Berkshire Hathaway's AGM (2025)

Monthly updates: JET2, XPEL, WOSG, LOGC

Don’t forget to read the recent Special Report on XPEL based on 54 interviews. XPEL is a great company going through a blip.

Read insights from Watches & Wonders in Switzerland, the watch industry’s biggest trade show.

Hidden Gems Investing has reached over 3,400 free subscribers and 190 paid subscribers in the five months since the newsletter was launched. Thank you for subscribing, and upgrade to paid to receive our best content. An annual membership is just $347 and subscribers are protected against future price rises. Go here to learn about what you can expect as a paid subscriber.

Thank you to all of you who attended the first Hidden Gems Investing meetup in Omaha last weekend. The most valuable part of the Berkshire weekend in my view are the meetups before and after the Saturday annual meeting, which are only possible because thousands of value investors descend on the same locations. I hope to see more of you in future as this newsletter keeps growing.

For those who have not been to a Berkshire Hathaway meeting before, this is what being sat in the audience is like:

And here are some of the exhibits in the hall:

This meeting will forever be remembered for the last five minutes of the Q&A, when Buffett announced he would be retiring as CEO at year-end. I filmed the standing ovation he received after he announced it:

Well deserved for an outstanding record over 65 years.

But I suspect this is not the last time we will see him on stage. Buffett announced he will be retiring as CEO, but he also holds the position of Chairman and did not announce his retirement from that position. His energy levels were high on and off stage.

On to the monthly update - Has there been any other news over the last month?

The announcement of tariffs on Liberation Day significantly impacted stocks, including those profiled by this newsletter. I expect many of the companies themselves will be largely unaffected from tariffs. As markets from move from panic to reflection, many of their stocks are now recovering.

This is how I think tariffs will impact the companies profiled by this newsletter, and several are discussed below:

Direct negative impact: TerraVest, Watches of Switzerland, XPEL

No material direct impact: Jet2, Kyndryl, Macfarlane, Seaport Entertainment

Direct positive impact: ContextLogic.

Jet2 (JET2.L)

Jet2's stock jumped 20% after a trading update on April 29. The results themselves were brief and largely in line with the February update, but investors reacted to the announcement of a £250mm buyback, equivalent to 8.5% of the pre-announcement market cap. The buyback is expected to be complete in nine months and is in addition to the company buying back all £304mm of outstanding convertible debt in March.

The two buybacks combined will eliminate around 14% of the fully diluted share count and mark a big change in capital allocation policy.

Jet2 has compounded EPS at 24% p.a. over the last decade, yet the stock has 'only' returned 15% p.a. and was trading on 6.5x P/E prior to the announcement despite having net cash, double-digit growth prospects, the best competitive position and management team in the industry, and a track record of gaining share during downturns.

At 6.5x P/E, Jet2 could theoretically buy back all its shares in 6.5 years if the stock price does not go up. The company had in the past been resistant to a buyback because although Founder Phillip Meeson had most of his net worth invested in the shares, like many founders he preferred to reinvest all cash into the business and held a large amount of excess cash on the balance sheet.

My biggest concern over the last few years has been whether Meeson's retirement would reduce shareholder friendliness further, but the opposite seems to have happened. Over the last six months, Jet2 has bought back all convertible debt, offset all dilution in the employee share save scheme, and now announced a major share buyback.

I believe that despite the 20% stock move investors still underappreciate these changes.

It looks to me that announcement is not a one-off and that buybacks will now be an ongoing use of cash. The company has £1.1bn of own cash and a target to reduce this to £600-700mm, meaning it will still have excess cash after the £250mm buyback and future cash generation. I could therefore see a smaller buyback of around 4% of the share count being an ongoing feature if the stock stays where it is.

Here is how I think about the value of the company and the buyback:

Current EPS is £1.9, or £2.0 after the buyback.

EBIT should grow slightly over 10% in most years with Jet2's aircraft order guaranteeing about 7% seat growth for the rest of the decade, a mix shift towards much higher ASP package holidays, and inflation.

That will be offset to some extent by lower interest income on cash balances, meaning EPS over three years should increase to around £2.5.

I believe a company with these qualities should trade at 15x, implying a stock price of £37.5 vs £16.5 today. However, even a modest 12x multiple implies a value of £30.

Even a £30 valuation is roughly double today's share price, meaning that every 10% of the shares Jet2 is able to reduce buy back today increases intrinsic value of the remaining shares by another 10%.

In Jet2's case, I think the value creation is even greater. The company sits on £1.1bn of 'own cash', defined as net cash minus customer deposits. This is such an enormous cash pile that investors appear to have placed no value on it as it seems like there was little prospect of the cash being put to work (the P/E was low at 6.5x but ex ‘own cash’ its even cheaper at 4.5x). That should now change as it turns out the cash is worth something. If the company is willing to reduce own cash from £1.1bn to £600-700mm via buybacks, we should arguably be subtracting the £400-500mm of own cash from the market cap. That would put the stock on an ex cash P/E of 7x, even today.

For completeness, the results themselves largely reiterated what management stated in February:

PBT ex FX for FY25 is expected to be £565-570mm or +9% y/y.

Summer '25 capacity is +8.3%, with management still "satisfied" with bookings.

Pricing for package holidays are still "displaying a modest average increase" and will help mitigate previously announced cost increases.

Overall, UK travel demand seems to have held up ok and been unaffected by any spillover from US tariffs. Various travel agents are reporting strong late bookings and Ryanair's CEO also said about 10 days ago that they had not seen an impact.

XPEL

Special Report, Notes from the trade show

I attended the New York Auto Show where I spoke with several representatives from Ford. This was helpful because 18 months ago a short seller called Culper Research released a report that stated a Detroit OEM (later revealed to be Ford) had partnered with paint company PPG to paint vehicles not through spray paint but by wrapping it with colored paint protection film. Culper argued that this would happen at mass scale and mean XPEL's film installed in the aftermarket obsolete, causing the stock to fall heavily.

Culper would later highlight PPG's announcement that it had produced a "revolutionary new matte clear film" for the Ford Mustang 2024 Edition as the result of this.

I argued in the Special Report that this was marketing spin, not a threat to XPEL, and that colored film has not replaced spray paint because it is thousands of dollars more expensive. I believe my conversations at the New York Auto Show now give final confirmation of that.

The PPG film for Ford Mustangs that Culper talked about was on display and Ford representatives confirmed to me that the film is transparent (not colored or a replacement for spray paint), optional for $6,000, and that they are not aware of any colored film that Ford will offer.

The big news on XPEL since the Special Report was published is of course the launch of US tariffs.

I will comment more thoroughly on the impact to XPEL at the next update because the company is reporting this will and will undoubtedly provide significant commentary.

A 25% tariff will apply to all imported cars, which President Trump appears to have confirmed is not additional to the current tariffs on individual countries (mostly 10%), except for China.

US assembled cars will also be tariffed based on imported parts, but these will now be partially shield at 15% of the value of a US assembled car in year 1 from May 1, 2025, 10% in year 2, then 0% in year 3. USMCA-compliant parts will continue to be tariff free. That means a US assembled car made with 85% US and USMCA parts will be tariff-free in year 1.

I anticipate this means the blended average tariff on new car purchases will be something like 10% and that prices will be about 7%. That should lead to a high single-digit decline in XPEL's US aftermarket business for a 2-3 quarters, which is worse than the -4% I anticipated at the time of the Special Report but nowhere near as bad as things looked after Liberation Day. One thing to watch out for is whether interest rates decline, because rates are typically a bigger driver of the change in a car buyer's monthly payments than car prices.

Tariffs have also pulled forwards car purchases, with car dealers AutoNation and Lithia Motors both reporting new car volume growth of 7% in Q1 but a much stronger March. That trend continued in April but has now moderated and I would expect growth to start turning negative in May, which is when many dealers will begin running out of pre-tariff inventory and begin raising prices. Both dealers believe (talking their own book) that new car prices will increase less than many expect because OEMs all have portfolios where some models are affected more than others, and some OEMs are affected more than others. So there will likely be a shift in buying patterns, and dealers will also absorb some profit hit.

XPEL will also be able to soften the blow from tariffs in a couple ways. First, on the last earnings call management talked about the strong US dollar as a headwind, but the dollar has since depreciated about 6%which should boost revenues at a group level by around 3% and also improve margins.

Secondly, I believe all or most of XPEL film in the US is supplied domestically by the manufacturer Entrotech, which itself has limited China exposure. That is also true for XPEL's biggest competitor Eastman Chemical and both companies are likely to gain share from smaller competitors who have less domestic supply, particularly those sourcing low cost film from China.

XPEL should also be somewhat insulated from the reverse. The company's China business is partially supplied by Chinese and Indian manufacturing, which the company has built out over the last few years. Investors have been critical of the associated inventory build, but I think we can now see why investing in a diversified supply base made sense.

Watches of Switzerland (WOSG.L)

Special Report, Notes from the trade show, Podcast

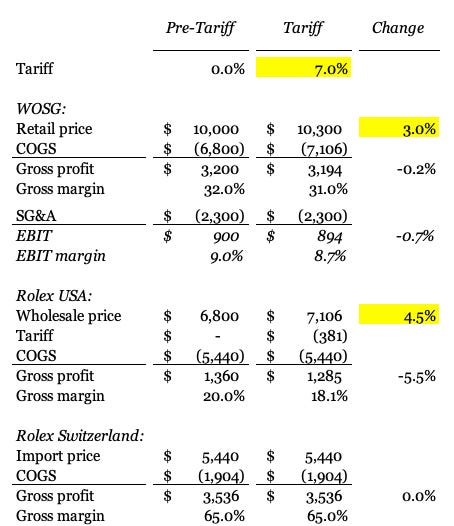

President Trump's pause in tariffs means that Swiss watch imports will now face a 10% tariff rather than 31%. Since the US has already had a 3% tariff on watches for many years, this is only a net 7% increase.

