Kyndryl (KD): Spin-off, Turnaround & Valuation | Deep Dive

Sold down spinoff trading on 5x future FCF

Kyndryl is a spin-off from IBM that is successfully turning itself around. The stock trades at $14/shr and we estimate will generate $2/shr to $4/shr in FCF in three years as the 40% of its contracts at 0% gross margin get renegotiated. We see upside to $20/shr to $40/shr by then in our base case, up to $60/shr in a bull case, and downside to $9/shr if we are wrong.

Spin-off and Situation Overview

Kyndryl is a leading IT infrastructure services provider that was spun out of IBM in late 2021. The company primarily manages traditional on-premise data centers and private or hybrid clouds, but also provides other IT outsourcing services such as handling applications and security.

The on-premise data center market is declining mid-single digits per annum as companies move their infrastructure to public clouds like AWS, Azure, and Google Cloud. This decline led IBM to offload Kyndryl as part of its strategy to rebrand itself as a growing and cloud-focused business. IBM initially hoped that Kyndryl would be priced at $50/shr, but had to settle for $28/shr. The stock sold off after the spin as it was 5% of IBM’s value, didn’t pay the dividend that many IBM shareholders are looking for, and was a loss making business in a declining industry that few wanted to own. The stock ended 2021 at $18/shr and bottomed in 2022 at $8/shr before rebounding to $14/shr today.

But there are several clues that suggest Kyndryl will be able to turn itself around as a standalone company. CEO Martin Schroeter was an IBM-lifer who knows the business well and came out of retirement to take the job. He owns 1.2mm shares and has another 1.2mm of RSUs, PSUs, and options. The options exercise at $18/shr and PSUs vest from $24-39/shr, and we think it is unlikely that Schroeter would have come out of retirement unless he thought these targets were achievable. He has also made significant buys between $9/shr and $17/shr. We think his stock ownership is very material to his net worth and that Schroeter likely sees this as a three year job to turn the company around and potentially multiply his net worth. Other insiders have also bought shares frequently, most recently in November when the CEO, CFO, and President all bought, albeit at $9/shr.

