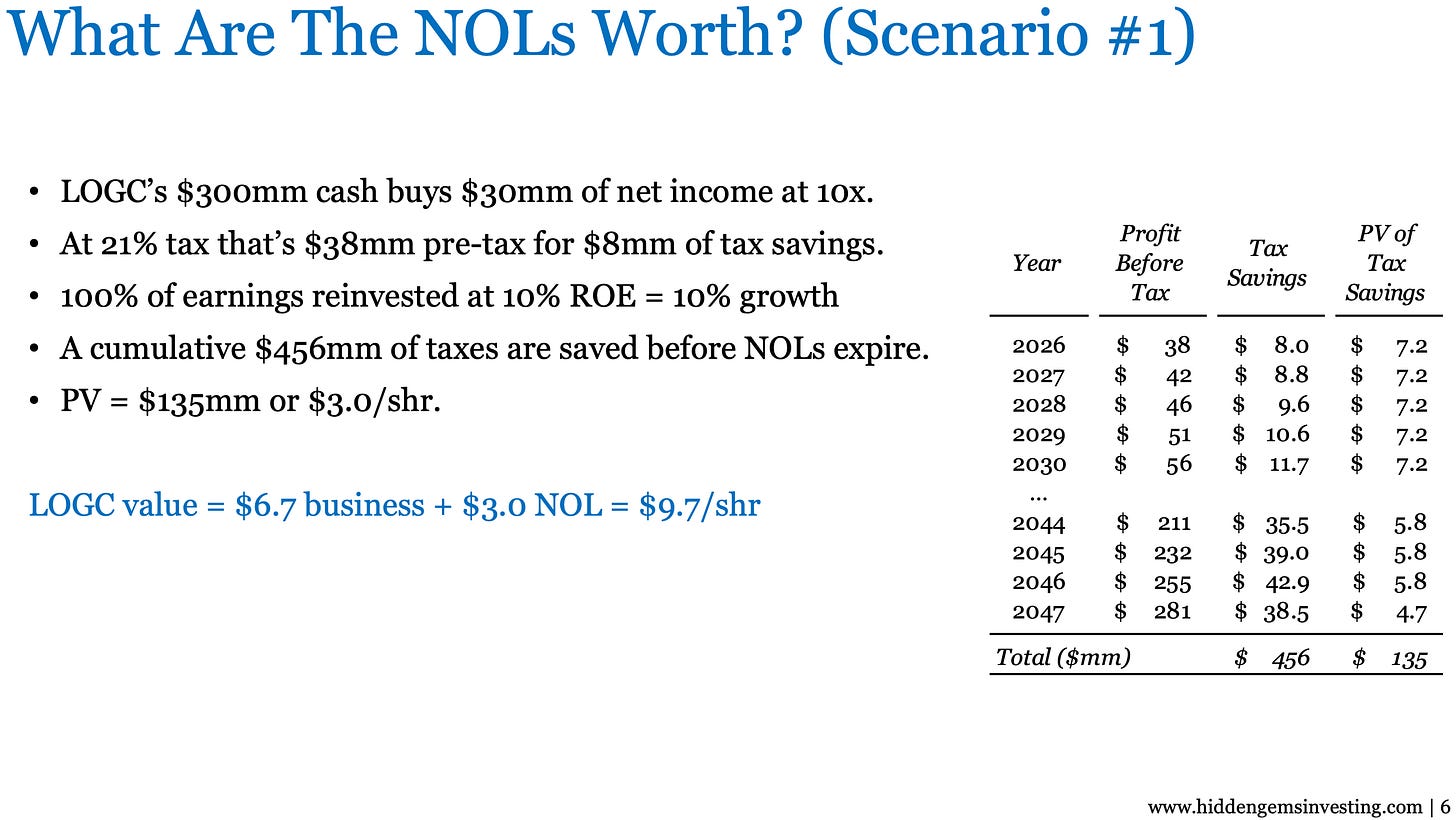

To illustrate the value of the NOLs, let's suppose management takes the $300mm in cash they have today and buy a boring business at 10x PE. That buys $30mm of net income or $38mm pre-tax, of which $8mm is the tax that would now be offset by the NOLs.

