I was in Reno, Nevada, a few days ago for the International Window Film Conference and Tint-off (WFCT) – a trade show for the auto film industry attended by XPEL and most of its competitors. I spoke with 17 film brands, manufacturers, and distributors to try and understand the growth runway for the industry and XPEL and came away concluding that XPEL still has a long runway of double-digit growth ahead of it once the current cyclical headwinds subside.

As a reminder, XPEL’s stock since 2020 has gone from $15 to $100 and back to the $30s after the company went from delivering 25%+ growth for years to 6% in 2024. The Special Report published in March argued that investors have overreacted and are extrapolating 2024 growth to be the new normal. I believe the company’s long term growth rate is the key debate among investors today.

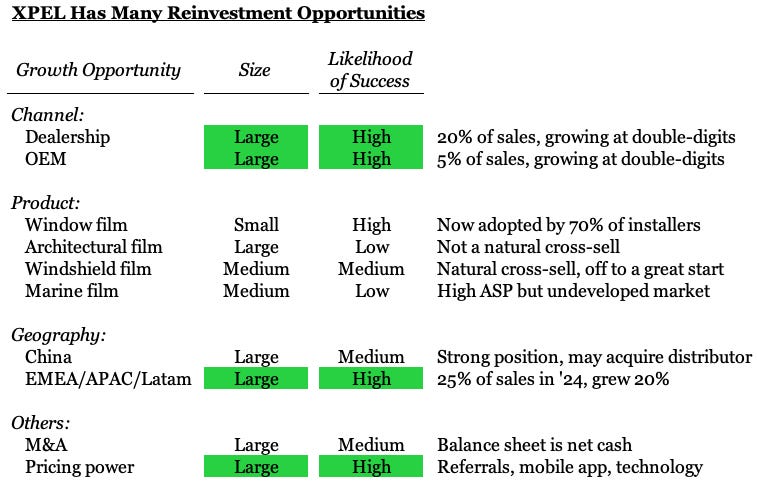

XPEL still has four large organic growth opportunities, each of which could contribute 5ppts of revenue growth at the company level. These are growth by:

OEM & dealership channels

New products

International expansion

Pricing

This update will focus what I learned at the trade show and why it was supportive of XPEL’s growth opportunities among the OEM and dealerships channels and new products like colored PPF and windshield film.

If you are interested in more background, take a look at the 35 page report on XPEL published in March. I believe XPEL is a great company with an excellent owner/operator that is now coming through a blip. The report was based on 54 interviews and covers XPEL’s:

Economics and competitive advantages

Growth runway

Difficult cyclical conditions

Governance

Valuation

OEM Demand is Accelerating

The biggest positive I took from the trade show was that the OEM channel is clearly going to be a big opportunity, this is accelerating, and XPEL is in an advantaged position to capitalize on it.

Until recently, the OEM market for PPF was primarily made up of white label products. A typical relationship involved an OEM sourcing cheap films from China or India and pre-loading that onto a few areas of a car where the paint is particularly vulnerable to rock chips and scratches. For instance, some Toyotas have a small amount of film applied to protect particularly vulnerable areas like fenders and hood arches, and in many cases customers have not paid extra for that and may not even be aware of it. Installation typically takes place at the factory or a port where Toyotas come off a boat and film is installed on-mass.

What has changed is that the growing popularity of PPF means some consumers are willing to pay for higher quality and more expensive branded film and for it to be installed on more surfaces like the entire front of a car. Some customers also want other types of films like window tint, windshield film, or colored PPF.

This creates a very complex logistical problem for OEMs because different amounts and types of film need to be installed on different vehicles. Doing such quantity and variation of installation at the OEM’s factory requires a lot of space, cars coming off the production line, and an inventory backlog because film needs time to set. That has been the key bottleneck which has held OEMs back from upselling film to customers, which in turn limits the awareness of film among people who are not car enthusiasts.

XPEL is in the leading position to solve the logistical problem because the company has the most extensive installer network in the world and its software now allows OEMs to outsource all installation and aftermarket services to that installer network. Some customers also ask for XPEL specifically, which means OEMs are more likely to successfully upsell film to customers if they partner with XPEL.

As a result, XPEL is currently the only company that has significant branded partnerships with OEMs, although a small number of competitors like Eastman (SunTek & Llumar) have partnerships with a few dealers. XPEL has direct partnerships with Tesla, Rivian, Porsche, Jaguar Land Rover, and several others and I had many conversations where competitors told me how envious they were of the Tesla partnership.