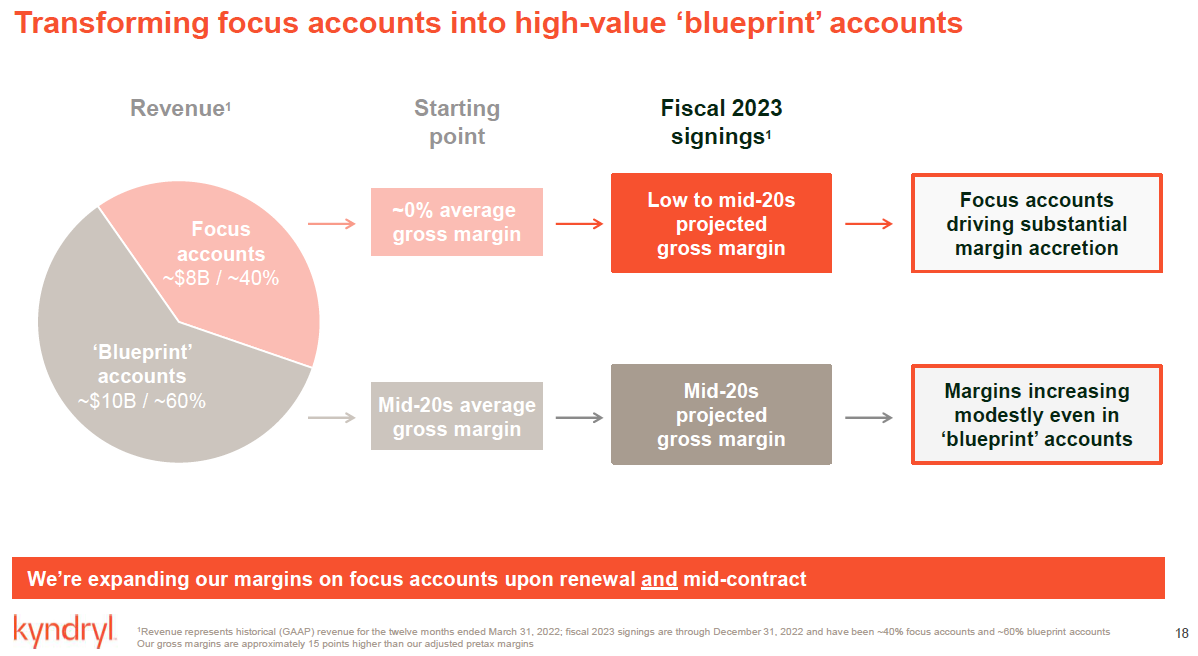

There are some easy wins for Kyndryl now that it is a standalone company. 40% of its contracts currently earn 0% gross margins (!) as IBM often bundled these in with higher software margin services to fuel growth in areas management thought would benefit its stock price. Kyndryl can also now offer services that compete with IBM, such as helping clients move to AWS or Azure. Finally, IBM has a famously bureaucratic cost structure and culture which Kyndryl has taken steps to address. It’s sales per employee is much higher than competitors, suggesting greater profit potential if it can reduce costs.

We believe these steps give Kyndryl a path to $2/shr to $4/shr in FCF in three years, and the company’s results a few weeks ago (where it raised medium term gross margin guidance) suggests it is executing well. At a 10x multiple implies a valuation of $20/shr to $40/shr. The stock trades at $14/shr today.

Turnaround and Gross Margin Opportunity

Kyndryl has various opportunities as a standalone company, but what matters most for an investment to work is that the company succeeds in increasing gross margins from 12% in FY22 to 20% or more. On $17bn in revenue an additional 8ppts in gross margin equates to $1.36bn or $6/shr. Obviously, this is an oversimplification as not everything drops through to FCF and revenues may keep declining, but the point is that if Kyndryl can raise gross margins achieving $2/shr to $4/shr in FCF is relatively straightforward.

The key slide in Kyndryl’s presentation is the one below, which states that 60% of contracts are earning mid-20s gross margins, while 40% are earning 0%. Our conversations with ex-IBM employees suggests that management’s story checks out.

These contracts are typically 3-5 years long with Global 500 companies, highly complex with cost-plus calculations based on man hours, servers, software, and other requirements, and are often over $100mm in size. While there is a competitive RFP process when contracts come up for renewal there is also significant stickiness as changing IT infrastructure providers is disruptive and costly.

Poor margins across the industry became common as a result of mismanagement at IBM and other competitors and in response to pressure as companies moved to public clouds.

The three largest companies in this industry are Kyndryl ($17bn in revenues), DXC ($8bn), and Atos ($6bn), all of which have recently been forced to become more rational. In Kyndryl’s case that is because it is now a standalone public company that can no longer rely on funding from IBM or is incentive to bundle services in at cost, while Atos is going through a similar spin-off and is heavily loss making. DXC’s CEO and CFO changed a couple years ago and the company embarked on a similar strategy to Kyndryl and are further along in the process.

There are also reasons why not every client will move all data storage away from on-premise data centers. For example, half of Kyndryl’s customers are financial services companies holding sensitive data, and those companies are often resistant to move that data to public clouds for regulatory and security reasons. In addition, cloud storage can be more expensive for data that is used frequently as cloud providers typically charge customers per retrieval of that data.

For these reasons, the IT infrastructure industry is rationalizing, and that is allowing Kyndryl to renegotiate its contracts as they come up for renewal.

And that plan is working.

Gross margins have increased from 11.2% in FY21 and 12.2% in FY22 to 14.2%, 13.5%, and 16.4% in the quarters YTD. Even more impressively, management raised guidance to suggest that low/mid 20s margins are achievable on the previously 0% margin accounts, while modest margin improvements are possible even on the 60% of contracts that were already at that level.