Now assume that this company reinvests all earnings because it wants to grow its earnings to shield even more taxes. If they reinvest all earnings at a 10% cost of capital they should grow at 10%, which pre-tax profits goes from $38mm to $42mm to $46mm, etc and taxes saved got from $8.0mm to $8.8mm to $9.6mm, etc.

You can do a DCF to calculate the present value of how much tax will eventually be saved, but in this relatively conservative case where ContextLogic just acquires with the cash it already has it would save $456mm of taxes over 25 years. That’s not the full $600mm because some of these NOLs would expire in that time.

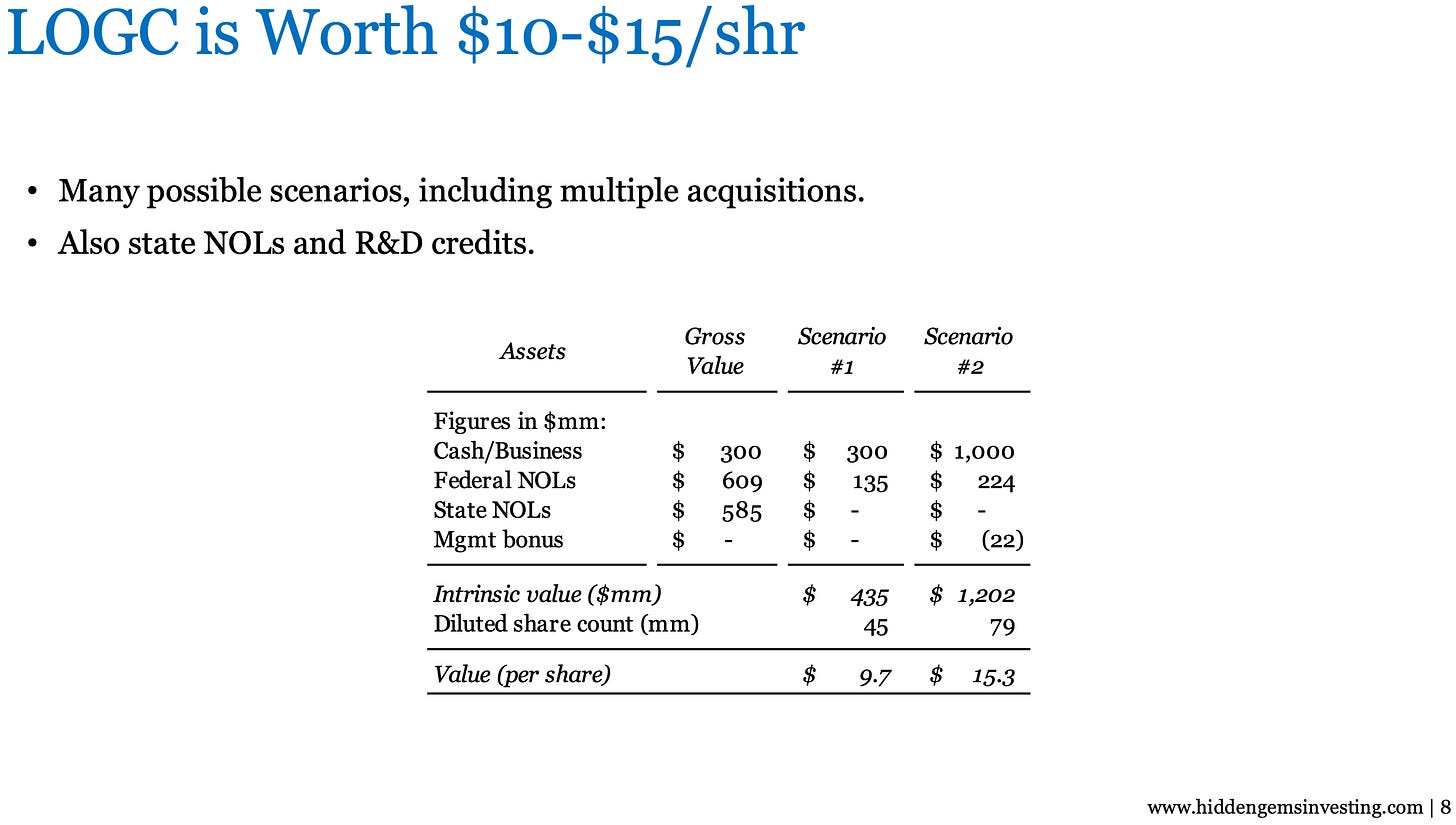

The present value of tax savings would be $135mm or $3/shr. The company in this case would be worth the $6.7/shr of cash + $3.0/shr of NOL = $9.7/shr.

