Judges Scientific (JDG): The Recovery Begins?

And update on Watches of Switzerland's acquisition

Make sure you’ve read the 2026 outlooks for TerraVest and Watches of Switzerland.

Expect an update from XPEL’s Dealer Conference next week.

See the Table of Contents for a list of all published articles, grouped by stock.

Hidden Gems Investing has reached over 6,600 free subscribers and 300 paid members in the 14 months since the newsletter was launched. Thank you. Most of our reports require well over 100 hours of work and thousands of dollars in research expenses. A subscription gives you all of that for just $397/year, saving you enormous time and cost and protecting you from future price rises. Join our members by upgrading below, or go here to learn about what you can expect as a paid subscriber:

Judges Scientific (JDG.L)

Judges released a brief but tough trading statement on January 23rd:

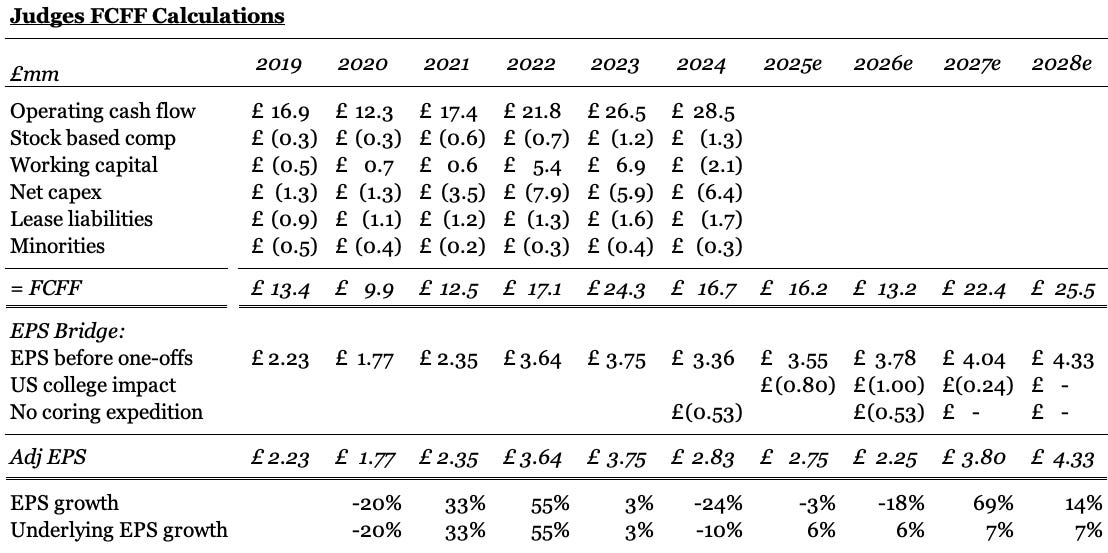

2025 EPS guidance cut from previous consensus of 289p to 275p (-4.8%).

Order book ex coring -6% for the full year, with the US -23%.

No recovery so far in the US.

No coring expedition likely until early 2027.

2026 EPS guidance of 200-250p, -18.2% at the mid-point. Guidance assumes no recovery in the US throughout 2026.

These results look very tough at face value, but as I wrote last month I expect the trading statement to mark the low point of the cycle and for a recovery to begin from here. I added to my position significantly post results.

I continue to view Judges as a great business with an excellent management team who as outlined in the Special Report have a 20 year track record of delivering 20%+ returns on incremental capital. The company has had a difficult couple of years, primarily for macro reasons, and I believe investors have been too quick to dismiss the previous track record.

I estimate the stock is trading on 13.8x underlying earnings power today, or 9.6x EPS in three years before acquisitions are taken into account.

Underlying Earnings Power

Despite guiding to adj EPS in 2026 of 200-250p, I believe the same guidance implies that Judges’ underlying earnings power is £3.78/shr.

There are two effects that I think are one-offs and impacting earnings in 2026:

No coring expedition (53p headwind)

Dramatically lower US college spending (100p headwind)

By backing these two effects out, we can see that the mid-point of 2026 guidance for 225p EPS implies 378p without the one-offs. That is 6% higher than 2025 and in line with Judges’ historic organic growth of about 7%.

I assume that over three years both of these one-offs recede and that the underlying business continues to grow at 7%, which results in EPS of 433p and £10.30/shr of cash generation in the interim.

At today’s share price of £52 that implies the stock is trading on 9.6x P/E minus excess cash in three years. Of course, Judges will likely do better than that by creating value with the cash through good acquisitions. The stock has historically traded on 25x and above.

Coring

By comparing earnings in H1 2025, which included a coring expedition, to H1 2024, which did not, I estimate a coring expedition adds about £3.5mm to EBIT or 52p to EPS.

Judges will have owned Geotek / coring for five years by the end of 2026 and in that period will have had expeditions in three years out of five.

Does that mean that these missed coring expeditions are no longer a one-off?

I have data on coring expeditions from 2002-2018 which shows 19 expeditions in 17 years. There were no expeditions in 2003, 2008 (but two in 2007), 2009, 2011 (but two in 2012), and 2014 (but three in 2015). So there were no expeditions in five out of 17 calendar years, but three of those were because of timing with multiple ones in adjacent years.

It is hard to know whether having expeditions in 3/5 years is meaningfully different to 12/17. My research suggests that there is nothing substantially worse about coring’s end markets. But even if we assume three expeditions in five years from now on, it would only lower EPS by 21p on average. That would be disappointing, but not a game-changer against my estimate of 433p in three years before acquisitions. This is one of the reasons why I believe investors are too focused on the Geotek acquisition.

US College Spending

I estimate that the decline in US academic spending was an 80p headwind in 2025, given Judges cut guidance by 38-82p in July last year when this issue became apparent then finished the year below that guidance.

Since academic spending began falling in March the full year impact, assuming no recovery in 2026, should be higher at 100p.

But I believe the recovery is about to begin.

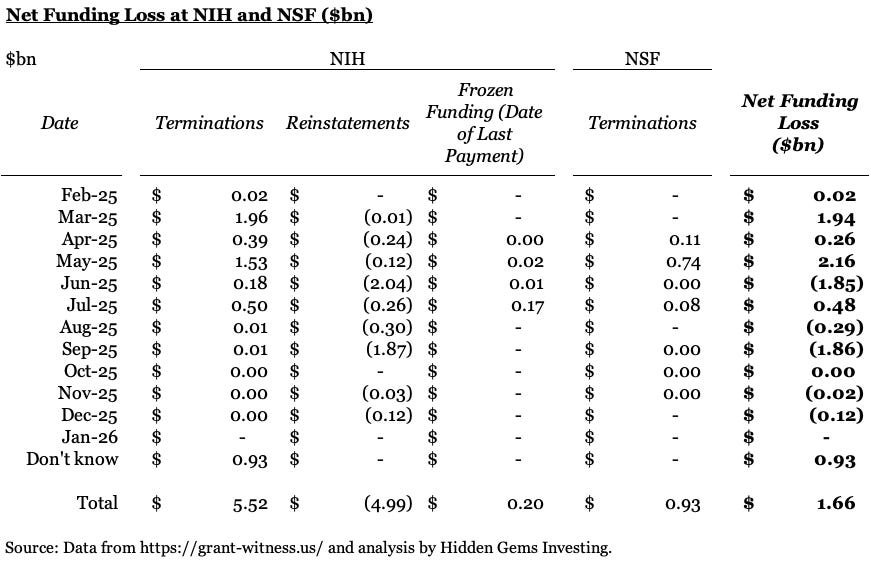

Two weeks ago, the US House of Representatives passed a major spending bill which increases the National Institute of Health’s funding by 1%. Budgets for various other institutes are also about flat y/y, not the roughly 40% cuts the President was very publicly calling for.

The bill passed the House 341-88 and there has been consistent support for scientific funding from both House and Senate committees. The bill now needs to pass the Senate to avoid another partial government shutdown. The shutdown will have likely begun by the time you read this article, but Polymarket has the odds of a shutdown over 7 days at just 14%.

In other words, we should see much greater certainty in funding for Judges’ customers soon.

That is crucial because it is primarily uncertainty that has stopped colleges from spending. While the NIH and National Science Foundation (NSF) terminated a large number of grants between March and July last year as the President asked for ~40% cuts, most of the grants were in fact restored by September and there have been no material cuts since.

Customers have halted spending because of the rhetoric and fear of future cuts, which the House’s bill should begin to draw a line under.

As Thermo Fisher, a major seller of scientific instruments, said last week: