Podcast on Judges Scientific (JDG.L)

With Yet Another Value Podcast

I recently discussed Judges Scientific with Andrew Walker at Yet Another Value Podcast for an hour. The video is available in full and for free above. Paid members additionally have access to:

A cleaned transcript (below)

Our 35-page Special Report on Judges Scientific

Monthly updates like this

Become a paid member to receive this and other content. Annual subscriptions are $347 and if you subscribe you will be grandfathered in at this price, meaning you are protected from future price rises. To learn more about what you can expect as a paid member, go to our About page.

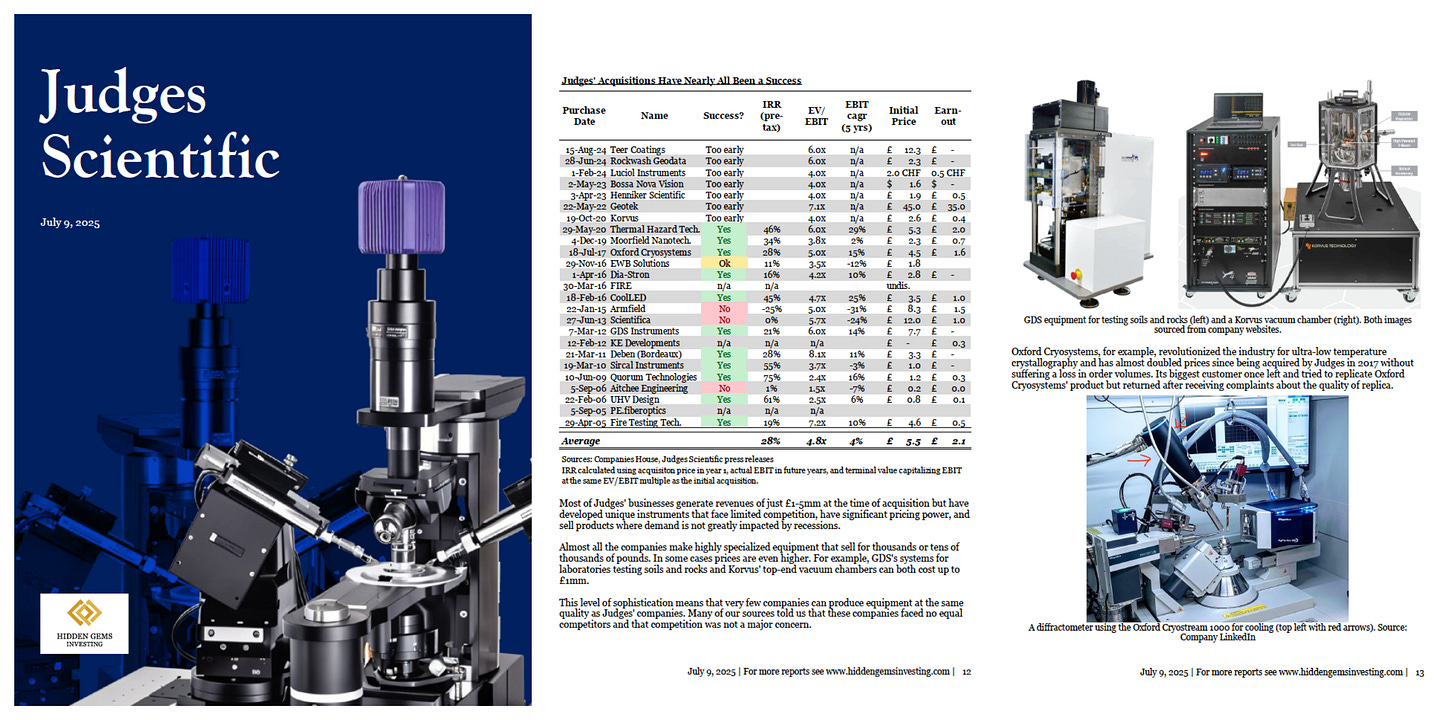

Judges Scientific (JDG.L) is a serial acquirer of niche scientific instrument businesses in the UK. The company has delivered 22% returns on incremental capital for 20 years by my estimates and 25% p.a. shareholder returns. Cofounder David Cicurel remains CEO and is someone with high integrity, a clear customer focus, strong capital allocation skills and owns shares worth around 200x his base salary. While the stock trades at an optically high 21x EV/FCF I believe it can still deliver a 25%+ IRR going forwards.

The timestamps to the video are:

[02:57] Overview of Judges Scientific

[06:43] Example acquisitions and product types

[07:47] Market misperceptions and headwinds

[09:32] Acquisition pricing discipline and competitors

[13:44] Reputation advantages over new entrants

[15:39] Acquisition pace and scaling challenges

[18:43] Geotech acquisition scale and risks

[20:07] Geotech’s business model and setbacks

[23:53] Expedition delays and revenue impact

[25:48] Halma example for scaling runway

[29:17] Management succession considerations

[32:51] Sale likelihood and culture preservation

[33:30] US college spending cuts and guidance

[36:56] Recovery scenarios and uncertainty impact

[39:21] Potential acquisition opportunities in downturn

[41:05] Valuation framework and growth assumptions

[43:34] Business quality vs. peer acquirers

[44:20] EPS target changes in compensation plan

[45:37] Dividend policy and UK investor culture

[48:35] Post-acquisition integration philosophy

[51:14] Closing thoughts and R&D discipline