TerraVest Industries (TVK): 2026 Outlook and Valuation

January updates on TVK, SEG, JDG

Make sure you’ve read the latest Special Report on GCI Liberty (GLIBK) and the update on why Malone is doing a rights offering.

Expect an update on Watches of Switzerland next week.

See the Table of Contents for a list of all published articles, grouped by stock.

Hidden Gems Investing has reached over 6,400 free subscribers and 300 paid members in the 13 months since the newsletter was launched. Thank you. Most of our reports require well over 100 hours of work and thousands of dollars in research expenses. A subscription gives you all of that for just $397/year, saving you enormous time and cost and protecting you from future price rises. Join our members by upgrading below, or go here to learn about what you can expect as a paid subscriber:

TerraVest (TVK.TO)

Special Report, Update & trade show, Podcast

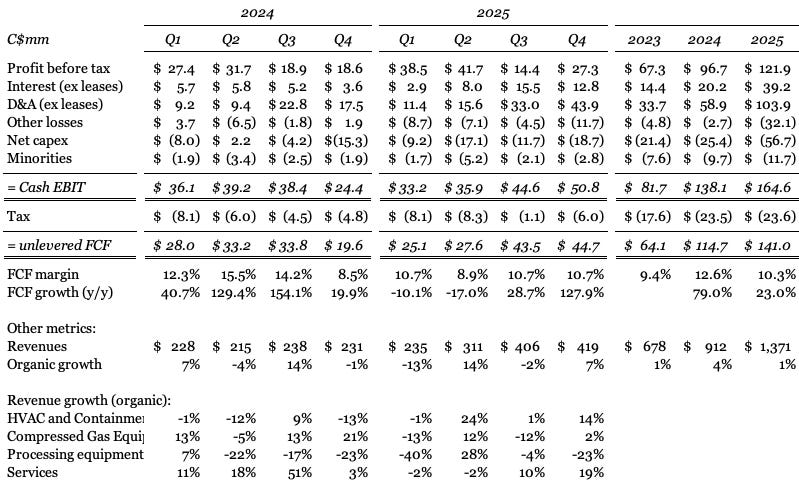

TerraVest reported a strong set of fiscal Q4 results on December 11. Organic revenue growth was 7%, with FCF growing 128% in absolute terms driven by the acquisition of EnTrans and others.

Organic revenue growth for the year was 1% and has averaged 2% over the last three years. That is lower than CPI inflation of 3.2% and RPI of 5.7% over the three years, as some of TerraVest’s traditional businesses continued to decline and the company faced headwinds with a slowdown in the US trailer market which has particularly impacted EnTrans, tariffs, and lower oil prices that have affected Western Canada.

These headwinds have been offset by strong growth in the Services business and TerraVest entering new verticals like serving datacenter customers. Those new markets have led to some investor excitement, but I think it is worth re-emphasizing that organic growth has averaged below inflation for three years.

These trends continued to play out in the quarter:

HVAC: +14% organic growth, against an easy comp of -13% last year. Driven by growth in demand for cooling tanks from data centers, which has resulted in a very long order book at Highland Tank and Simplex. Some of Highland Tank’s orders are being completed by TerraVest’s other subsidiaries.

Compressed gas: +2%. Higher sales for domestic tanks were offset by weaker demand in Western Canada and a continued slowdown for tank trailers and EnTrans. My estimate is that EnTrans’ EBITDA is currently annualizing around C$90mm, down from C$100mm in 2024 and C$130mm in 2023 (calculated using current USD/CAD rates).

Processing equipment: -23%. Continues to be hit by reduced demand in Western Canada.

Services: +19%. The organic growth number included the acquisition of Aureus which has been fully integrated and added to growth. The strength of the Services business over the last two years has significantly exceeded my expectations, and boosted profitability given the segment is higher margin.

The outlook statement was virtually identical to the previous quarter (the only change in bold):

“In general, TerraVest’s portfolio of businesses is performing well. Recent acquisitions have made a meaningful contribution and we expect this to continue throughout the next fiscal year. Opportunities to enhance performance through synergies between recent acquisitions and the base portfolio of businesses continue to exist and are a focus for management.

Recent tariff announcements have created an environment of uncertainty in North America’s manufacturing sector. This uncertainty has resulted in softer demand recently for a few of TerraVest’s businesses. However, TerraVest’s portfolio businesses are well-positioned manufacturing products predominantly for their domestic markets, which greatly limits the impacts of any potential tariffs.

The Company continues to make targeted investments to improve its manufacturing efficiency and expand its product lines, particularly in end-markets where it has a meaningful presence. With the new credit facility obtained in March 2025, TerraVest is very well-positioned to pursue its acquisition strategy.”

With FCF margins down to 10% in 2025 after a strong 2024 and a balance of headwinds and tailwinds facing the company, I think TerraVest heads into 2026 with financials back reflecting the underlying earnings power of C$175mm I estimated in Is TerraVest still cheap?. Unlevered FCF in H2 was C$176mm on an annualized basis.

Last week, the company announced the acquisition of KBK Industries for US$90mm / C$125mm and 5.6x EBITDA. KBK is a manufacturer of steel and fiberglass storage tanks based in Texas, and one of its key markets is underground fiberglass storage tanks for convenience stores. The convenience store market is growing at high single-digit / low double-digit rates, driven by strong ROICs companies are seeing from opening new stores and fiberglass taking share from steel as it lasts 30 years instead of 10.

It will be interesting to see if TerraVest can help KBK take share, as the market is currently dominated by NOV (ticker: NOV) and Mattr’s Xerxes (ticker: MATR). I have spoken with NOV and Xerxes at trade shows and both currently view the market as largely a duopoly with regulatory and reputational barriers to scale (customers have to believe the tanks will last 30 years).

Post the KBK acquisition, I estimate TerraVest is trading on 24x EV/FCF.

At first glance that appears to be not far off fair value, but I believe a better way to value a serial acquirer is to look out three years and estimate how much acquisition capacity the company has and what earnings power could be following future acquisitions and synergies.

Here are my latest estimates: