Progress at Seaport Entertainment (SEG)

Deep dive on important changes that are happening at 250 Water St, the Tin Building, and Pier 17.

Make sure you read the latest Special Report for more background.

One of the main reasons I started writing publicly about investments is because it typically leads to valuable conversations with industry experts and investors. This article brings you some of the insights from discussions I’ve had since the Special Report (edit: updated version) on Seaport Entertainment was published, and lays out:

Updates I’m making to the original analysis

Where I think investor ‘consensus’ is and catalysts to change that

Developments at the company

Overall, I think Seaport is making many of the changes laid out in the Special Report. This fairly rapid progress has gone largely unnoticed by investors and should become clearer over the course of 2025.

As a reminder, Seaport was spun out from Howards Hughes and owns properties in New York and Las Vegas. The most important properties are in Lower Manhattan and are:

250 Water St: Land approved for a 27-story building that could be sold soon

Pier 17: Concert venue, office space being converted to entertainment, restaurants

The Tin Building: A heavily loss-making food hall

250 Water St

I’ve spoken with several developers since the Special Report, and the punchline is I remain confident 250 Water St can be sold for ~$160mm sometime this year. The $160mm figure is actually slightly lower than estimated in the report, but I would not read too much into that given how sensitive the value is to several inputs.

The updated table above tries to back out what a developer could pay for the land and still make a 25% margin, which is the industry standard.

The logic is as follows: If the completed building at 250 Water St is worth $885mm and construction costs are $547mm, a developer could pay $161mm for the land and still make a $177mm profit, or a 25% margin on their total cost before financing and levered returns.

Another way to look at it is that the completed building should generate $42.8mm in NOI, or a 6.0% yield on development costs of $708mm (construction + land). That is a reasonable yield for a developer and a 120bps spread to the building’s cap rate of 4.8%.

In other words, if these assumptions are correct then Seaport should be able to sell 250 Water St to a developer sometime this year. There is no reason to wait given the building is fully approved for development and construction costs rise over time.

There are three important sets of assumptions that go into the valuation above:

Residential

Two-thirds of the value of the building lies in its 299 market rate apartments. These will be luxury apartments overlooking the Brooklyn Bridge and East River and ten minutes walk from Wall St.

I assume that the $31mm of rent these apartments generate converts at a high 85% to $26mm of NOI, and that these should be valued at a low 4.5% cap rate. This is an unusually high rate of conversion and unusually low cap rate, which for most residential buildings in Manhattan is 5.5%.

The key reason for this is that the apartments will pay no property taxes due to the 421a tax exemptions Howard Hughes secured. Property taxes in New York are 12% of ‘assessed value’, which is typically 20% of the market value for a building like this.

That means without the 421a exemption property taxes on the apartments would be the $585mm market value * 20% * 12% = $14m/year, or nearly half the rent.

This tax saving demonstrates why Seaport’s management highlight how important the 421a exemptions are, and why Howard Hughes was willing to build 100 affordable apartments in exchange for them.

Space is obviously constrained in Lower Manhattan, and a newbuild luxury apartment that is tax exempt and overlooking the water should fetch a premium valuation.

Office

About 40% of the space is zoned for office or retail, and the decline in demand for office space post-Covid makes this the biggest barrier to selling the land to a developer in my view.

The valuation above assumes that only the ground floor contains retail space and a developer might switch other floors from office to retail, which could increase the achievable rent.

There are also some green shoots of recovery in the Manhattan office market. A significant amount of supply is leaving as office space is converted to residential and demand is picking up as people go back to working in the office. SL Green, a Manhattan office landlord and developer, reported a bullish Q4 last week with rent on renewed office leases increasing 9% y/y and occupancy increasing from 90.1% to 92.5%.

Construction Costs

Several sources told me that hard construction costs are typically $500-800/sqft for buildings in Manhattan and up to $1,000/sqft for luxury condos. The valuation above assumes $1,000/sqft, which may be too conservative.

That implies a construction cost of $547mm, which is still significantly below the “project cost” of $850mm Howard Hughes previously outlined.

However, bear in mind that the $850mm included other costs (most of which are already incurred) that need to be added to the $547mm:

$180mm to acquire the land

$40mm for the air rights

$60mm in litigation

Design / engineering

Marketing

Financing

Tenant improvements

Overall, 250 Water St is on track to be sold for ~$160mm sometime this year.