Rolex raised US prices by 3% on May 1 and cut retailer gross margins by 1ppt, essentially completely offsetting the tariff increase while keeping Watches of Switzerland's gross profits flat in absolute dollars.

Here is an update to the table I produced after attending Watches & Wonders, showing how the economics of a watch with a retail price of $10,000 are split between Watches of Switzerland, Rolex's USA, and Rolex Switzerland:

There is one important headwind this table does not account for, which is the 6% depreciation in the US dollar against the Swiss franc since Liberation Day. While Rolex has offset the impact of tariffs in US dollar terms, prices have to rise another 6% for those dollars to be worth the same in francs, and I would expect that to happen later this year or in January.

Another headwind from tariffs and associated uncertainty is likely to be customers taking a wait-and-see approach with discretionary purchases like Rolexes. This will reduce demand, but I believe investors have overreacted like they have done consistently over the last couple years.

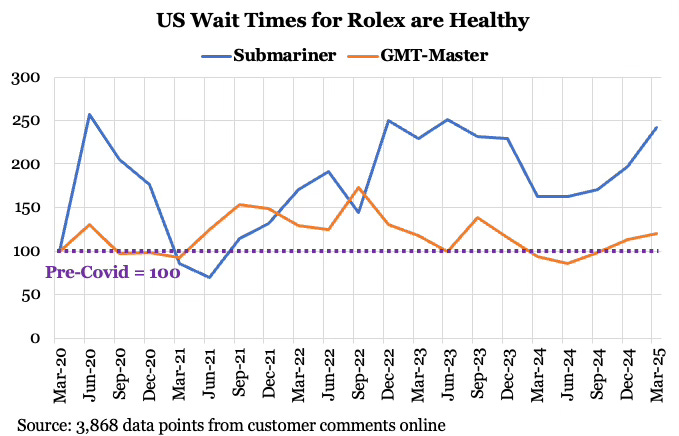

I estimate that around 75% of Watches of Switzerland’s profits come from Rolex and Patek Philippe sales. Sales in those brands are mostly driven by supply rather than demand because customers often have to register their interest in a watch months or even years before they are offered a chance to buy it. That means Rolex and Patek effectively sell as many watches as they want to make. The effect of lower demand is likely to be a reduced wait time rather than fewer sales.

A retailer who owns three stores in California spoke to WatchPro magazine this week and illustrated this point:

“The only brand that is still strong is Rolex. We can still sell every watch that we receive because demand has been so much greater than the supply we had. We still do well with Cartier, but other brands are feeling less demand,” Mr Lee describes. Although he says he can still sell every Rolex he is allocated, Mr Lee says that demand has weakened for the brand. “Demand for Rolex has also dropped, but the drop still leaves demand higher than supply. Our other brands have really slowed down due to the tariff situation causing ripples across the economy. Interest rates have not come down, which is also not helpful for business. The stock market has gone down and tariffs have directly affected many people and is causing inflation to rise,” he analyses.

My customer data suggests that waitlists in the US remained healthy coming into Liberation Day, which provides a large buffer to sales and matches Watches of Switzerland's comments in February that they were seeing continued momentum. Data from WatchCharts also showed that Rolex secondary prices increased in Q1. Premiums for Rolex are now higher than any brand, including Patek and AP.

Lastly, the BBC reported that Watches of Switzerland will shut 16 stores across the UK, making 40 people redundant. It's too early at this stage to know whether this is bad news suggesting deteriorating conditions or simply that the company is shutting underperforming stores.

For context, the company has 155 stores and 709 staff in the UK. None of the stores being shut are Rolex and the small number of staff being made redundant suggests these are small mono-brand stores rather than any of the large multi-brand ones.

ContextLogic (LOGC)

ContextLogic received a notice from the Nasdaq that as a public shell they no longer qualify for a listing. This is unsurprising, and the company now has a hearing to explain it's ambitions to make an acquisition and seek a delay. I expect the company will announce the result of the hearing at some point in the next couple weeks, with a potential delisting at the end of May.

Assuming the delisting is upheld, there will be some forced selling as the company beings trading OTC. That would be an opportunity as the fundamentals are unchanged and the company will likely uplist once it has made an acquisition.

There is also a chance that ContextLogic announces an acquisition beforehand. After all, if ContextLogic was not somewhat progressed with an acquisition I don't think there would have been any point in applying for a hearing to try and delay things. And if the result of hearing is a delay to the delisting, I would take that as a strong signal that an acquisition is close.

This article is for informational purposes only and is not investment advice. Plural Investing, LLC currently holds a position in Jet2, XPEL, Watches of Switzerland, and ContextLogic. Read important disclosures here.