I think that would be a reasonably conservative scenario, because management will want to do additional acquisitions in year 2 and 3 or a much bigger initial deal of a more profitable company, meaning more taxes that can be shielded.

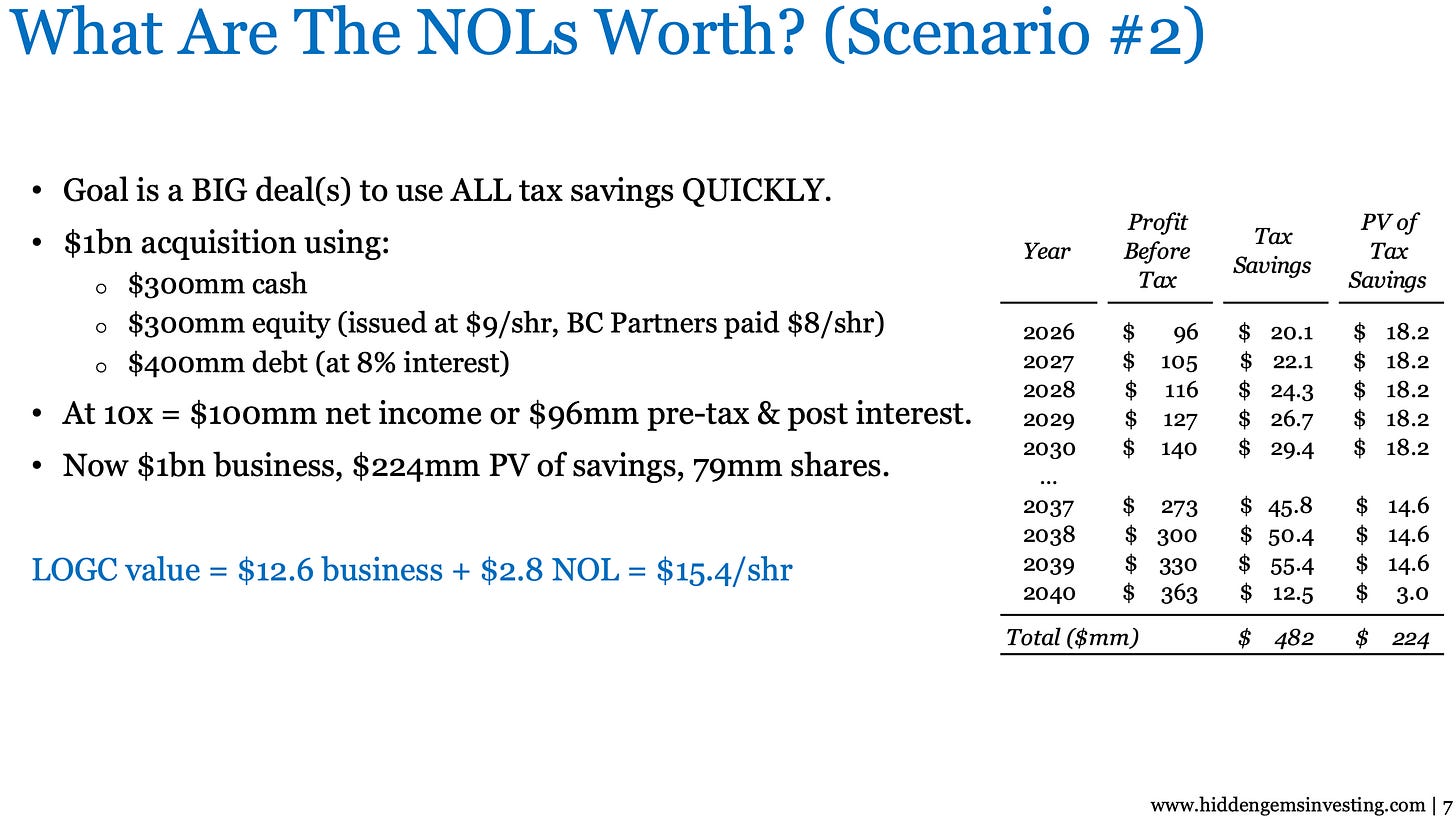

To illustrate the Bull case, suppose ContextLogic made a $1bn acquisition instead of $300mm, either in one go or through multiple acquisitions over several years. This could be financed through additional equity, debt, or retained earnings in the case of multiple deals.

The $1bn of acquisitions at 10x P/E would mean $100mm of net income instead of $30mm. That means more taxes shielded more quickly and going through the same math gives ContextLogic a value of $15.4/shr.

Overall, the way I think about the valuation is that the stock and cash is at $6.7/shr and depending on how successfully management monetize the NOLs the valuation increases to $10-15/shr. My Base case is towards the lower end of that range at around $12/shr.

There is also another sources of value which I have not accounted for. ContextLogic also has $9bn of state NOLs, which at an average state tax of 6.5% means almost another $600mm in taxes could be offset.

However, state NOLs are very difficult to use because they spread across many different states and so you have to buy a business in the right state(s). Some states also make them particularly difficult to use them for technical reasons that I won’t go into here. So while some investors place significant value on the state NOLs, the valuations above do not.

A lot of NOL shells actually don't work out for key reasons: (i) cash burn, (ii) failure to do an acquisition, (iii) bad management.

I think that all three of those risks are very low in this case.

Cash burn is often a problem because the NOL is created by a heavily loss making company. For example, if Wish.com had not been sold and was still losing lots of money you could imagine a scenario where management could monetize the NOLs, but Wish.com loses so much money in the interim that it offsets the value of the NOLs.

That does not apply here. Wish.com has been sold and ContextLogic has no operations and minimal cash burn.

Failure to do an acquisition is normally another major risk. Again, when the company was Wish.com the management team had no interest in monetizing the NOLs and did not want to convert from being an e-commerce website to a tax loss company. So quite often companies with NOLs have a management team has no interest or ability to do make an acquisition.

Again, that's not the situation here. Wish.com’s management are gone and CEO Rishi Baja came in specifically to monetize the NOLs.

Private equity firm BC Partners have also joined and provided funding for an acquisition. That is important because companies with NOLs tend to be losing a lot of money and so often do not have the cash to do a big acquisition.

BC Partners also have the Chairman and another board member and 40% of the diluted share count.

At this point, I think the biggest risk for an investor in ContextLogic is that the company do a bad acquisition. But bearing in mind how much value gets created from any acquisition, it would have to be an extremely bad one for the net effect to be negative.

There are some other signs from the BC Partners deal that I think are positive.

The Head of BC Partner’s Credit division is now Chairman of ContextLogic and another Principal is on the board and working on this full time. I think it is a good sign that people of this seniority have taken these roles, as it suggests BC Partners sees a substantial opportunity here.

The $150mm of financing BC Partners have provided is actually relatively small for a firm with €40bn in assets, and so I think BC Partners likely sees a bigger picture where it can help source deals and grow ContextLogic into something much bigger, like the $1bn acquisition scenario that would give the stock a $15 valuation.