From my conversations, I think this is something investors underappreciate and would be a major catalyst for the stock. A sale would generate ~$100mm net of the mortgage on the property, which is very significant in comparison to Seaport’s market cap of $330mm. It would also demonstrate that there is substantial value in some of the company’s assets.

Pier 17

Pier 17 is Seaport’s largest and arguably most valuable property if turned around. It makes money in three ways:

The rooftop concert venue

Three floors of office space being redeveloped towards entertainment

A ground floor with five restaurants

The company has made significant progress in two of these areas.

The Rooftop

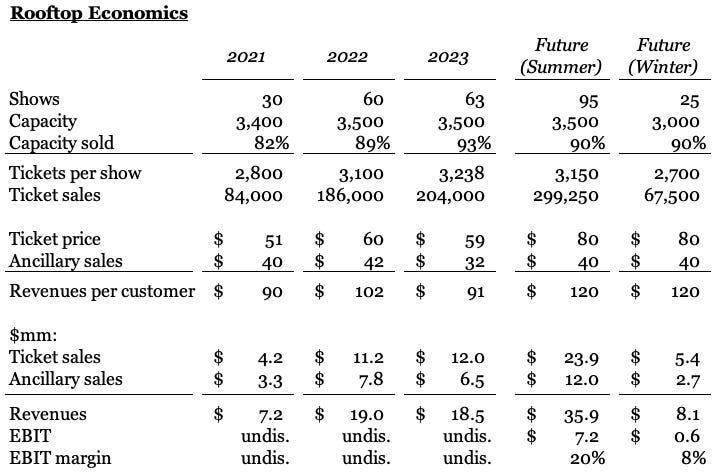

Seaport announced that the rooftop at Pier 17 will host concerts through the winter beginning in late 2025. The rooftop summer concert series has arguably been the company’s most successful development, and extending it year-round is probably the most effective way to monetize the roof and bring thousands of people to the area. The additional foot traffic should benefit all the other properties.

The 25 concerts and higher pricing (VIP balcony) are actually slightly better than what I hoped for in the report. While the added cost of the glass structure means I don’t think this will generate a large profit, it is significantly better than the losses currently incurred during the seasonally weak winter (~$3mm on ice skating alone).

And, again, the added foot traffic should also benefit the other properties in the area.

Ground Floor Restaurants

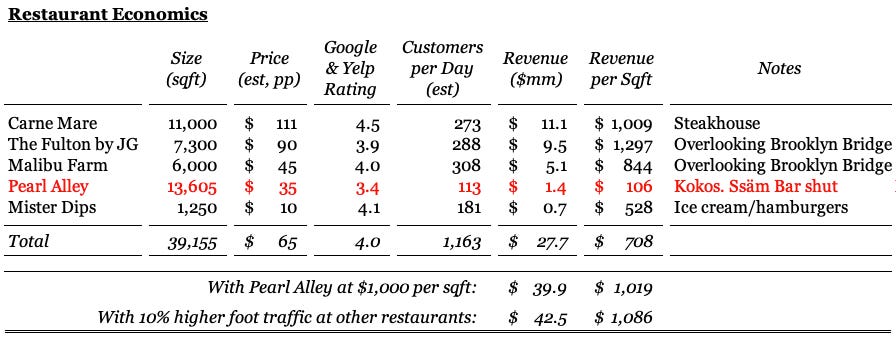

Of the five restaurants at Pier 17, three have had moderate success (Carne Mare, The Fulton, Malibu Farm), while one (Pearl Alley - in red above) occupies one-third of the space yet is largely unproductive or shut down.

Redeveloping Pearl Alley into a moderately successful $1,000 per sqft space would result in an additional $12mm of revenues.

That is now happening. The images below show Pearl Alley in September ‘24 (left) and January ‘25 (right):

Other changes are happening to accommodate this. At a recent Manhattan Community Board meeting (1hr 33min in), Seaport was approved to reconfigure the layout of The Fulton, one of its more successful restaurants, to ensure the new concept at Pearl Alley has more waterfront space.

That new concept is GITANO, a restaurant and nightclub that is opening this Spring. The concept will feature glass doors opening onto the water and New York’s biggest disco ball.

While no one addition to the Pier will be material, GITANO shows management are adding the right concepts, for two reasons.

First, the whole Seaport area currently has few, if any, nightlife options. That means the area is empty at 10pm on Fridays and Saturdays after the concerts finish. Those should be peak times for an entertainment destination.

Introducing nightlife is part of management’s plan to broaden Seaport’s offering and encourage customers to spend on multiple occasions. An obvious win is for customers at the concerts to go to the nightclub afterwards.

