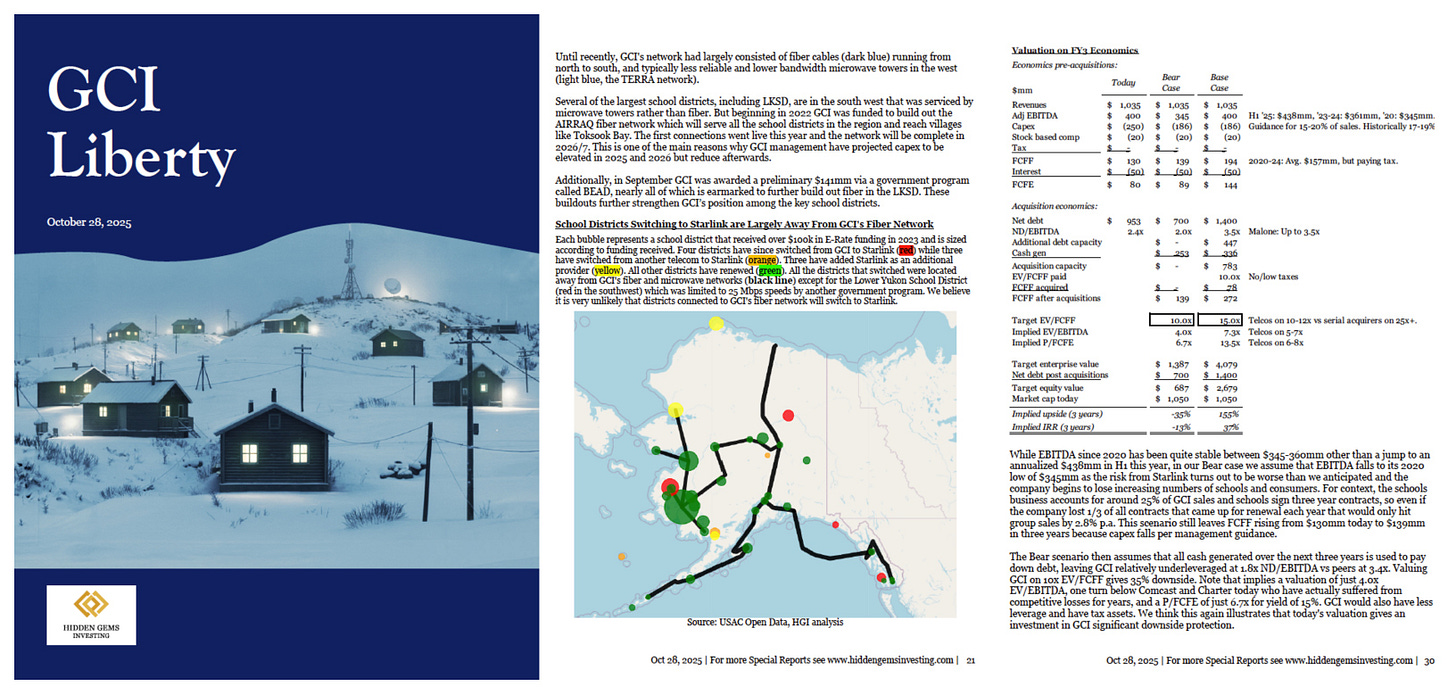

Updates: GCI Liberty, Watches of Switzerland, ContextLogic, Macfarlane (GLIBA, WOSG, LOGC, MACF)

Why John Malone is focusing on GCI Liberty, and latest analysis on results

Make sure you’ve read the latest Special Report on GCI Liberty (GLIBA).

See the Table of Contents for a list of all published articles, grouped by stock.

Hidden Gems Investing will be raising prices at the end of this year, but any subscription made before then locks in today’s rate for life. Most of our reports require well over 100 hours of work and thousands of dollars in research expenses. A subscription gives you all of that for just $347/year, saving you enormous time and cost. Join the over 5,400 free subscribers and 280 paid subscribers who have upgraded in the 11 months since the newsletter was launched, or go here to learn about what you can expect as a paid subscriber:

GCI Liberty (GLIBA)

Shortly after the Special Report was published, the FT and WSJ reported that John Malone would be stepping down as Chairman at Liberty Media and Liberty Global, but seemingly remaining at GCI Liberty. From the FT:

John Malone is stepping down as chair of his media and telecoms empire, marking the end of an era in which the “cable cowboy” reshaped both industries over the course of 50 years of dealmaking. Malone, 84, is relinquishing his full-time board role at Formula 1 owner Liberty Media and at Liberty Global, the group behind telecoms operator Virgin Media O2…

… He told the FT in August that he expected to end up directly controlling just two businesses, including an Alaskan communications group that he said “could be a vehicle to do something with”.

From the FT article in August:

“Everything will be spun off, and then let’s see what new things we can create,” Malone said, adding that GCI — an Alaska-based telecoms company in which he will retain a shareholding — “perhaps could be a vehicle to do something with”.

I think Malone choosing to stay at GCI when he is stepping back from his other companies would be a significant positive if true, which appears likely given the reporting and the fact he has bought stock on multiple occasions since the spin. It is a signal that he sees a significant opportunity to use GCI’s cash cow business, underleverage, and tax shields to build the advantaged acquirer outlined in the writeup.

We will learn more about the vision when GCI reports Q3 results on Wednesday.

I think the company could surprise positively on EBITDA but negatively on revenues. Revenue growth was +7% in H1, driven by Business Data growth of +14%. That was largely the result of GCI’s E-Rate government subsidies for schools jumping 63% from fiscal 2023 to fiscal 2024 to fund the build out of new fiber infrastructure in Western Alaska. Since the fiscal year runs from July-June that translated into a boost in H2 2024 and H1 2025 revenues.

Q3 2025 will be the first time GCI comps against those elevated levels and since fiscal 2025 E-Rate funding was still elevated but down 4% y/y, Q3 revenues should be similarly down low single-digits.

On the other hand, GCI was preliminarily awarded $141mm in BEAD funding in late September, which investors seem to have missed given the stock did not react when it was announced on the Alaska Broadband Office’s website. I expect management to call that out.

Finally, EBITDA margins averaged 41% in H1, up from 35% in H2 last year, I believe driven by the elevated E-Rate funding. If margins are 41% in Q3 that will drive 12% EBITDA growth to $103mm even with revenues down 4%.

Some other positives on future EBITDA guidance could come from the loss-making video business being shut in Q3, and technology savings management have touched upon a couple of times on the pre-spin call without quantifying.

Watches of Switzerland (WOSG.L)

Special Report, Notes from the trade show, Podcast

Watches of Switzerland will release a trading update on November 6.