Monthly Updates: TerraVest, Seaport, XPEL

TerraVest, Seaport, XPEL

Don’t forget to watch the podcast or read the Special Report on Judges Scientific based on 16 interviews, and update on ContextLogic.

I will be publishing an update on XPEL this month after attending a major trade show. Let me know in the comments below if there are questions you would like me to ask the industry.

Watch out for an update on Seaport Entertainment later this month also.

Hidden Gems Investing has reached over 4,500 free subscribers and 260 paid subscribers in the nine months since the newsletter was launched. Thank you for subscribing, and upgrade to paid to access our best content. An annual membership is just $347 and subscribers are protected against future price rises. Go here to learn about what you can expect as a paid subscriber.

TerraVest (TVK.TO)

Special Report, Podcast, Presentation

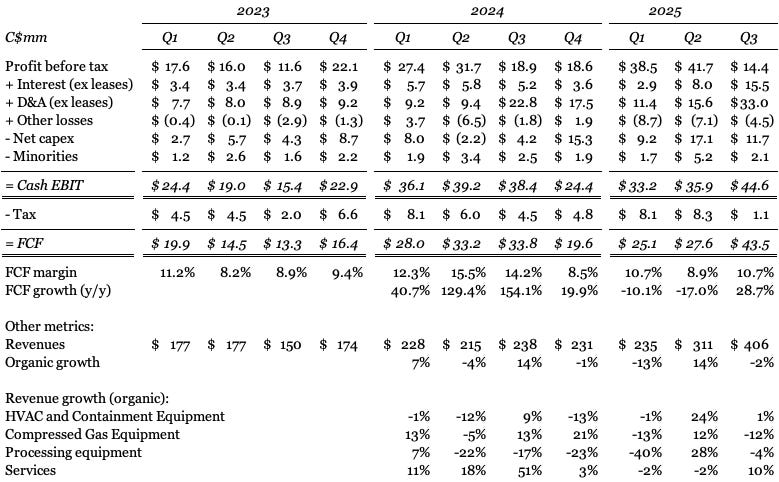

TerraVest reported weak fiscal Q3 results on August 14 as it continued to lap an unusually strong 2024 and face some cyclical headwinds. Organic growth was -2%, with FCF margins by my calculations declining from 14.2% to 10.7%. FCF in absolute terms grew by 28.7%, driven by the large EnTrans acquisition:

Overall, I think profitability has largely declined to mid-cycle levels now, although the Services segment is still probably overearning after a very strong two years. The multiple on the stock has declined to 22.5x EV/FCF and in my view is now slightly below fair value.

By far the largest segment of TerraVest is Compressed Gas Equipment, which after the acquisition of EnTrans in March now accounts for just over half of company revenues.

That segment is facing softer demand with tariffs creating uncertainty for customers, which is causing delayed or reduced orders. Organic revenue growth was -12% in the quarter, which is not as bad as it looks given the tough comps of +12% in fiscal Q2 and +13% last year in fiscal Q3.

I believe the segment could face further headwinds in fiscal Q4 given current conditions and an even tougher comp of +21% from last year. My understanding is that demand remains weak, particularly for the tank trailers that EnTrans manufactures.

The tariff induced uncertainty and weakness in this segment was reflected in TerraVest slightly downgrading its outlook from previous quarters (new words in bold):

“In general, TerraVest’s portfolio of businesses is performing well. Recent acquisitions have made a meaningful contribution and we expect this to continue throughout the fiscal year. Opportunities to enhance performance through synergies between recent acquisitions and the base portfolio of businesses continue to exist and are a focus for management. Recent tariff announcements have created an environment of uncertainty in North America’s manufacturing sector. This uncertainty has resulted in softer demand recently for a few of TerraVest’s businesses. However, TerraVest’s portfolio businesses are well-positioned manufacturing products predominantly for their domestic markets, which greatly limits the impacts of any potential tariffs. The Company continues to make targeted investments to improve its manufacturing efficiency and expand its product lines, particularly in end-markets where it has a meaningful presence. With the new credit facility obtained in March 2025, TerraVest is very well-positioned to pursue its acquisition strategy.”

Results in the other segments were mixed:

HVAC: +1% organic growth. Continued uptick in sales and new end markets. A decent quarter given the pull forwards from tariffs in fiscal Q2.

Processing equipment: -4%, with reduced demand for energy in Western Canada.

Service: +10% despite a very tough comp with fiscal Q3 last year at +51%. The organic growth number was boosted by the acquisition of Aureus, which has been fully integrated and so included in organic numbers.

FCF or underlying earnings power for the quarter by my calculations was C$43.5mm for an annualized C$174mm, almost the same as what I estimated in Is TerraVest still cheap?, which discussed the runway the company has post four acquisitions to continue making attractive deals.

And although fiscal Q3 is usually one of TerraVest’s seasonally weaker quarters, I view C$174mm as a reasonable annual estimate because tax was exceptionally low this quarter at just C$1mm, and I believe the Service segment is still over-earning.

Note also that I remove “other losses/gains” from my FCF estimate because this is typically made up of FX or equity gains/losses - e.g. TerraVest this year has benefited from big gains in equity investments, which I remove as I assume they are not recurring and do not reflect underlying earnings power.

The company’s enterprise value is: C$3,126mm market cap + C$702mm net debt = C$3,918mm.

The stock is therefore now trading at an EV/FCF of 22.5x. That is down from the high 20s earlier this year and in my view now slightly below fair value.

At 22.5x FCF I would typically be arguing that TerraVest is “significantly” rather than just “slightly” below fair value, but in this case the company has less capacity than normal to make attractive acquisitions after the super-sized purchase of EnTrans.

Net debt of C$702mm puts ND/EBITDA at 2.6x if fiscal Q3 is annualized, which places it roughly in line with the historic average of 2.4x. Cash generation is likely to be around C$336mm over the next three years (3 x C$174mm in FCFF - C$62mm in interest expenses).

That means today’s net debt of C$702mm is on track to become C$366mm over three years. At a ND/EBITDA of 2.4x that implies the company has only C$287mm of buying power (C$272mm in current EBITDA x 2.4 - C$366mm net debt = C$287mm).

At TerraVest’s normal acquisition multiples of 11x FCF and 7x post-restructuring, that would imply acquired FCF of C$41mm post-restructuring and total company FCF of C$215mm.

That puts TerraVest on 18x post-restructuring FCF in three years if it can continue making good acquisitions. Given the exceptional management team and track record I think that makes the stock slightly undervalued after recent declines, without being exceptionally cheap.

Management may choose to create more acquisition capacity by issuing equity, which is not my preferred method of financing. Interestingly, TerraVest instead launched a potential buyback / NCIB after results for up to 7% of its shares. The company has not bought back shares materially since 2021, and I would be surprised if they did at these prices having issued equity twice in the last couple of years.

However, management is likely giving itself the ability to buy shares if the stock declines further from headwinds continuing / worsening or sentiment weakening. That would likely be a good time for investors to buy too.

XPEL

Special Report, Notes from the trade show

XPEL reported a strong Q2 on August 6, with growth so far this year above my expectations. I have two important takeaways from the quarter which I believe investors are underappreciating:

XPEL are making substantial progress on using pricing power and growing the OEM channel. These are two of my key thesis points for why the company's structural/mid-cycle growth rate remains around 15%.

The company is close to acquisitions that could add around 25% to FCF.