Updates: Judges Scientific, Jet2, Watches of Switzerland (JDG, JET2, WOSG)

Latest analysis on results and tariffs affecting Jet2, Judges Scientific, and Watches of Switzerland.

Latest articles: Updated Report on Seaport Entertainment (SEG) and XPEL & Tesla - A Roadmap for Growth?

See the Table of Contents for a list of all published articles, grouped by stock.

Expect a writeup on a new idea later this month.

Hidden Gems Investing will be raising prices at the end of this year, but any subscription made before then locks in today’s rate for life. Most of our reports require over 100 hours of research and thousands of dollars in research expenses. A subscription gives you all that work for just $347/year, saving you enormous time and cost. Join the over 5,000 free subscribers and 270 paid subscribers who have upgraded in the ten months since the newsletter was launched, or go here to learn about what you can expect as a paid subscriber:

Watches of Switzerland (WOSG.L)

Special Report, Notes from the trade show, Podcast

Watches of Switzerland released a trading update on September 3 that was positive across the board.

“We are pleased with our performance in the 18 weeks to 31 August 2025 and are on track to deliver a good H1 FY26 in line with our expectations. We have seen consistently strong trading throughout the period, particularly in the US despite the announcement of increased tariffs on Swiss imports. The stability we saw in the UK luxury watch and jewellery markets during H2 FY25 has continued, and we have delivered good year on year growth. Registration of Interest lists continue to grow in both markets.”

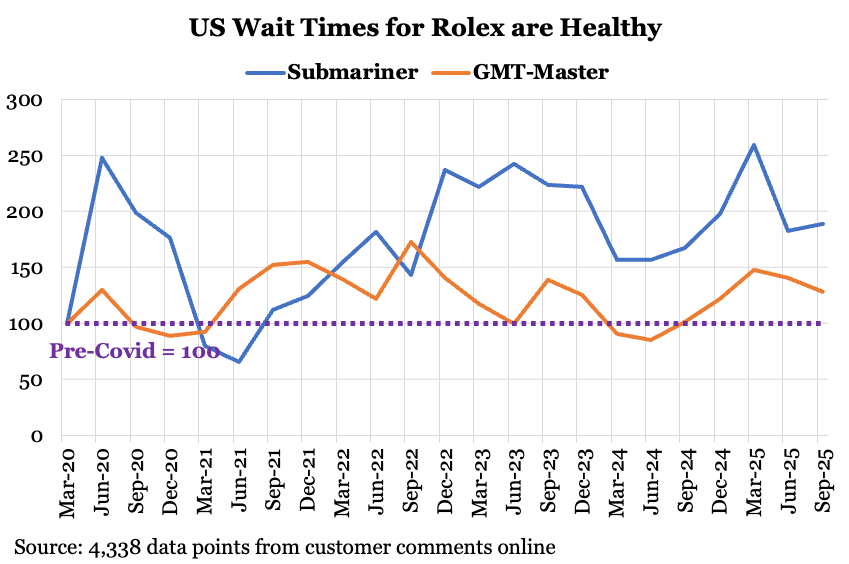

This matches my data, which continues to suggest that waiting lists for Rolex remain healthy in the US (there is not enough data to meaningfully track UK wait times):

Watches of Switzerland also provided this outlook:

“We do not anticipate any material impact from the US tariffs in H1 FY26 as brand partners have increased inventories as shown by Swiss Watch Exports in July 2025 (+45% vs prior year). We will provide a further update as to any potential impact on FY26 guidance, if any, once more information is available.”

The Swiss watch export data the company cites shows that the value of exports to the US is +19.5% cumulatively YTD through the end of August. This suggests that pre-39% tariff inventories are unlikely to run out until towards the end of the year.

However, we are now beginning to see watch brands raise prices in the US and cut retailer margins. Patek Phillipe has raised US prices by 15%, while most major brands are raising prices by 6-10% and cutting retailer margins.

That is unsurprising and I expect will hurt Watches of Switzerland’s margins vs their full year guidance, which assumed a US tariff of 10% and corresponding margins from watch brands.

But with the stock trading at 9x FCF I believe some reduction in guidance is already priced in, and the question is whether tariffs remain at 39% and how the brands react.

You can see the full mechanics of how tariffs impact the brands and retailers in my analysis from attending Watches & Wonders, but to simplify I believe roughly speaking, an X% tariff reduces Watches of Switzerland’s group profits by 0.5* X%.

For instance, the company’s guidance assumes a 10% tariff. If the current 39% remains, that is an additional 29% which I think would reduce group profits by another 15%. If tariffs are reduced to 20%, that would be an additional 10% or an extra 5% hit to profits.

I believe the current price rises by the watch brands are assuming that tariffs are eventually reduced to around 20%. Watches of Switzerland earns a roughly 40% gross margin from most non-Rolex/Patek brands, meaning a watch that retails for $10,000 incurs $6,000 of COGs and $4,000 of gross profit. A 6% rise in retail prices to $10,600 and 10% rise in wholesale prices (paid to the brand) to $6,600 still leaves the same $4,000 of gross profit to Watches of Switzerland even though margins are reduced in percentage terms.

Since most brands already adjusted for the initial 10% tariff in April or May, this suggests that they have just adjusted for another 10% rise for a cumulative 20% tariff.

Note this example is a simplification and I expect Watches of Switzerland will take some margin hit in $ terms too, but the point is if the ‘final’ tariff comes down to 20% then I think most of the knock-on effects are already priced in by the industry and investors.

I have no special insight into when and whether a tariff reduction will be announced, but Howard Lutnick did say in early September that “We’ll probably get a deal done with Switzerland.”

Judges Scientific (JDG.L)

Judges reported H1 results on September 18 that were in line with the trading statement in July:

Revenues = £70.2mm, +15% y/y.

Organic growth: +7% at group level, -18% in North America, China +12%, EU +5%, UK +1%, ROW +41%.

EBIT = £8.4mm (+17% y/y)

Adj EBIT = £14.3mm (+16% y/y). This adds back £4.9mm of acquisition amortization and £0.9mm of stock-based comp.

Order intake:

North America -18%, China +120%, EU +7%, UK -7%, ROW +2%.

While these headline numbers were strong, bear in mind the growth in revenues and profits was entirely driven by a coring expedition taking place in H1 the year vs none last year. Profitability was down excluding coring, primarily because of the weak academic environment in the US. That should continue in H2 and is factored into full year EPS guidance of £2.9, meaning Judges is under-earning right now.

There were a couple of other positives. First, China has been a drag on growth for a couple of years and management said it was “back to normal”, although they noted that in the long run Chinese customers will increasingly buy from local producers. CEO David Cicurel said this meant the Chinese market would no longer be a source of “super growth”.

Secondly, Cicurel stated that the addition of Rik Armitage as Head of M&A should “increase the rhythm of acquisitions”, particularly outside the UK, and that Judges has “significant firepower”. I thought this was an important point. It is very unlikely that Judges relax their valuation criteria on acquisitions, and the ability to deploy more capital at 4-6x EBIT is key to the business continuing to compound at 20%.

I do think there was one negative that has been underreported.