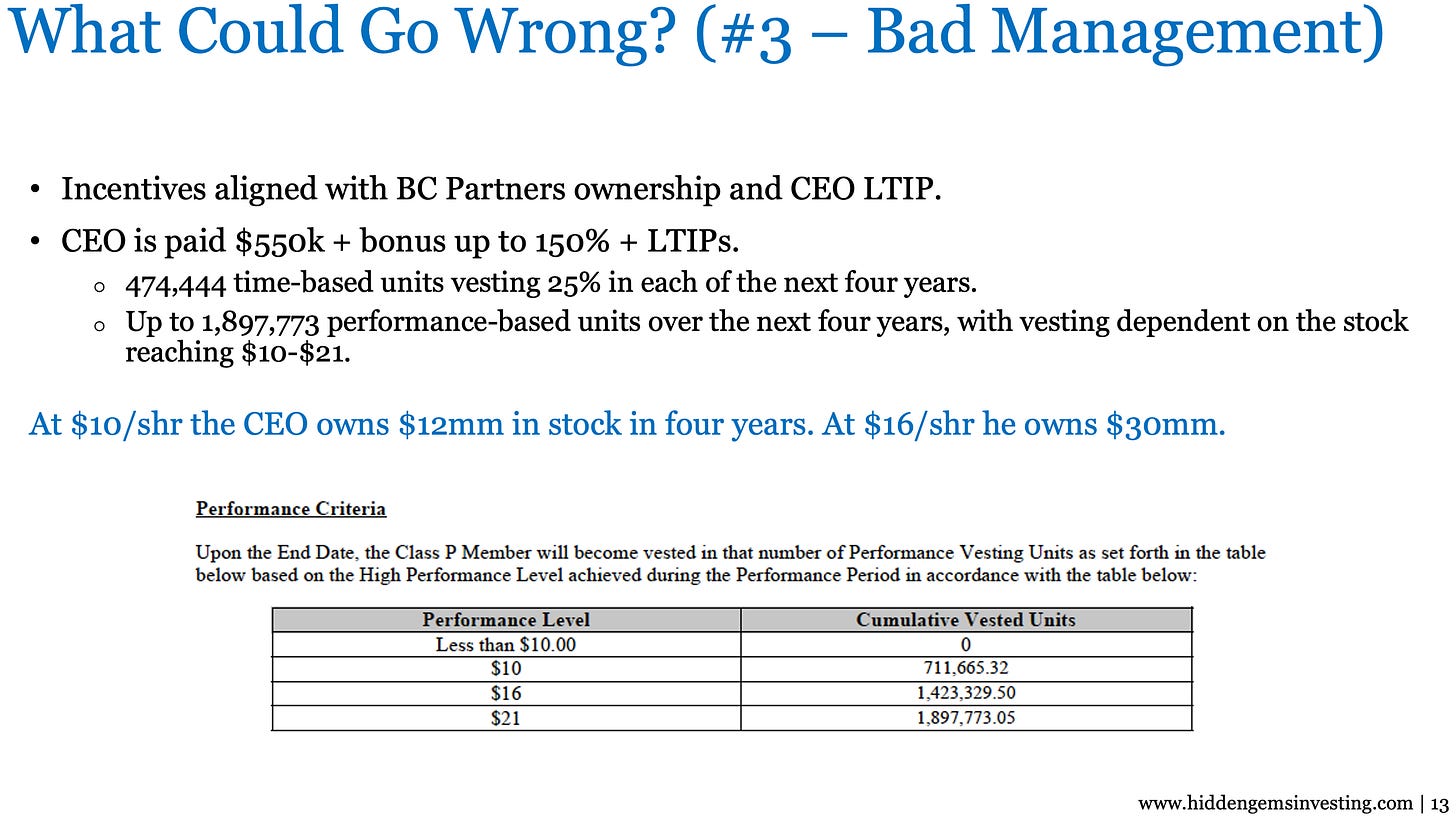

Management incentives are very aligned.

BC Partners own 40% of the diluted shares and so will get paid for more through the stock doing well than the interest they are making on the convertible debt.

The CEO is also extremely incentivized by the stock.

He makes $550k in base salary, but gets issued equity at different share prices in four years. If the stock is below $10/shr he is issued no performance shares, at $10/shr he owns $12mm, at $16/shr he owns $30mm, and at $21/shr he owns $50mm.

Bear in mind the valuation scenarios I calculated were $10-15/shr.

These payouts are hugely meaningful to him and so clearly he is incentivized to monetize the NOLs rather than just collect the base salary, which can sometimes be a risk in these situations.

I’ve spoken with five people who have worked closely with Bajaj, Bajaj himself, and one of the BC Partners board members. Reference checks are not perfect because they tend to be positive by their nature, but I found no red flags in his history.

Bajaj has a special situation and activist background running hedge fund Altai Capital. Altai appears to have moderate rather than spectacular success since its inception, but again I don’t see any red flags given the setup at ContextLogic is simple and Bajaj is highly incentivized and aligned. I think the amount he can get paid here if the stock does well could potentially multiply his net worth.

A few technical factors also make this a particularly interesting opportunity.

