Seaport Entertainment (SEG): Pier 17, Tin Building & Valuation | Special Report

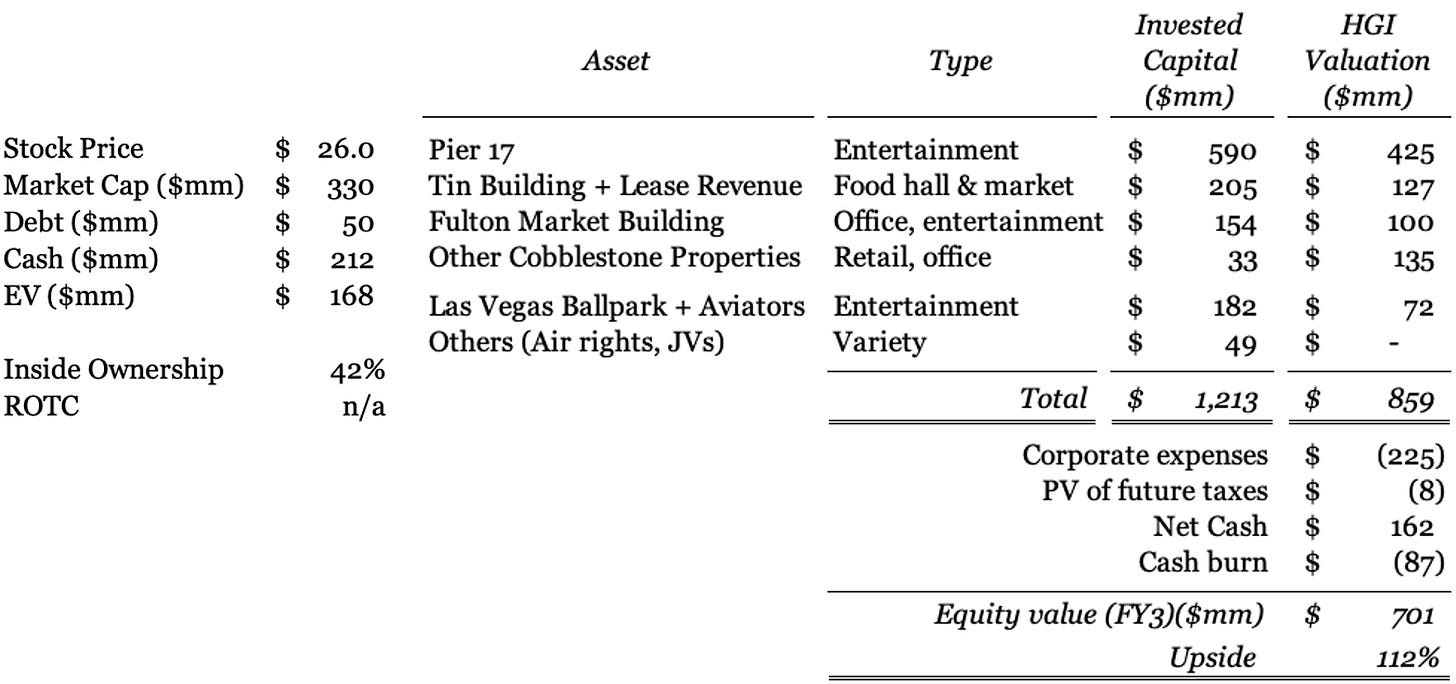

SEG stock trades at a $330mm market cap despite $162mm in net cash and $850mm of properties. This deep dive updates on valuation, business model, and new management.

This deep dive on Seaport Entertainment (SEG) is an almost entirely updated version of the one published in November 2024. If you have already read that one, skip forward to:

Why Meow Wolf and more concerts will transform Pier 17 (p.11-17)

A new section on leasing up the Cobblestones (p.18-19)

A 9-step plan to turn around the Tin Building (p.20-27)

Thoughts on the CEO change last week (p.28-32)

Valuation post the 250 Water St sale and opportunities for M&A (p.33-36)

All research on Seaport Entertainment be viewed at the Table of Contents.

Situation Overview

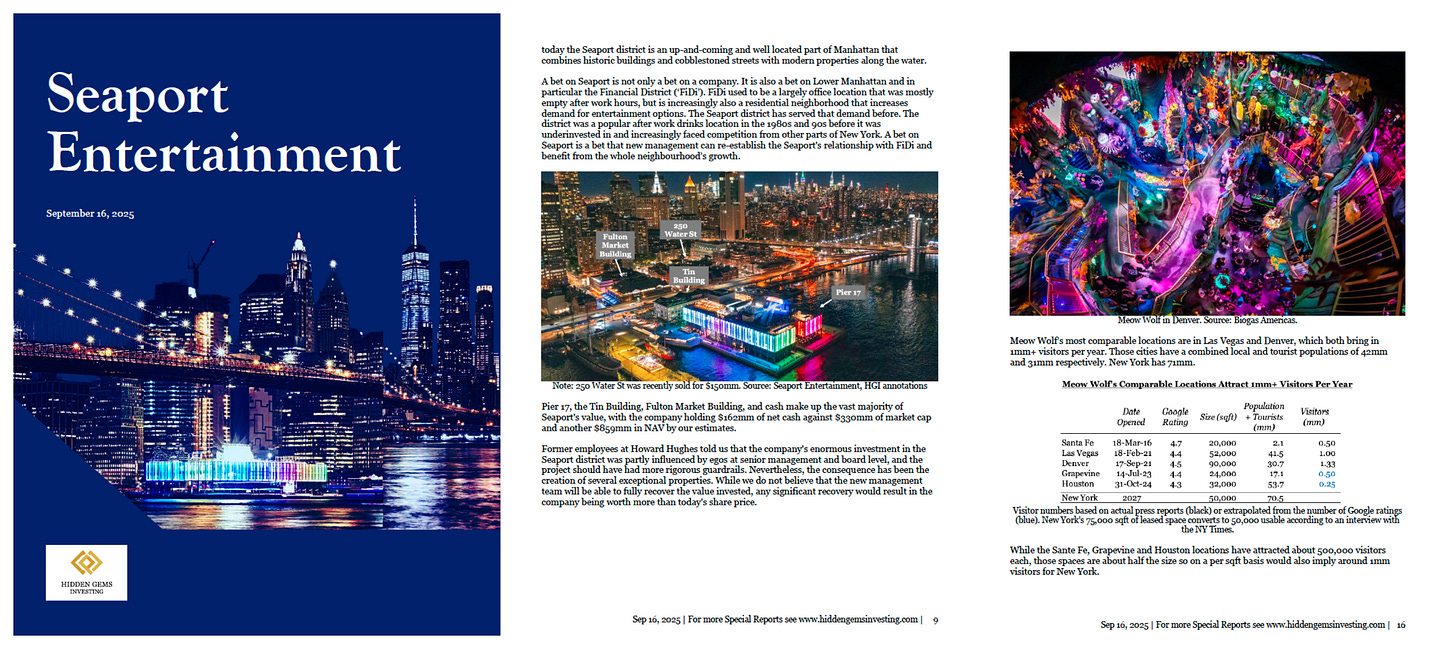

Seaport Entertainment (SEG) stock was spun out of Howard Hughes (HHH) in July 2024 and owns a complex portfolio of loss-making properties, primarily in Manhattan just 10 mins walk from Wall St. The company is ignored or put in the ‘too hard’ bucket by investors but has a market cap of $330mm vs $162mm of net cash and properties Howard Hughes spent $1.2bn on.

Execution by new management post-spin has been strong and cash burn is rapidly reducing, with Seaport targeting breakeven in 2026. One property was recently sold for $150mm.

Bill Ackman’s Pershing Square owned 38% of the company pre-spin and Ackman was Chairman of Howard Hughes for 13 years, including when the spinoff was announced. Pershing backstopped the post-spin rights offering at $25/shr and increased its stake by oversubscribing to the shares. Seaport’s new CEO moved his family to New York for the role and is largely compensated in stock.

That suggests insiders think the stock was cheap at $25 before the substantial progress Seaport has made, yet it trades at $26 today and has $13/shr of cash. We believe intrinsic value will be increasingly recognized as the company becomes FCF positive and investors shift focus towards its capacity to redeploy large amounts of capital on acquisitions and growing FCF.

Key Insights

1. Pier 17 could be worth more than the market cap and recent leases will help realize its earnings potential. The Cobblestone area next door is similarly being leased up (See p. 11-20)

2. The Tin Building food hall accounts for most of Seaport’s cash burn but management are about to redesign the building or lease it to another party. We share 9 steps to turn the building around. (See p. 20-28)

3. New CEO Matt Partridge was promoted from CFO last week and we believe is better positioned to deploy Seaport’s substantial acquisition capacity. (See p.29-36)

Research Methods

In addition to utilizing secondary sources such as company filings, transcripts, and services such as Tegus, the information in this report was gathered by speaking with primary sources. This included discussions with:

Seaport Entertainment’s CEO and former CEO

5 former employees at Howard Hughes

4 former or current employees at comparable properties in New York

10 real estate specialists in New York or Las Vegas

2 other relevant sources

Multiple visits to all of Seaport Entertainment’s properties in New York and several comparable properties in New York

We spoke with some sources more than once. Information that could reveal the identity of the sources above are redacted from this report unless sources gave their permission, apart from Seaport Entertainment’s CEO, CFO, and IR given the company is publicly traded. While Hidden Gems Investing gained many insights from these conversations, no information that was both material and non-public was shared.

We think you will enjoy this writeup more in a pdf format. Click “Download” below:

If you are a free subscriber and would like to view an example of our Special Reports before upgrading, click here to view our report on TerraVest for free.