XPEL: Update from the Dealer Conference

Deep dive on manufacturing build-out and growth runway

I was in San Antonio, Texas, recently for XPEL’s Dealer Conference (‘XDC’). The conference was attended by 725 of XPEL’s top installers, making it the company’s biggest event ever. I spoke with many of the installers to get their views on XPEL’s manufacturing plans and growth runway.

The stock has risen from $32 in March 2025 when I published a Special Report on the company to $55 today, but I think can double again over the next three years.

If you are interested in more background, take a look at the 35 page Special Report. I believe XPEL is a great company with an excellent owner/operator that is now coming through a blip. The report was based on 54 interviews and covers XPEL’s:

Economics and competitive advantages

Growth runway

Difficult cyclical conditions

Governance

Valuation

Hidden Gems Investing has reached over 6,500 free subscribers and 300 paid members in the 14 months since the newsletter was launched. Thank you. Most of our reports require well over 100 hours of work and thousands of dollars in research expenses. A subscription gives you all of that for just $397/year, saving you enormous time and cost and protecting you from future price rises. Join our members by upgrading below, or go here to learn about what you can expect as a paid subscriber:

Manufacturing Build-out

At its Q3 results, XPEL announced that it will invest heavily in manufacturing. This is expected to:

Require $75-$150mm over 2 years via capex, M&A, and/or JVs

Increase gross margins by 10ppts to 52-54% and EBIT margins to mid/high 20s% by the end of 2028

My experience is that the base rates of companies achieving transformational changes on time and on budget are low, but I believe that XPEL’s plans are plausible.

XPEL’s manufacturing goals are mostly centered around cost reduction and margin improvement, but there was some evidence from XDC that installers would see minor benefits also.

CEO Ryan Pape’s keynote speech focused on deepening the quality of the company’s existing products, and the insourcing of manufacturing should allow the company to speed up the innovation of new films by months and improve quality.

That is partly because the incentives for XPEL are different to its manufacturers. It makes sense for XPEL to increase the amount of waste/discarded PPF at the manufacturing stage if that results in less work being redone by its installers down the line, as the cost to installers and XPEL is much greater than the cost to the manufacturer.

When I asked installers about XPEL’s plans, they were optimistic that this would ensure the company had the best quality films. They did admit though that most major film brands are already similar on quality and were unsure if much innovation was possible.

The Acquisition Route

My assumption is that XPEL’s manufacturing buildout will only address:

The US market (56% of sales)

Product COGS (82% of COGS)

TPU and coatings but not every process and product (80% of product COGS)

That means the company’s plans address 56% x 82% x 80% = 37% of COGS.

With XPEL likely to have generated $480mm in sales and $280mm in COGS in 2025, that translates to about $100mm in COGS.

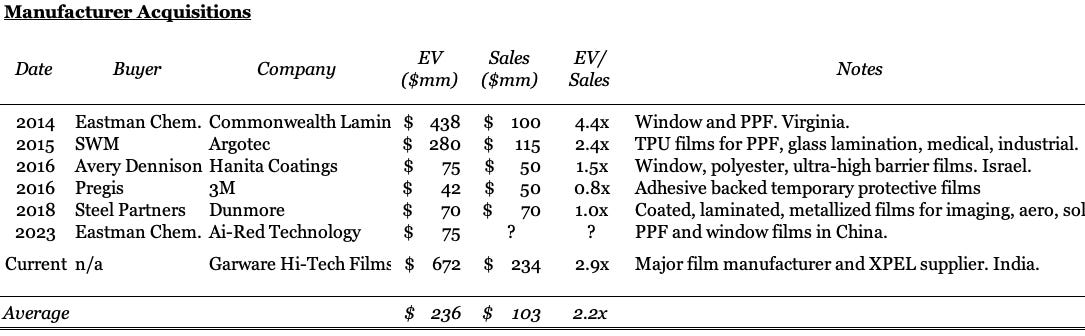

If XPEL were to acquire a manufacturer for $150mm, the top end of management’s guidance, that would imply an EV/S ratio of 1.5x. That is a lower multiple than most acquisition multiples in the industry over the last decade, but not unheard of.

The Capex Route

I spoke to ex-employees from XPEL’s suppliers recently to better understand the challenges involved in the company building out its film manufacturing from scratch.

All of them felt XPEL was in a good position to in-source its supply chain, but there was still significant execution risk.

PPF typically has three layers:

TPU (urethane) - this is the vast majority of the film by cost and volume

Adhesive - glue beneath the TPU that sticks it to the vehicle

Clear coat - on top of the TPU for scratch resistance.

The hardest and most important part of this process for XPEL will be making its own TPU. This involves buying resin from large chemicals companies and using an extruder to turn the resin into film that consistently has the correct clarity, thickness, stretch, etc. without tiny defects.

The people I spoke to thought building this process out and perfecting it would take at least three years, meaning XPEL’s end of 2028 target appears ambitious.

Buying the equipment is unlikely to be the hard part. There are major equipment suppliers like Davis-Standard and Midwest Engineering that know XPEL well.

This equipment can also be customized. For example, the machines that handle coating and lamination often have cartridges that can be pulled out and replaced. Similarly, other machines have coating heads that can be customized.

XPEL will also benefit from all new equipment, which makes customization easier - its key supplier Entrotech has an old production line that has limited its ability to retrofit pieces and improve quality.

The hardest part for XPEL is likely to be staffing.

Running the three lines (TPU, adhesive, lamination) will likely require four people per line for three shifts a day, or 36 people in total before staff for warehousing and material handling.

While the employees will not be anywhere near as expensive as the equipment, they will be essential to the lines running effectively and on time. I believe that whether XPEL can bring the right people on board who have run these lines before will be the key determinant of whether its manufacturing buildout is successful.

One negative XPEL has is that if its plant is built near San Antonio that will make it harder to hire more than a few former employees from Entrotech, which is based in Ohio.

However, the company has got off to a good start. I met XPEL’s Director of Manufacturing Greg Booth at XPEL’s Investor Open House in 2023. Booth was previously Director of Film Technologies at Entrotech and the people I spoke to recently said he is exactly the type of person who has the right knowledge and knows who to contact.

XPEL already has a team of engineers that go on site with its suppliers, do some R&D, and test the products. If management does go down the capex-only route this will have been the result of years of planning and recruitment, which I think reduces the execution risk.

These tables lay out what I think XPEL’s economics look like once it insources its production: