Updates: TerraVest Industries, Watches of Switzerland, Seaport Entertainment (TVK, WOSG, SEG)

Latest analysis on TerraVest, Watches of Switzerland, Seaport Entertainment

Make sure you read our most recent reports on Seaport Entertainment (SEG) and Watches of Switzerland (WOSG.L).

We will be publishing a (paid) follow-up article on Seaport this month.

We have reached over 2,200 free subscribers and 130 paid subscribers in the seven weeks since the newsletter was formally launched. Thank you for subscribing, and upgrade to paid to receive our best content. An annual membership is just $347 and subscribers are protected against future price rises.

TerraVest (TVK.TO)

Special Report, Podcast, Presentation

TerraVest reported a more modest fiscal Q4 on December 13th, after several strong quarters.

Sales were C$230.7mm, +33% y/y and -1% on an organic basis.

The prior comparable period did not include the acquisitions of LV Energy (Oct '23), Highland Tank (acquired Nov '23), and Advance Engineered Products (Apr '24).

Organic growth for the year was +4%, in line with the low single digit trend rate of growth for the company.

Quarterly organic growth tends to be volatile so we would not read much into the -1%, especially after the strong Q3. For the four quarters of the fiscal year organic growth was: +7%, -4%, +14%, -1%.

Organic growth and declines followed normal trends in the quarter, with growth driven by service, compressed gas equipment, residential and commercial petroleum tanks. Declines were driven by furnaces and boilers, and oil & gas processing equipment.

We would not read too much into TerraVest’s segments as management likes to disguise true segment growth from competitors. Highland Tanks, for example, is consolidated into the HVAC segment despite also manufacturing storage tanks. Nevertheless, organic growth by segment was:

HVAC: -13% in FQ4 after being +9% in FQ3. -5% for the full year.

Compressed gas: +21% in FQ4. +11% for the full year.

Processing equipment: -23% in FQ4. -14% for the full year.

Service: +3% in FQ4. +19% for the full year.

Underlying earnings power and FCFF by our calculations was C$23mm for the quarter and C$125mm for the year, putting the stock on 19x EV/FCF.

Net debt declined to C$161mm, putting ND/EBITDA at 0.8x vs a historic average of 2.4x. Cash generation is likely to be around C$315mm over the next three years (3 x C$125mm in FCFF - C$20 in interest expense).

That means today’s net debt of C$161mm is on track to become net cash of C$154mm over three years. Using TerraVest historic ND/EBITDA average of 2.4x implies the company has C$610mm of buying power (C$190mm in current EBITDA x 2.4 + C$154mm cash = C$610mm).

At the company’s normal acquisition multiples of 11x FCF and 7x post-restructuring, that would imply acquired FCF of C$55mm and C$87mm respectively, and total company FCF of C$180mm and C$212mm.

That puts TerraVest on 15x FCF and 13x FCF in three years, suggesting the stock is still reasonably priced despite the run-up.

We think that point is worth reiterating. Markets tend to underappreciate management that deploy capital at strong incremental returns, and typically do not price in value creating acquisitions until after they happen.

TerraVest’s underlying FCF of C$125mm for 2024 was estimated by adjusting for a few important factors:

Net capex is significantly lower than D&A. This gap has grown in the last year as TerraVest has amortized acquired intangible assets. The company has also consistently sold old PP&E for significant sums.

Working capital swings from year to year, but is excluded above because a business with low single digit organic growth should not consistently require working capital investment.

A few subsidiaries have minority partners.

TerraVest’s outlook statement was again positive. The outlook was word-for-word the same from FQ1 to FQ2, turned more positive at FQ3, and is largely the same at FQ4. The only meaningful change is highlighted in bold here:

TerraVest’s businesses continue to perform well. Recent acquisitions have made a meaningful contribution and we expect this to continue into the next fiscal year. Opportunities to enhance performance through synergies between recent acquisitions and the base portfolio of businesses continue to exist and are a focus for management. The Company continues to make targeted investments to improve its manufacturing efficiency and expand its product lines, particularly in end‐markets where it has a meaningful presence. With the new credit facility obtained in October 2023 and the more recent equity offering, TerraVest is very well‐positioned to pursue its acquisition strategy.

However, we do think it’s worth noting that the company will begin to have tougher comparables as it laps the acquisitions of LV Energy and Highland Tanks in FQ1.

Group margins were slightly elevated for FY24 as a whole but particularly elevated in FQ1 and FQ2 post those two acquisitions and the strength in the Services business. There is some risk that those businesses were overearning, again setting up a tough comp.

Watches of Switzerland (WOSG.L)

Watches of Switzerland reported strong fiscal H1 results on December 5th, sending the stock up 13% on the day.

We continue to think the company is significantly undervalued.