Secondly, the biggest challenge the Seaport faces is that it is ten minutes walk from the nearest subway station, which means visitors have to be motivated to make that journey. GITANO’s previous location in New York was a pop-up on Governors Island that required visitors to take a ferry there and back, suggesting it has a committed customer base that will not find Pier 17’s location a hurdle.

Space Conversion

The conversion of Pier 17’s second, third, and fourth floors from office to entertainment space will be one of the most important drivers of upside. Not only should it enhance the economics of space that is only 47% occupied, but also attract thousands of additional people to the area, thereby benefiting all the properties.

This will be a multi-year process, rather than a near-term catalyst.

While the 53% of unoccupied space can be worked on immediately, ESPN’s office lease only expires in December ‘25 and Nike’s lease goes longer than that.

There has been no major news on the conversion so far. GITANO will take up some space on the second floor, but is mostly ground floor space.

Nevertheless, management have made good progress at the Pier since the spin-off and I will be expecting more news on converting the office space.

The Tin Building

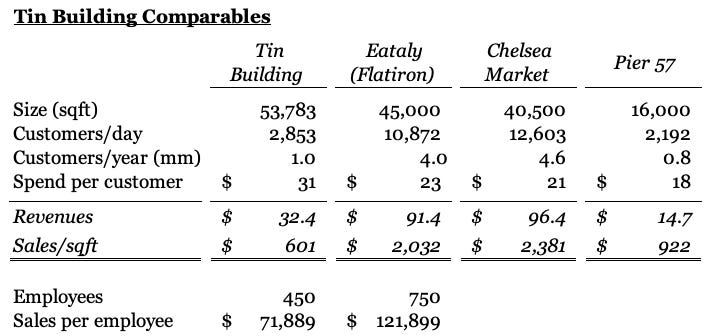

The Tin Building by Jean-Georges is a luxury food hall and market next to Pier 17 that generated $32mm of revenue on $74mm of cost in 2023 for a $42mm loss, making it the most problematic property Seaport owns.

In the Special Report, I discussed how other food halls in New York were profitable and that to bridge the gap the Tin Building would have to:

Shut the 25% of space dedicated to unproductive grocery and retail concepts

Shut underperforming restaurants

Expand the successful restaurants, cafes, and bars into the shut space

Cut labor costs by 25%

Cut G&A and other costs significantly by consolidating concepts and procurement

**Most importantly, renegotiate the contract with Jean-Georges so that the distorted incentives are eliminated and the above changes can be made

I believe these changes will boost revenues from $600/sqft to $1,000/sqft and cut costs, excluding the lease Seaport earns rent on, from $1,150/sqft to $850/sqft.

Promisingly, management are making or have already completed many of these changes.

On January 7, Seaport announced that it will become the employer of the Tin Building’s employees. My reading of the new contract is that Seaport will likely acquire Jean-George’s company CCMC by June 30, 2025, which will give it full control of the Tin Building instead of just funding all the losses.

Shortly afterwards, the workforce at the Tin Building was reduced by at least 100 people, or 22% by my estimates.

At the same time, all the underperforming restaurants were shut, including a Mexican restaurant with only 8 seats, a Japanese restaurant with only 18 seats, a vegan restaurant, and a sandwich & salad bar.

The successful restaurant Frenchman’s Dough will remain open, and almost certainly expand into the vacated space along with some of the other successful concepts.

While cash burn at the Tin Building will likely be significant in Q1 as these changes take place, I expect that we will see substantial improvements by the summer.

Overall, I think management have made a lot of progress in a short period of time and most of this has gone unnoticed.

My sense from speaking with investors is that many agree the stock is trading at a large discount to NAV, but think it is ‘too hard’ to know whether the required changes are happening or will be successful.

But while execution remains a significant risk, I think the early signs are encouraging. I see the rough timing of catalysts for the company’s FCF to improve as follows:

Under 12 months: The sale of 250 Water St could happen anytime.

12 months: Cash burn at the Tin Building should reduce significantly. The rooftop and restaurants at Pier 17 will be better monetized.

Next 1-3 years: The office space at Pier 17 should be redeveloped and draw traffic to all the buildings in the area.

If you want more information on Seaport Entertainment, make sure you read the Special Report.

Let me know what you think in the comments below!

This article is for informational purposes only and is not investment advice. Plural Investing, LLC currently holds a position in Seaport Entertainment. Read important disclosures here.

Hi Chris,

What are your thoughts on how Zohran's potential mayorship will impact SEG?