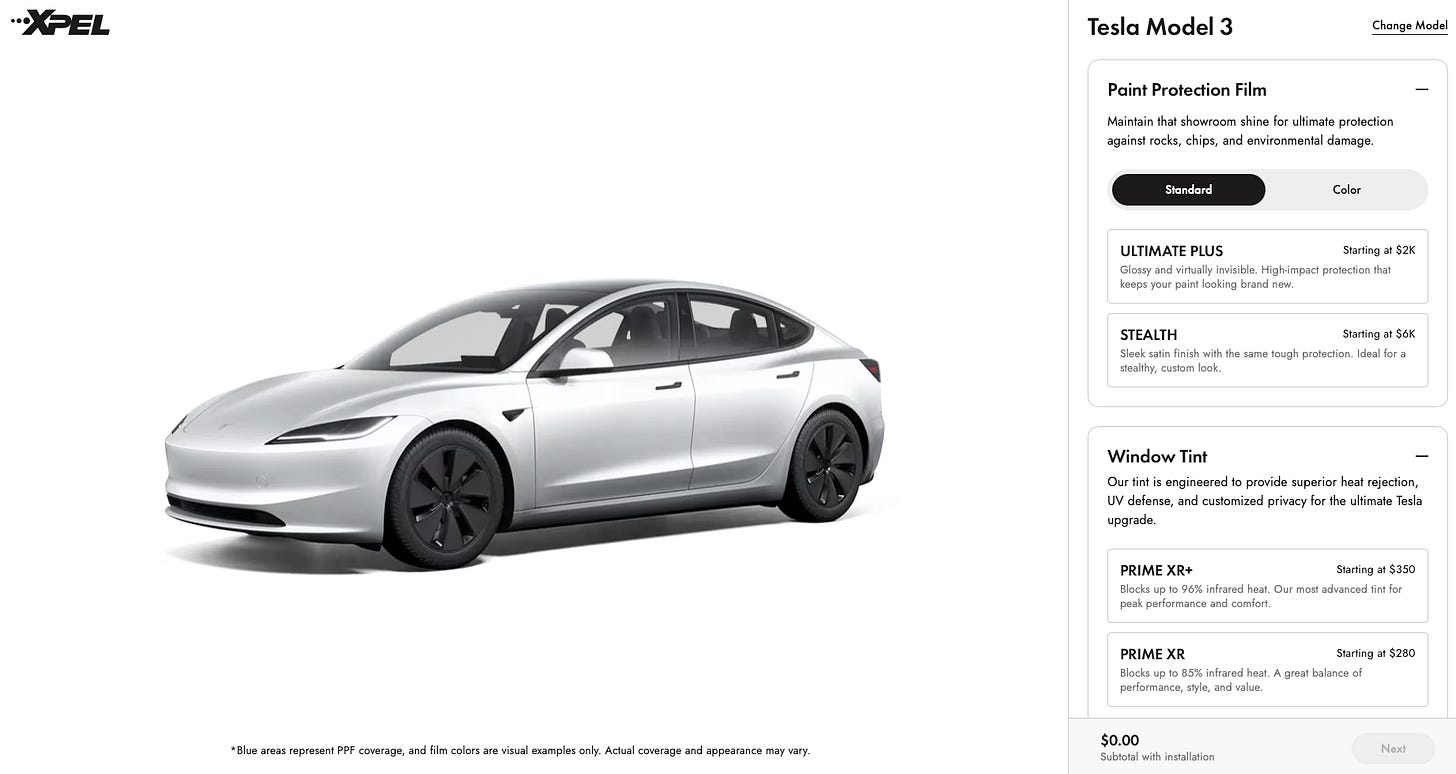

As a reminder, in early July Tesla greatly expanded its partnership with XPEL by now offering XPEL PPF on the Model 3 and Y (see here). Tesla’s website and app is taking customers to an XPEL page where you can place an online order which is then routed to a local XPEL shop for installation.

The growing popularity of PPF, XPEL’s increasing ability to route an OEM’s orders to its aftermarket installer base, and the success of the Tesla partnership have all led to growing interest from OEMs. I got a sense across conversations that the OEM market will be large and that interest has accelerated quite a bit recently. Some of that is also because of colored PPF, which I discuss below.