One interesting comparable comes from the 2024 edition of the 300 richest Swiss by Bilanz magazine, which shows that an additional CHF 5 billion is available to the new Jorg G Bucherer Foundation. The vast majority of this is likely to have come from the sale of Bucherer to Rolex. Since Bucherer had revenues of around CHF 2bn, this implies an EV/S multiple of over 2x, matching what a Swiss sell-side analyst at Vontobel has claimed over the last year. Watches of Switzerland trades on 1x sales (ex leases), even after the recent run-up.

While Watches of Switzerland’s H1 results did not appear eye-catching at first glance, investors were surprised given the industry downturn that the company did not struggle and had such a strong outlook.

Revenues were +4% in constant currency terms in H1. This was split -2% in Q1 and +11% in Q2.

US revenues were +11% in constant currency terms. This was split -1% in Q1 and +24% in Q2 as the company built up Rolex inventory in Q1 to improve the customer experience.

UK & EU revenues were -1% in constant currency terms. This was split -4% in Q1 and +2% in Q2 as the market saw "continued stabilization". The period saw six EU stores sold or closed, which implies UK organic growth was surprisingly positive.

EBIT was £60mm, -23% y/y or -10% excluding impairments in the EU stores the company is exiting and store opening costs. The company stated that "profitability was impacted by the lack of leverage, which will reverse in the second half of the year."

Roberto Coin has performed strongly since it was acquired, with revenues of £51mm / $64mm. This was a surprisingly strong performance since revenues last year were $139mm and are weighted towards FH2 with Christmas and Valentines Day, and there was disruption due to the acquisition. Management stated that “sell-in and sell-out data [is] encouraging".

Rolex certified pre-owned performance was strong and is now the group's second biggest brand. EBIT margins have improved to a similar level to new watches.

FY guidance was unchanged, with comments that "Q3 trading has started encouragingly". UK sentiment is much better going into Christmas than last year. US demand has been continually strong and additionally benefited post-election. Several new store openings are coming in H2.

Management claim that more names are being added to waitlists than are being taken off. We are somewhat skeptical that this is entirely true, but agree that waitlists are healthy (see below).

The fact the stock was up 13% on these results suggests investors expected Watches of Switzerland to have been more impacted by the broad decline in demand for luxury goods. Indeed, the stock on a day-to-day basis often moves similarly to luxury goods companies like LVMH who generate much of their profits from China or Chinese tourists.

Many investors point to data from WatchCharts, which shows that an index of Rolex watches has declined in value by over 30% since peaking in March 2022:

This set of results suggests that these concerns are misplaced.

Chinese tourists make up less than 5% of Watches of Switzerland’s sales and the WatchCharts Rolex index represents the prices of Rolexes on the secondary market, where people are reselling watches they have already bought from retailers.

Watches of Switzerland does NOT sell into the secondary market in a significant way.

Instead, the company sells into the primary market and around 60% of sales are made up of waitlist brands (mostly Rolex). The waitlist cushions the impact from any cyclical decline, and these brands tend to have more affluent customers who are less impacted in the first place.

In our view, the best indicator of supply and demand is therefore the current length of waitlists and how that compares versus history.

Rolex and Watches of Switzerland do not disclose this information.

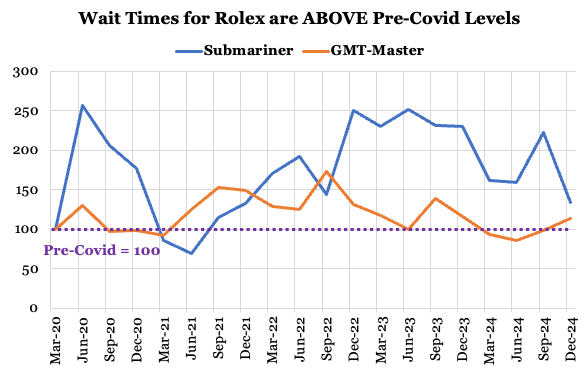

However, we collected 3,565 messages online where customers described actual Rolex purchases. Each message included the date they received their watch and how long their actual wait time was.

This data shows that supply and demand is actually healthy:

This chart shows how wait times for two of Rolex’s most prestigious brands (the Submariner and GMT-Master) have changed since Covid. Each is indexed to pre-Covid levels, meaning anything above 100 indicates wait times are higher than pre-Covid levels.

Although wait times have declined since the peak of the bubble in 2022, they remain at healthy levels.

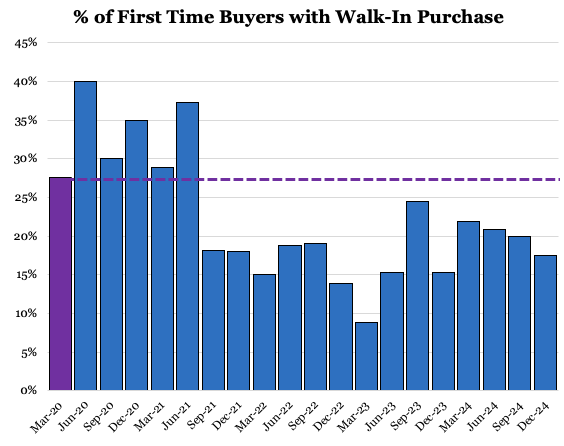

Another way to cut the same data is to look at what proportion of customers are able to walk into a store and buy their first Rolex. The data shows that fewer customers are able to do so today than pre-Covid, which also suggests that supply/demand for new Rolexes is healthy.