Economics & Valuation

Kyndryl heavily adjusts earnings and so we value it on FCF/shr, effectively expensing up-front costs deferred across the estimated length of a client relationship. We calculate FCF as OCF before WC - SBC - deferred costs - capex. This calculation suggests gross margin improvements are dropping through, with FCF improving from $-4.3/shr in FY22 to $-0.6/shr in FY23.

Management has also outlined an additional $1.5bn in margin improvement opportunities, which we are relatively skeptical of as some of them involve new services in areas that are highly competitive. These are:

$600mm in automation and not replacing staff attrition

$400mm in advisory services

$300mm in spin costs rolling off

$200mm in higher margin hyperscaler services

Offset against that are $600mm in higher costs from IBM charging for services. Overall, we expect the company to achieve a net $200mm in margin improvement from these various factors.

Our estimates for FY26 are:

We value the company at 10x for a $35/shr price target in three years. That compares to DXC at 10x today (albeit half of DXC’s business is higher quality) and IBM at 15x. We expect that the turnaround in Kyndryl’s earnings will act as the catalyst for the stock, like it has been over the last few weeks.

Just as importantly, we think the recent results makes us more comfortable with the downside. Up until recent results we were invested in the LEAPs but not the equity as we thought we could see the upside case, but that if the turnaround failed Kyndryl could remain a cash burning business in a declining industry, leading to potentially substantial downside for the equity. With the business now clearly demonstrating improving FCF and management guidance suggesting this trend will continue to at least some extent, we think a downside scenario still sees gross margins for blueprint accounts at 22% and for focus accounts at 13%, for a blended 18.4%. Even if cash opex as a % of sales remains at the current 15.6% level that implies $364mm in FCF on a lower $13bn of revenue, or $1.6/shr. A conversative 6x multiple for a declining business still implies a valuation of $9.6/shr, before accounting for roughly $2/shr in FCF we expect would be generated in the interim and used to pay down debt.

On the other hand, it’s not hard to see a Bull case where some of our assumptions prove conservative, particularly around a 6% pa revenue decline or the various initiatives management have outlined that we have given relatively little credit to. If some of these growth initiatives are a success the company could continue to see positive revenue growth (cc growth was +3% and +1% in the last two quarters), the stock could move up to a 12x or even 15x multiple on $4+ of FCF. Our gross margin improvement of 450bps over the next three years also doesn’t seem aggressive given gross margins have improved 450bps over the last 12 months, and management’s guidance.

Finally, there are some additional risks worth mentioning.

The company has $3bn of debt and $1.9bn of cash with a BBB- rating and stable outlook. It is important for Kyndryl to remain investment grade as some large customers are likely to leave if that changes. Losing its investment grade rating is one of several reasons why Atos expects its core infrastructure business to decline by ⅔ from 2022 to 2024. Obviously, IBM understood this at the spin-off which is why Kyndryl has $1.9bn of cash, but it will be important that the turnaround continues at least to the point where the company stops burning cash. We expect that FCF will be allocated initially to debt repayments, similar to DXC in the last couple of years.

Kyndryl has a book/bill of 0.7x on a trailing 12 month basis and management said they were going to stop reporting bookings after FQ2 as salespeople are now incentivized through gross profits, which caused the stock to decline. They also claim that the book/bill is low because contracts are getting shorter, which to be fair is supported by the fact that remaining performance obligations within two years are only down 7% y/y on a cc basis. Kyndryl’s newer consultancy services do tend to be project based and so have shorter contracts, typically measured in months rather than years, but we are skeptical that this explains the entire different between positive organic growth and negative bookings. There is also some deliberate churn as the company reduces work with customers hesitant to accept high margin contracts or who prefer to buy some services from IBM directly. Finally, like with many spin-offs there is some initial churn from customers, which is exacerbated in this case by Kyndryl losing the IBM brand. Still, it will be important to monitor whether these factors are indeed temporary.