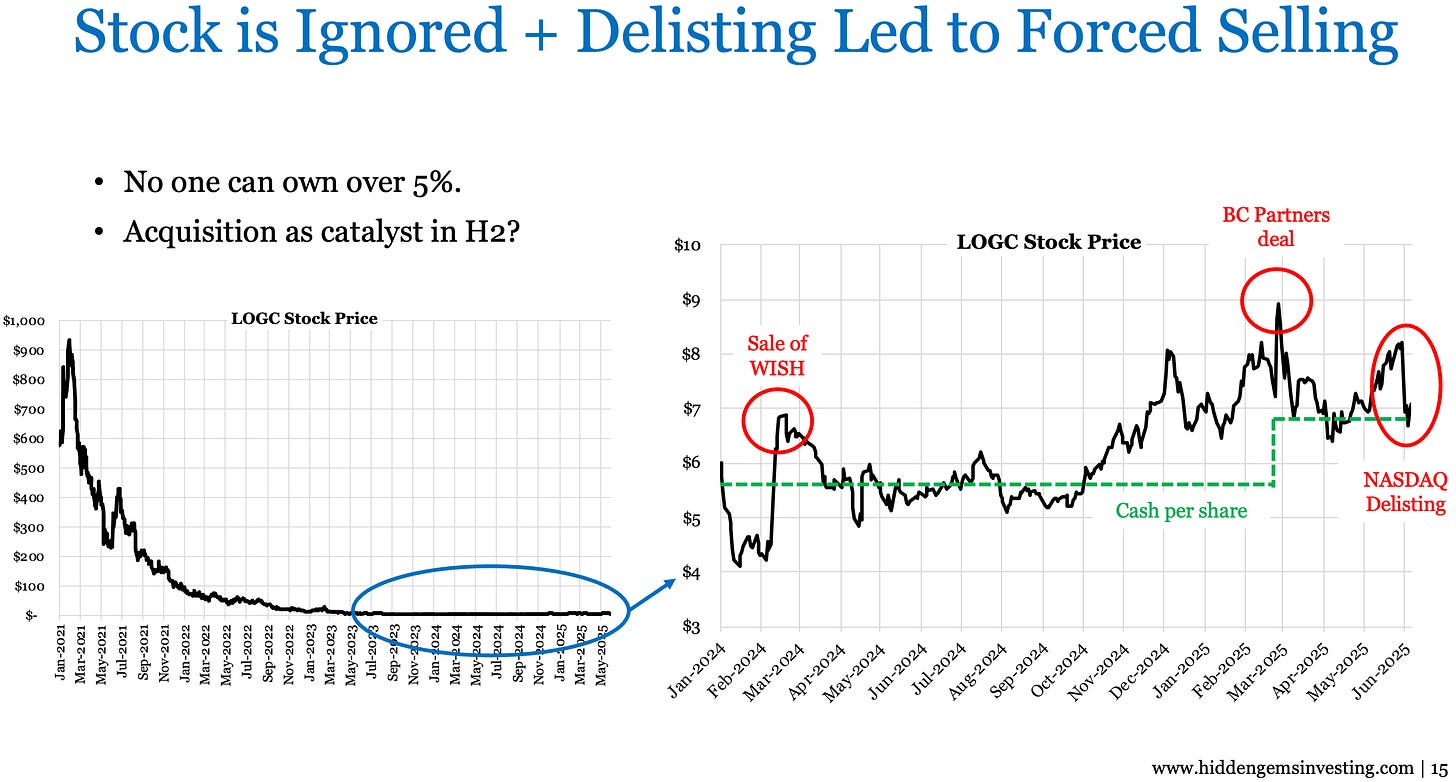

No investor can own over 5% of the stock as part of a tax preservation plan to prevent a change of control invalidating the NOLs. That is common in these situations, but means the maximum a fund could own is $7.5mm which means ContextLogic is probably only on the radar of small funds and individual investors.

The stock as Wish.com has declined 99% from its peak and now completely change business model, which makes it obscure and likely ignored.

Despite that, once Wish was sold and the company converted to ContextLogic it did eventually consistently trade above its cash value (green line above) as investors started figuring out the company has an NOL value. That culminated in the stock rising above $9/shr as BC Partners deal was announced.

That premium above cash has disappeared however in the last couple weeks following forced selling as the stock was delisted from the Nasdaq to the OTC. This caused the stock to fall 20% despite the value of the company remaining unchanged. ContextLogic will likely uplist back to the Nasdaq or NYSE once it makes an acquisition.