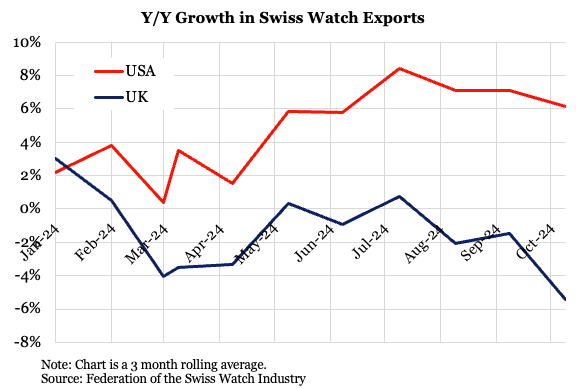

This tight supply/demand balance is despite the value of Swiss watch exports into the US growing at mid-single-digit rates. While growth into the UK dipped in the last couple of months, that may be a temporary impact from the October Budget and Watches of Switzerland commented that its sales in the UK were strong in November.

This data is an aggregate of all Swiss watches. While Rolex data is not broken out individually we do know that watches over CHF 3,000 have performed much stronger than watches under CHF 3,000, which suggests that Rolex and the other waitlist brands that Watches of Switzerland focuses on are doing better.

In other words, Rolex and Watches of Switzerland are benefitting from both increasing volumes and healthy supply/demand. Rolex also annouced price increases for 2025 this week.

Rolex’s peers are arguably Hermes and Ferrari, both of which have reported strong results recently. That is unlike the non-waitlist watch brands, with Richemont, LVMH, and Swatch all reporting revenue declines.

Watches of Switzerland remains cheap at 14x FCF or 9x our estimate in three years. With US financial assets at all-time highs and interest rates declining, the company should benefit from a cyclical recovery acting as a catalyst.

Seaport Entertainment (SEG)

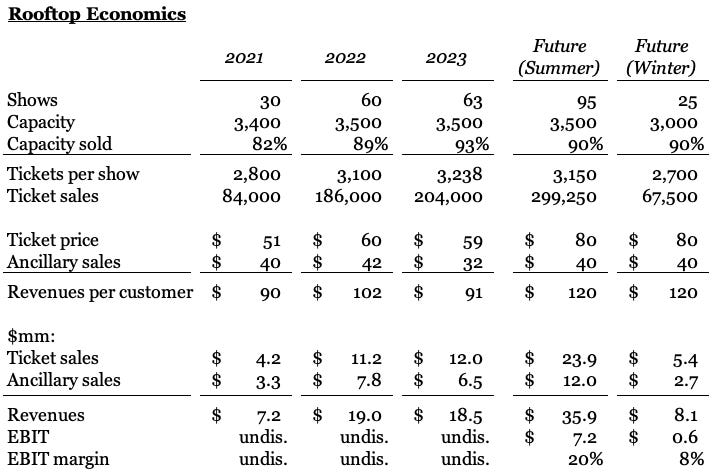

Seaport announced that the rooftop at Pier 17 will be able to host concerts through the winter beginning in late 2025. This was one of the improvements we forecast in our Special Report, and our full follow-up analysis on this and other topics will be published in a piece later this month.

From the press release:

The floor-to-ceiling glass enclosure will transform the 1.5 acre venue five stories above the East River into a climate-controlled, indoor space while preserving its famous views of the lower Manhattan skyline and Brooklyn Bridge.

The winter configuration capacity will be 3,000, compared with 3,500 for the typical open-air events held May through October. The venue is also adding a new VIP balcony level. Project cost was not disclosed.

The announcement coincides with a five-year extension of the partnership between venue operator Seaport Entertainment Group and Live Nation to continue programming the concert venue as the exclusive booking partner.

The new design makes it possible to expand The Rooftop at Pier 17’s Seaport Concert Series, with an estimated 25 additional performances planned for the late fall and winter months.

The 25 concerts and higher pricing (VIP balcony) are actually slightly better than what we hoped for in our report, although we are still skeptical that this will be a material contributor to profits given the costs of building a floor-to-ceiling enclosure.

However, it will drive more people to the Pier, which is the key to improving the economics at all the properties in the Seaport district.

Other Updates

I was recently interviewed by Graham & Doddsville (begins p.34). Take a look if you're interested in my research process, Seaport Entertainment, Watches of Switzerland, or other interviews and stock writeups.

This article is for informational purposes only and is not investment advice. Read important disclosures here.