FAQ

I have receive a significant number of questions on ContextLogic over the last few months, and here are the ones I think are most useful for readers:

Q: When do the NOLs expire?

$1.9bn do not expire at all, while $0.9bn expire from 2030-37. Scenario #1 where ContextLogic makes just one $300mm acquisition results in some of the NOLs expiring worthless, while Scenario #2 with $1bn of acquisitions results in very few NOLs expiring.

Q: What is the ideal type of company for ContextLogic to acquire?

ContextLogic should be looking for as low a P/E as possible, and there are a few types of companies that could make sense:

A company like a bank that trades on a P/B of 1x and P/E of 6x.

A boring stable business where you could add significant debt to it as that would free up additional buying power for more acquisitions.

A serial acquirer like a TerraVest that can go make additional acquisitions on ContextLogic’s behalf.

Q: Is ContextLogic likely to buy a BC Partners portfolio company?

I initially thought this was likely as BC Partners owns a number of private companies that could go public via an acquisition from ContextLogic.

However, a deal like that would have been easy to do and so the fact it has not happened yet suggests this is not the route the company will take, possibly because of conflicts of interest.

Q: Could BC Partners dump businesses it wants to exit onto ContextLogic?

I don’t think so. BC Partners has 40% of the diluted share count so there would be a cost to them to do so, but more importantly CEO Rishi Bajaj and the board would likely block such a transaction.

Bajaj is obviously highly incentivized for the stock to do well. In addition, there are six members of the board of which two are BC Partners and the rest are Bajaj and three friends of his. So the board would likely vote 4-2 against a deal that favored BC Partners at the expense of ContextLogic shareholders.

Q: What is the risk that ContextLogic overpays for an acquisition because it is rushing to monetize the NOLs?

I think a bad acquisition is the biggest risk here, but bear in mind in a conservative $300mm acquisition scenario $3/shr or $135mm of NOL value is monetized. That means ContextLogic would have to overpay by over 30% before a deal becomes a net negative, which gives us a significant buffer.

I also think ContextLogic should not have to pay a big premium to acquire a business, because it is adding value. The acquired business will no longer have to pay taxes and so will become more valuable, and will also go public in a relatively simple and very cost effective manner.

Q: How big an acquisition is ContextLogic likely to make?

ContextLogic has $300mm in cash today and they could issue additional debt and equity. I think an initial $1bn acquisition is aggressive but the company could become a serial acquirer where they make a $300mm+ acquisition in year 1 then follow up with additional acquisitions in years 2 and 3.

I think the company has access to significant additional funding if it needs it. BC Partners clearly has the ability to provide more financing, and ContextLogic could issue more convertible debt at a significant premium to cash. The BC Partners deal was done at $8/shr for example when cash at the time was $5.7/shr.

So you could imagine ContextLogic issuing another $150mm in convertible debt at closer to $9/shr and $300mm of straight debt for $750mm in buying power today with additional acquisitions to come.

Q: How significant is the cash burn while we wait for an acquisition?

ContextLogic is currently losing about $1mm/quarter. Usually companies with NOLs are burning significantly more cash and it can take years to make an acquisition, by which point the additional cash burnt offsets the NOL value monetized.

I don’t think that will happen here. ContextLogic secured the funding it needs in February, has a well connected private equity sponsor and board, and is incentivized to do a deal. I think an acquisition is likely in the next six months, but even if it takes longer than that the additional cash burn is unlikely to materially reduce the company’s value.

The BC Partners convertible debt will likely also convert to equity on an acquisition, meaning the acquired company is not incumbered with debt in a $300mm acquisition. That’s helpful because sometimes companies can be put off by the prospect that they will have to take on substantial debt.

This article is for informational purposes only and is not investment advice. Plural Investing, LLC currently holds a position in ContextLogic. Read important disclosures here.

Thanks for your response, you dug deep once again! Very hard to pass this one. As you said, there’s also a margin of error on the acquisition. Closing a deal would validate the investment...

Thanks for the well-written article Chris, this looks rather promising. Referencing your slides, could I ask how you determined the diluted share count of 45 and 79mm for scenarios 1 and 2 (slide 8) respectively? Was it meant to factor in performance shares and potential equity dilution due to acquisitions?